Daily Comment (October 31, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a note about the Pentagon’s annual report on Chinese military power. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest on the Israel-Hamas conflict, a loosening of the Bank of Japan’s yield-curve control policy, and what to expect from this week’s Federal Reserve policy meeting.

Chinese Military Power: As is usual at this time of year, the U.S. Department of Defense last week released its annual report on Chinese military power, which is the basis for much of our analysis regarding U.S.-China relations (and our popular in-person presentation on global fracturing, geopolitical blocs, and their investment implications, which we provide to financial advisors and their clients all over the country). The DOD report does a deep dive into all aspects of Chinese military power, and we’ll be incorporating the latest information in our writings and presentations over the coming weeks. Today, we want to stress that the report also provides a useful discussion of what’s driving Chinese leaders. As we continually write about the increased geopolitical aggressiveness of General Secretary Xi and the rest of the Chinese Communist Party, and how that has ushered in a new, riskier era for investors, the DOD report helps explain why they’re acting the way they are. As you read our discussions of China, we encourage you to keep in mind the following:

- In both public pronouncements and private documents, Xi and the CCP have said that their overarching mission is to achieve the “great rejuvenation of the Chinese nation” by 2049 (the centenary of the People’s Republic of China). This mission encompasses:

- Reclaiming China’s traditional status as the world’s richest, most powerful, most culturally advanced nation, and

- Erasing the “Century of Humiliation” from the mid-1800s to the mid-1900s, when China was dominated and nearly dismembered by foreign powers.

- To achieve their mission, Xi and the CCP have adopted the following priorities:

- Defending and advancing sovereignty, especially over Hong Kong and Taiwan,

- Ensuring the security of China, and of the CCP’s rule, and

- Protecting China’s economic development

- To achieve the “great rejuvenation” by 2049, Xi and the CCP have selected certain subsidiary and interim goals, including:

- Protect the CCP’s monopoly on power,

- Develop the economy and become a technology leader,

- Revise the global political and economic system to serve China’s rejuvenation,

- Leverage tribalism, i.e., the sense that “East is rising, West is declining,”

- Create a global “community of shared future” dependent on China, and

- Build a “world class military” that can “fight and win” wars, including a conflict with a “strong adversary” (a euphemism for the U.S.), by 2049.

- Finally, we note that these missions, priorities, and goals stem from deeply ingrained, longstanding instincts that have evolved over millennia to help humans survive in a dangerous, challenging world: the drive for status, the resistance to being dominated, the sense of security that comes from being a part of a strong group, and the motivation that comes from casting the adversary group as evil (in-group vs. out-group thinking). To the extent that Xi and the CCP are operating on the basis of these deep motivations, China’s new aggressiveness is likely to be long-lasting and could extend even to the point of conflict with the U.S. and its evolving geopolitical bloc, with big implications for investors.

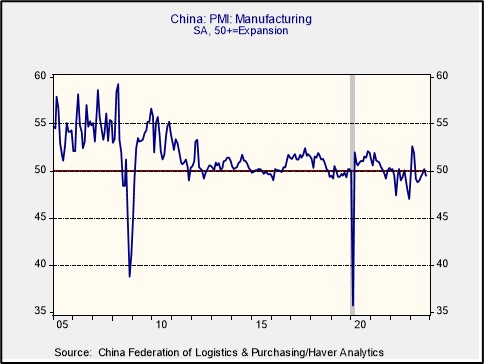

Chinese Economic Growth: The official purchasing managers’ index for manufacturing declined to 49.5 in October, down from 50.2 in September. The PMIs for construction and services also fell, leaving the October composite PMI at just 50.7. Like most major PMIs, the official Chinese gauges are designed so that readings above 50 point to expanding activity.

- At their current levels, the figures suggest the Chinese economy continues to struggle against headwinds such as weak consumer demand, high debt, poor demographics, and foreign decoupling.

- Given the huge size of China’s economy, its current weak growth will likely be a headwind for businesses around the world. That could help mollify global inflation pressures, but it could also take some wind out of global asset values.

Israel-Hamas Conflict: Dashing hopes for a more limited ground offensive, the Israel Defense Forces have ratcheted up their infantry attacks and airstrikes on Gaza over the last 24 hours. IDF tanks, troops, jet fighters, and other forces are actively engaging Hamas fighters in a wider area of the enclave, with a focus on destroying the extensive tunnel network used by Hamas to hide and protect its fighters and move supplies and equipment from place to place. Along with Islamist attacks on Israel from Lebanon and Syria, and retaliatory Israeli strikes against them, the risk of the conflict spreading regionally remains.

Venezuela: The country’s top court, which is packed with supporters of the authoritarian Maduro government, has “suspended” the opposition’s recent primary election, throwing a wrench into the recent deal in which Venezuela agreed to allow free and fair elections next year in return for the U.S. to relax sanctions on its energy industry. If the move prompts the U.S. to reimpose its sanctions, it could lead to new oil supply challenges and put upward pressure on prices.

Eurozone: Third quarter gross domestic product fell at a seasonally adjusted, annualized rate of 0.4%, erasing most of the annualized 0.6% increase in the second quarter. In contrast with the U.S.’s third-quarter growth rate of 4.9%, the figures illustrate how the eurozone economy is now faring much worse because of headwinds such as high inflation, rising interest rates, and a crisis of confidence in the face of geopolitical tensions.

- On a more positive note, the eurozone’s October consumer price index was up just 2.9% from the same month one year earlier, after a 4.3% rise in the year to September.

- Excluding the volatile food and energy components, the October Core CPI was up 4.2% year-over-year, compared with 4.5% in September.

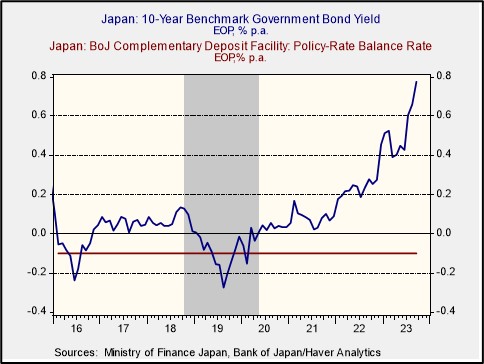

Japan: As previewed in our Comment yesterday, the Bank of Japan today held its benchmark short-term interest rate steady at -0.1% but said that it will now consider its 1.0% upper bound for 10-year Japanese government bond yields to be merely a “reference rate” rather than a hard limit. Since investors were looking for a more substantial loosening or even abandonment of the BOJ’s yield-curve control policy, both the 10-year JGB yield and the yen (JPY) fell back after an initial jump. Separately, as if to emphasize that the era of ultra-low consumer price inflation in Japan is over, the policymakers also projected that annual price increases would remain close to 3.0% until 2025.

- The yield on the 10-year JGB ended trading in Tokyo at 0.95%, compared with 0.774% at the end of September.

- The JPY closed at 150.70 per dollar ($0.0066), compared with its September close of 147.85 per dollar ($0.0068).

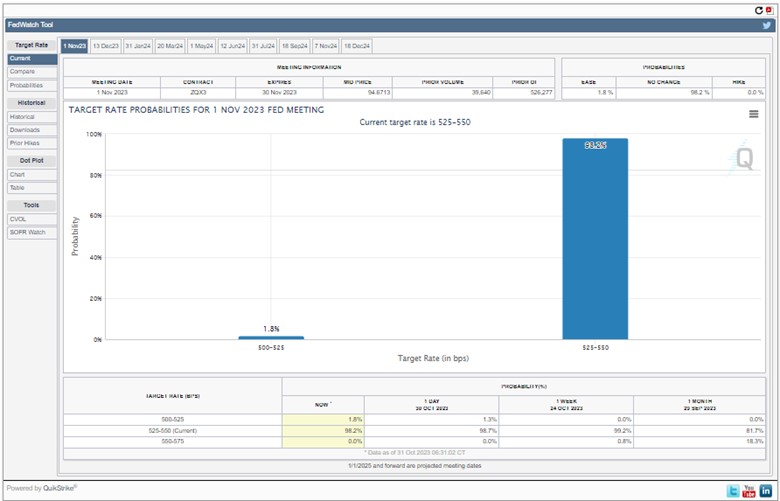

U.S. Monetary Policy: The Federal Reserve begins its latest two-day policy meeting today, with the decision due to be released tomorrow at 3:00 PM EDT. As shown in the chart below, the popular CME FedWatch Tool (based on 30-day fed funds futures prices) indicates investors are nearly unanimous in believing the policymakers will hold the benchmark short-term interest rate unchanged at 5.25% to 5.50%. The focus will therefore be on any guidance regarding future rate changes in the committee’s statement or in Chair Powell’s post-meeting press conference.

- No new economic projections are due to be released at this meeting.

- Nevertheless, the statement and Powell’s discussion could well express a bias toward further tightening, consistent with Powell’s “higher for longer” mantra.

- We think it makes sense to take Powell at his word. Even though we think U.S. interest rates are probably near their peak, we continue to believe the Fed will try to hold them at elevated levels for an extended period to wring inflation out of the economy.

U.S. Regulatory Policy: The Securities and Exchange Commission is suing information technology company SolarWinds (SWI, $9.31) in connection with the company’s failure to stop Russian hackers from infiltrating its systems, a scandal discovered in 2020. According to the SEC, the company mislead investors about its cybersecurity and failed to disclose known risks. The lawsuit illustrates how cyber breaches not only put companies at operational and reputational risk, but also at regulatory risk.

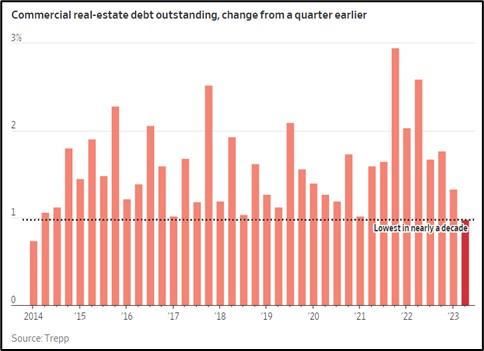

U.S. Commercial Real Estate Industry: According to data provider Trepp, net new bank lending for commercial real estate is now growing at historically low levels. Commercial real estate loans held by banks were only up about 1% from the same period one year earlier. Since banks are the top source of funding for the sector, the slowdown in lending bodes poorly for commercial borrowers’ ability to roll over their loans as they come due, probably adding to the stress in the market today and pulling down commercial real estate values even further.

U.S. Auto Industry: As we flagged in our Comment yesterday, the United Auto Workers on Monday struck a tentative deal for a new labor contract with General Motors (GM, $27.36), the last of the Big Three U.S. automakers it was striking. The tentative deals mean that workers at GM, Ford (F, $9.77), and Stellantis (STLA, $18.00) can go back to work immediately.

- If approved by the companies’ UAW workers, the deals will raise wage rates by about 25% over the four-year life of the contracts, improve job security, and increase benefits.

- That will put pressure on the firms to cut other costs, potentially by investing in new labor-saving technologies.

- The deals may also encourage labor organizing, strikes, and higher wage demands beyond the auto industry.

- In any case, the deals will probably add to pressures shifting the share of national income toward workers and away from capital owners.