Daily Comment (October 31, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an examination of the US push for a digital free-trade economy. We then assess the ongoing government shutdown and its implications. Further coverage includes the Senate’s movement on tariff-repeal bills, the role of corporate earnings in bolstering tech sector sentiment, and the EU’s development of a new trade strategy to counter China. We also include our regular summary of critical international and domestic data releases.

US Digital Service Economy: The White House is aiming to preserve the US global trade surplus in services by championing tariff-free digital commerce. This move signifies a broader strategic shift as the US redefines its economic dominance by emphasizing global technology access over traditional consumer market access. Such tailored policy making demonstrates a clear alignment with the interests of Silicon Valley, granting those companies a significant political and economic advantage on the world stage.

- To implement this strategy, the administration has leveraged tariffs on goods to dissuade foreign governments from imposing barriers on US tech companies. The plan has already seen some success. The White House has secured commitments from nations like Malaysia, Cambodia, and Thailand that they will not impose restrictions, while also convincing major partners, including the EU, Britain, and Canada, to openly discuss loosening their digital services regulations.

- While tariff-free digital services encompass a wide range of commerce — including social media, streaming, and cloud platforms — this policy is also critical to the US ambition for global dominance in AI. As detailed in our Bi-Weekly Geopolitical Report, “The Great AI Race,” the United States is actively trying to construct a technological ecosystem where it sits at the center of the AI supply chain, ensuring that both the core technology and supporting equipment are manufactured domestically.

- The growing partnership between the White House and Silicon Valley marks a significant strategic shift in US economic policy. By leveraging tariffs on goods to push for deregulation in foreign markets, this alliance aims to secure crucial market access and vital resources for American tech giants. However, this support comes at a clear cost: companies must align their business plans with Washington’s policy initiatives.

- In the near term, this alignment should accelerate the expansion of US tech firms and boost returns. However, we project that long-term profitability may be hampered by the political friction this partnership generates. Furthermore, we anticipate other nations will resist this trend to protect and bolster their own domestic industries, reducing their reliance on the US. This resistance could, in turn, spur increased investment into their own local tech champions.

Government Shutdown: Friction is escalating within both political parties as the government shutdown extends into its fifth week, with neither side showing an immediate willingness to concede on key demands. November is shaping up as a critical inflection point as millions of vulnerable households reliant on SNAP (food stamp) benefits may begin to see those funds dry up. Furthermore, the expiration of federal funding risks a significant spike in Affordable Care Act health insurance premiums if existing COVID-era subsidies are not renewed before the deadline.

- The Democratic caucus is under increasing strain to approve a clean government funding bill proposed by Republicans. This mounting pressure is driven by key labor leaders, particularly those representing airline industry workers and government workers, whose constituents are missing paychecks. The situation is further complicated by Senators such as Jon Ossoff (D-GA) and John Fetterman (D-PA), who face competitive re-election battles and are viewed as possible defectors seeking a quick end to the political standoff.

- Simultaneously, Republicans are beginning to question their party’s strategy for resolving the impasse. They are now debating whether to allow SNAP benefits to lapse — a move that would sever a key source of funding for vulnerable households. Furthermore, there is growing concern that the prolonged shutdown will complicate efforts to pass other critical legislation.

- The White House has so far adopted a nuanced strategy during the shutdown. While the president has expressed a willingness to work with Democrats on modifying the Affordable Care Act to better serve working families, he has simultaneously urged Republicans to pursue the “nuclear option” of eliminating the legislative filibuster, which requires 60 votes for most bills to pass.

- The shutdown is not expected to severely impact near-term economic activity, but the financial toll increases daily. Our main concern is the effect on consumer sentiment, which is already low. Consequently, a prolonged shutdown could quickly reduce household spending, especially among low-income earners sensitive to financial uncertainty and payment delays.

Senate Tariff Challenges: The Senate passed bipartisan legislation to repeal the president’s use of sweeping global tariffs imposed on US allies. Although the bill is unlikely to be taken up in the House or survive a presidential veto, it represents a growing, cross-party resistance to the executive’s trade restrictions. This political maneuver is unfolding as the White House anticipates a Supreme Court hearing that will rule on the constitutional limits of the president’s authority to unilaterally impose tariffs without congressional approval.

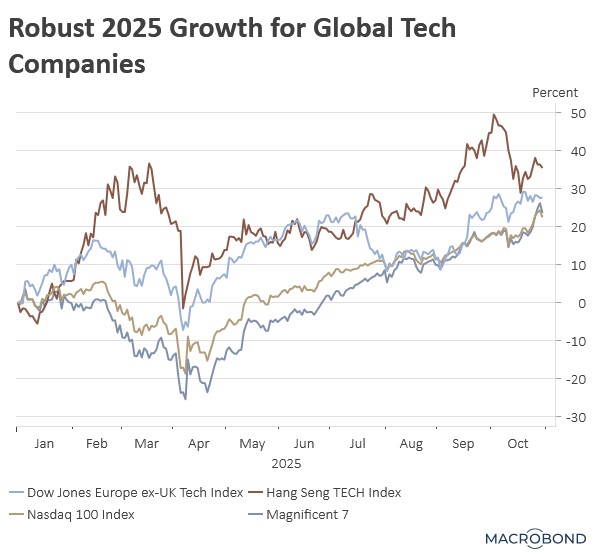

Tech Sentiment Strong: Tech sector sentiment received a necessary boost following strong outlooks from Amazon and Apple. Amazon Web Services (AWS) beat cloud revenue estimates, while Apple, despite a current revenue dip due to soft China sales, announced expectations for its best-ever December quarter revenue. Given the ongoing market headwinds and policy uncertainty, we maintain our view that corporate earnings remain the single most critical factor for judging the sustainability of the current market rally.

EU Trade Strategy: To address Chinese import dumping, the European Union is devising a novel toolkit that moves beyond traditional tariffs. Key proposals include “in-kind” tariffs that require Chinese exporters to directly supply the EU’s strategic reserves of critical raw materials or mirroring China’s own tactics by restricting exports of key goods. This delicate balancing act highlights the EU’s primary objective to reform China’s unfair trade practices without jeopardizing the very mineral resources essential to its own green and digital transitions.

More Oil: Exxon and Chevron surpassed market earnings expectations as new oilfield acquisitions boosted their crude output. This production increase comes amid signs of a supply glut, driven by the OPEC+ alliance flooding the market to retain market share. The situation suggests that oil prices may face downward pressure as major players compete for dominance in an increasingly competitive global market.

Note: Due to the federal government shutdown, we were unable to update the Business Cycle Report this month. The report will return as soon as we are able to once again access government data.