Daily Comment (October 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Happy Fat Bear Week! We’ve already filled out a bracket, and our money is on #32 Chunk to take the crown as the fattest bear. Today’s Comment discusses the recent rise in global bond yields, the ongoing dollar drought, and problems with funding for Ukraine. As usual, our report also provides an overview of the latest domestic and international data releases.

Bond Bears Roar: Yields are increasing due to uncertainty over the future of monetary and fiscal policy, but this is likely to be temporary.

- Partisan governments and soaring inflation in advanced economies are making it difficult for investors to price future risks as governments struggle to find a clear path back to normalcy. This is particularly evident in Europe, where governments are built on fragile coalitions and Spain has been unable to form a government, and in the United States, where the House of Representatives ousted Speaker Kevin McCarthy (R-CA). Meanwhile, a slowdown in global economic activity and elevated inflation have complicated the central bankers’ ability to conduct monetary policy as policymakers struggle to reach a consensus on a path forward.

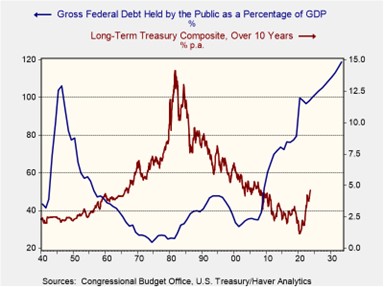

- Missed economic growth forecasts and unclear plans for addressing pandemic deficits have weighed heavily on investor sentiment. At the start of the year, many expected the U.S. and Europe to enter recessions in 2023, but the labor market has remained resilient in both regions. This has led the central bankers and investors to push up their expectations for policy rates as they look to keep inflation from becoming sticky. On the fiscal side, the EU has struggled to get governments, such as Italy and France, to comply with deficit targets that will come into effect in 2024. At the same time, U.S. budget projections show that the deficit is expected to exceed GDP over the next few years unless lawmakers decide to cut spending or raise taxes.

- Interest rates are unlikely to return to pandemic levels anytime soon, but yield pressures could ease in the coming weeks. Weaker economic data could reduce inflation expectations and prompt policymakers to pivot, leading to a decline in the yields of 10-year German Bunds and U.S. Treasuries. This expectation was evident in the recent decline in global bond yields following disappointing euro area retail sales and ADP private payrolls data. However, concerns over widening deficits and volatile inflation may temper any drop in yields, as lawmakers struggle to address budget shortfalls without political blowback.

When The Fed Sneezes: A shortage of U.S. dollars is cascading through emerging markets, causing widespread disruptions.

- Countries in Africa, Asia, and South America are reeling due to the lack of dollar liquidity. The shortage of available greenbacks has made it difficult for countries to pay for imports and repay debts, leading to a series of economic and political shocks throughout the developing world. The Pakistani government has imposed capital controls that restrict profit repatriation. Nigeria’s currency has plummeted against the dollar. At the same time, political instability in Bolivia has deepened amid soaring inflation and economic hardship. It is estimated that poorer countries owe around $200 million to their wealthier counterparts.

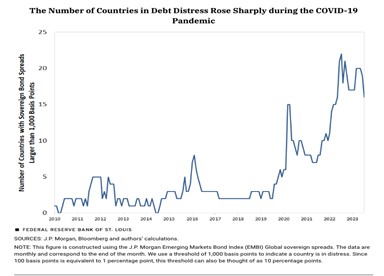

- The U.S. dollar shortage is a direct result of the Federal Reserve’s quantitative tightening policy. Last month, the central bank’s balance sheet fell under $8 trillion for the first time since June 2021. This drawdown has been particularly difficult for commodity-dependent countries, which have struggled to export their goods due to the recent global economic slowdown. As a result, governments have been forced to reduce spending and have asked creditors to restructure their debt payments. This has left some countries with reduced credit ratings and higher interest rates to compensate for the new risk. A JPMorgan index showed that 16 countries, or 23% of the index, had yields 10% or higher than those of the United States and Germany.

(Source: Federal Reserve Bank of Saint Louis)

(Source: Federal Reserve Bank of Saint Louis)

- The situation in emerging markets may worsen but should not spillover to the U.S. Only 11 countries have defaulted in the past few years, far lower than the 1980’s peak of 58. Additionally, the debt issues are less of a problem for larger developing nations such as Brazil and India. However, that does not mean there will be no negative effects for certain sectors of the American economy. An increase in defaults could make it difficult for grain and commodity exporters to sell goods to affected nations, which could lead to increased hunger and social unrest.

Putin’s Waiting Game: The Russian president has been biding his time in hopes that the West will drop its support for Ukraine.

- Funding the war in Ukraine is causing frictions throughout the West, especially as governments struggle with widening budget deficits. In the U.S., a dispute over new funding for the war has contributed to a standoff in budget negotiations. Meanwhile, in Europe, sympathy for Russia is rising, particularly in Eastern European countries such as Slovakia, Bulgaria, and Hungary. This new resistance comes at a time when Ukraine’s much anticipated counteroffensive has finally shown signs of life following weeks of making only slight progress. The dispute over funds highlights the growing fatigue of the fight.

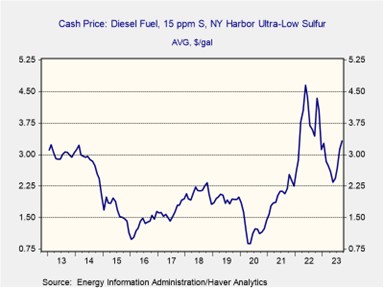

- The main contention of the war is its economic fallout, both in terms of its cost and its impact on trade. American lawmakers argue that spending on the war is complicating efforts to reduce the budget deficit. Eastern European countries complain that preferential treatment to Ukrainian exports has come at the expense of their own agricultural industries. Rising dissatisfaction with the war is impacting elections, with more voters selecting candidates who favor a shift away from Kyiv. This situation could worsen if gasoline prices remain high in the coming months. That said, Moscow is also facing funding issues.

- The longer the war rages on, the greater the risk of Ukraine losing support. While the West insists that peace can only come with a Russian withdrawal, markets care little about the actual outcome of the war, just that it ends. Any resolution that leads to an end to the conflict should calm investors’ concerns about commodity volatility and pave the way for the West to relax increasingly ineffective sanctions. European equities could be one of the biggest beneficiaries of this outcome, as they may be able to regain access to Russian energy. However, the path of normalization of ties between Brussels and Moscow remains uncertain.

Ins and Outs: Accusations of industrial espionage by Chinese tech giant Alibaba (BABA, $83.17) are likely to worsen the growing distrust between the West and China. Saudi Arabia’s exploration of a theme park is further evidence that the country is seeking to diversify its portfolio as the world transitions to a more sustainable economy. The Biden administration’s reversal of the border wall construction highlights its growing concern over the rise in illegal immigration. Rising yields and declining imports add to concerns that the Fed may not be able to avoid a hard landing.