Daily Comment (October 30, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest on the Israel-Hamas conflict. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a preview of the Bank of Japan’s important new policy meeting starting today and a discussion of the U.S. labor market as the auto industry’s strikes look like they’re finally drawing to a close.

Israel-Hamas Conflict: Over the weekend, the Israeli Defense Forces launched what Prime Minister Netanyahu called the “second stage” of Israel’s war against the terrorist Hamas government in the Gaza Strip. While the initial stage focused on airstrikes targeted against Hamas leaders and military forces, the new stage has sent IDF ground forces into Gaza on extended incursions. Meanwhile, Netanyahu is facing increased political peril for his perceived reluctance to take responsibility for the October 7 attacks by Hamas that started the conflict. Over the weekend, Netanyahu blamed Israeli intelligence services for not warning him of the attacks beforehand, but he was forced to backtrack and apologize after his statement sparked a wave of criticism.

- So far, Israel’s new, extended ground incursions appear to be more focused and limited than many observers feared, suggesting Israeli leaders have heeded U.S. advice not to launch the feared massive ground invasion until they have a set of clear, realistic objectives and a plan to achieve them. The relative restraint being shown by Israel right now is a welcome development that could lower the risk of the conflict expanding into a regional conflagration.

- Nevertheless, Iranian-backed Hezbollah fighters in southern Lebanon continue to launch missile barrages into Israel, prompting Israeli retaliatory strikes and keeping alive the risk of escalation. Israel today also reportedly carried out airstrikes against military targets in Syria and against Palestinian targets in the West Bank.

Russia-Ukraine War: Media analysts are reporting a surge in on-line disinformation aimed at discrediting Ukrainian President Zelensky and undermining Western support for military aid to Ukraine. The disinformation, which is believed to have been placed by Russia, has appeared mostly on social media networks. Nevertheless, U.S. and European officials are vowing continued support for Kyiv no matter what.

China-United States: U.S. semiconductor giant Broadcom (AVGO, $838.36) and cloud software firm VMware (VMW, $142.20) said they will miss their goal to complete their $69-billion merger today, as Chinese authorities still have not provided their approval. The firms still have time to complete the deal before their final contracted deadline of November 26, but there is increasing concern that China will continue to slow-walk its approval or even scuttle the deal in retaliation for the Biden administration’s latest clampdown on transferring U.S. advanced semiconductor technology to China.

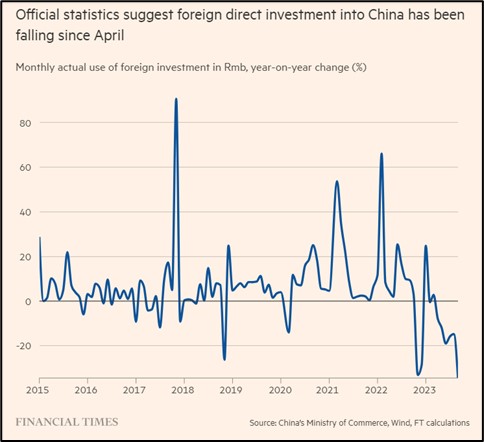

China: New analysis by the Financial Times suggests foreign direct investment in September was down a whopping 34% year-over-year, marking the largest decline since monthly records became available in 2014 and leaving monthly FDI at just $10 billion. FDI in China has now been down by double-digit percentages on a year-over-year basis every month since May, reflecting increased pessimism regarding China’s structural economic headwinds (including poor consumer demand, high levels of debt, bad demographics, and foreign de-coupling), along with President Xi’s statist economic policies.

Japan: The Bank of Japan begins a two-day policy meeting today, and when it releases its decision tomorrow, many observers believe it will signal that it is finally preparing to drop its longstanding policy of negative short-term interest rates and/or further modify its yield-curve control policy. After expanding its tolerance band for 10-year government bond yields to 1.0% in July, some observers expect the policymakers to widen the band to 1.5%, while others believe they will abandon the limit entirely.

- Such policy modifications are increasingly likely as the yen (JPY) continues to weaken toward multi-decade lows.

- Recently, Japanese 10-year government bond yields have risen near 0.90%, suggesting increased market consensus that the policy band will be widened.

European Union-Australia: EU and Australian officials hit an impasse in their negotiations for a free-trade deal, likely postponing any new talks or agreement until at least 2025. Sticking points reportedly included the EU’s reluctance to open its market to Australian beef and sheep, and Australian resistance to the EU’s food-labeling requirements. The failed deal is yet another example of how the last three decades’ trend toward ever-greater globalization has largely ended.

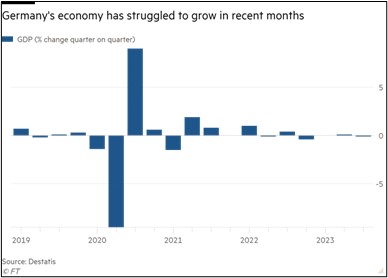

Germany: Third-quarter gross domestic product fell by a seasonally adjusted 0.1%, slightly better than the expected decline but still almost enough to reverse the prior period’s small increase. Germany’s economy continues to stagnate in the face of headwinds such as weak foreign demand, high inflation, and rising interest rates. GDP in the third quarter was down 0.3% from the same period one year earlier.

U.S. Auto Industry: On Saturday, the United Auto Workers reached a tentative agreement on a new labor contract with giant automaker Stellantis (STLA, $18.04), days after reaching a separate deal with Ford (F, $9.96). The agreements have raised hopes that the UAW’s historic, six-month strike against the top three U.S. automakers may come to an end soon. However, it’s important to remember that General Motors (GM, $27.22) continues to hold out. To encourage GM to get in line with Ford and Stellantis, the union over the weekend expanded its strike against the company to include one of its key factories in Tennessee.

- The tentative deals with Ford and Stellantis still need to be voted on and approved by their respective union workforces.

- However, the overall contours of those deals suggest UAW workers at the firms will get a substantial pay raise spread over the life of the contract, better retirement and other benefits, improved work conditions, and job protections.

- As we have argued in the past, the labor shortages spawned by the mass retirement of Baby Boomers and other hurdles to employment during the pandemic have given workers greater bargaining power, prompting increased union demands and fast-growing wage rates.

- Over time, that will likely shift a greater share of national income toward workers and away from capital owners. This will likely erode corporate profit margins.

- Nevertheless, the impact on potential economic growth is still indeterminate. Since workers tend to spend a greater share of their income, stronger wage growth could potentially boost consumer demand. Companies might also increase their investment in labor-saving equipment, offsetting some of the investment cuts they might otherwise adopt as profit margins tighten.

U.S. Retirement Investment Industry: Under the Department of Education’s new rules for the Free Application for Federal Student Aid, pre-tax investments in retirement accounts will no longer be counted in a family’s income for purposes of calculating financial aid. The change is expected to result in increased financial aid of $5,000 to $10,000 per year for many families. Of course, it could also incentivize continued or increased retirement investing among those with kids in college.

U.S. AI Regulation: Using emergency powers in the Defense Production Act, President Biden issued an executive order today that will force major artificial-intelligence companies to notify the government when developing any system that poses a “serious risk to national security, national economic security or national public health and safety.” While rapid developments in AI are widely seen as promising great economic and social benefits, the new executive order aims to address various risks until a slow-moving Congress can study the technology and come up with a comprehensive regulatory scheme.