Daily Comment (October 3, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including news that Ukraine has retaken more land with its counteroffensives in the northeast and south of the country. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a dramatic U-turn in the U.K. government’s big tax-cutting proposal.

Russia-Ukraine: Over the weekend, Ukrainian forces recaptured the important transportation hub of Lyman in Ukraine’s northeastern Donbas region, and the Russian military admitted it had withdrawn its troops to avoid their encirclement. The loss touched off another round of angry recriminations by ultra-nationalist Russian bloggers and military commentators, who castigated Russia’s military leadership and demanded stronger performance from commanders on the ground. Importantly, it appears that the Russian military failed to reinforce its position in and around Lyman, probably because President Putin has prioritized holding the southern region around Kherson and Zaporizhzhia against the Ukrainian counteroffensive there in order to preserve Russia’s land bridge to its illegally annexed region of Crimea.

- Ukrainian forces continue to push eastward into the Russian-held province of Luhansk, further pressuring Russian forces and further raising the risk that President Putin will feel so backed into a corner that he would contemplate detonation of a tactical nuclear weapon to try to reverse his fortunes.

- It’s important to remember that NATO and the U.S. have had decades to refine their surveillance, monitoring, and intelligence capabilities regarding the all-important threat of Russian nuclear weapons. Since Russian tactical warheads are stored in specific bunkers and not married with artillery or missile systems until just before they’re used, our best sources suggest NATO and the U.S. would be able to see their preparation “as the process unfolds.”

- Of course, President Putin might want that to be the case anyway, since his greatest leverage would come with the threat, rather than the use of such weapons. There is probably a growing chance that Putin will at some point order the initial steps toward using tactical nukes in order to send an even stronger warning to the West, hoping it will split the allies or convince them to back off and let him have Ukraine.

- In a television interview yesterday, NATO General Secretary Stoltenberg warned that any use of nuclear weapons in Ukraine would “change the nature” of the conflict and would result in “severe consequences” for Russia.

OPEC+ Oil Cartel: Press reports indicate that the Organization of the Petroleum Exporting Countries (OPEC) and its Russia-led partners are planning to cut crude oil production by as much as 1 million barrels per day when they meet on Wednesday. The reports also suggest that Saudi Arabia, the key country in the group, wants to lower output both to prop up prices and to keep some production capacity in reserve in case Western sanctions lead to a drop in Russian output later this year. Russia, the other key producer in the group, also wants to prop up prices to help pay for its invasion of Ukraine.

- A question to be resolved is whether OPEC+ members will reduce actual production, their quotas, or a mixture of the two. The group is already 3.5 mbpd short of its target, as Nigeria, Angola, Russia, and others struggle to churn out the barrels they have committed to on paper.

- If implemented as output cuts, the deal could push energy prices up again, exacerbating inflation in the developed countries and complicating the Democrats’ chances in November’s U.S. mid-term elections.

- Indeed, Brent crude futures are up 3.9% to $88.48 per barrel so far this morning.

United Kingdom: After ten days of financial market turmoil touched off by her massive tax cut proposals, Prime Minister Truss has abandoned her plan to cut the top personal income tax rate from 45% to 40%. The decision came as Truss faced a revolt by her own Conservative Party members of parliament, which raised the risk that the provision wouldn’t pass the legislature.

- Abandoning the tax cut for Britain’s richest citizens has important political implications in Britain and beyond. The pushback against cutting taxes for elites reflects the enduring power of populism among right-wing parties today. Truss’s U-turn will likely be a signal to politicians worldwide about the danger in proposing elitist policies over populist ones.

- Having retreated on the top income tax rate, Truss could now come under pressure to reverse other proposed unfunded tax cuts that have blown a hole in the U.K.’s public finances. Examples include the £13-billion reduction in national insurance contributions, which gives the biggest benefit to better-off voters, and the £17 billion plan to reverse a previously-planned hike in corporate income taxes — a policy that business leaders have said is not a priority.

- Of course, the mess also seriously damages Truss and her government, raising the chance that she will be pushed out of power relatively soon.

- Abandoning the tax cut only marginally reduces the cost of Truss’s program, but financial markets so far this morning are taking the news positively. The yield on 10-year gilts fell modestly to 4.02%, down from approximately 4.60% at the height of the market turmoil last week, while the pound edged up in value to $1.1212.

European Union: The European Commission plans to propose a major reform of its “Growth and Stability” fiscal rules this month in order to give EU member countries more time to cut their debts and make space for public investment. Under the proposal, the EU and national capitals would work out multiyear, country-specific plans for getting their debt burdens under control. The plan aims to simplify the EU’s hugely complex fiscal rules while also tightening enforcement.

China – National Day Holiday: Marking China’s National Day on Saturday, President Xi said in an article that the country “has never been closer” to achieving its great national rejuvenation, but that the last mile would be full of perils and challenges. He urged Communist Party members to press on even as they face major challenges, risks, barriers, and contradictions in the coming years.

- In the run-up to the party’s 20th National Congress later this month, Xi’s article shows that he remains fully committed to his program of strengthening China and eventually displacing the U.S. as the world’s most powerful nation.

- Because of the National Day holiday, China’s stock markets and most business and government activities will be shut down all this week.

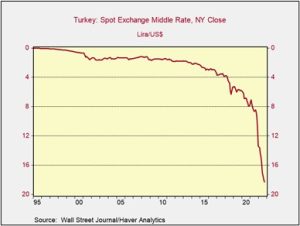

Turkey: The September consumer price index was up 83.5% from the same month one year earlier, accelerating from the rise of 80.2% in the year to August and marking Turkey’s highest inflation rate since July 1998. Despite the accelerating inflation, President Erdoğan continues to insist on further interest-rate cuts, pushing the value of the lira even lower. Against the U.S. dollar, the currency is now down approximately 27% year-to-date.

Brazil: In the first round of Brazil’s presidential election yesterday, leftist Former President Luiz Inácio Lula da Silva led with 48.4% of the vote, beating incumbent President Bolsonaro with 43.2% of the vote. However, Bolsonaro’s tally was significantly stronger than expected, setting up what could be a close vote in the run-off election on October 30.

- Public opinion polling had long predicted a very strong majority for Lula, prompting fears of a hard swing to the left in Brazilian economic policies and undermining Brazilian stock prices.

- Bolsanaro’s better-than-expected showing in the first round is likely to generate at least a short-term rebound in Brazilian stocks. Indeed, Brazilian stocks are up well over 5% in the U.S. this morning.

China – Real Estate Market: Ahead of the holiday on Friday, regulators announced a series of policy changes to support the contracting real estate development and housing industries. The moves include special interest-rate cuts for first-time home buyers and a tax cut for a broader group of home buyers. The moves prompted a jump in the Hong Kong-listed shares of major Chinese property developers today.

United States-China: The top Republicans on the House Agriculture and Oversight committees asked the Government Accountability Office to conduct a study examining foreign countries’ acquisition of U.S. farmland and its impact on national security, food security, and trade.

- The lawmakers, along with many Democrats, are especially interested in whether Chinese acquisitions, in particular, could pose a national-security threat.

- Naturally, the requested GAO study could be the first step in a legislative push to further restrict Chinese acquisitions of U.S. assets. That move would likely exacerbate U.S.-China tensions and accelerate the fracturing of the world economy into a U.S.-led bloc and a Chinese-led bloc, as we have often predicted.

U.S. Housing Market: As rising interest rates push more families out of the market for new homes, builders are reportedly cold-calling investment buyers and offering them discounts of as much as 20% from the price they would charge to individual buyers.

- The phenomenon illustrates the dramatic slowdown in housing demand in response to the Federal Reserve’s interest-rate hikes.

- Of course, that slowdown in demand is also likely to weigh on U.S. economic growth and could help push the economy into recession.