Daily Comment (October 28, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment summarizes yesterday’s GDP report, including how it may impact U.S. monetary policy. Next, we review why central banks are hesitant to totally remove their policy accommodations as the world heads into recession. We end the report with a discussion about how countries are adapting to a more uncertain world.

It Isn’t All Good: Don’t be fooled by Thursday’s Gross Domestic Product (GDP) report; a recession may still be on the horizon.

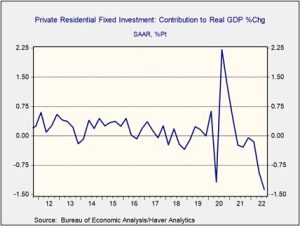

- The U.S. economy expanded at an annualized rate of 2.6% in Q3 2022. The growth exceeded the Bloomberg consensus estimate of 2.4% and ended a two-quarter streak of economic contractions. Most of the positive news came from net exports, which benefited from a decline in imports and an increase in exports. That said, there were concerns about the GDP data. Personal consumption slowed in the quarter, while residential investment contracted in the same period. The poor performance in the two areas suggests that higher interest rates are slowing the economy.

- Equities rallied initially after the GDP report was released; however, the S&P 500 and NASDAQ indexes dipped after another day of disappointing earnings. The brief optimism was related to a sigh of relief from the market that the economy was not in recession. That said, company earnings indicate that the country isn’t far from one. Earlier this month, the Conference Board U.S. Recession Probability Model showed a 96% chance of an economic downturn within the next 12 months. Although the latest GDP figure does not eliminate the possibility of an imminent recession, it does mean that the economy is more resilient than previously thought.

- The positive employment and GDP reports will likely encourage the Federal Reserve to be aggressive in its next two meetings. Although employment numbers have not been officially released, estimates show that U.S. firms added 200k workers to their payrolls in October. Assuming the employment numbers are in the ballpark, the Fed could raise rates higher than most investors are anticipating leading into the end of the year. Hence, we have yet to rule out the possibility of another 150 bps hikes over the last two meetings of 2022. As long as inflation remains elevated, the Fed will try to push rates as high as possible before the economy enters into a recession.

- Other possible threats to the economy include labor strikes. Rail workers’ unions have rejected the latest proposal suggesting that workers can go on strike in mid-November. This work stoppage could exacerbate supply chain issues and inflation.

Central Banks Won’t Commit: Policymakers are reluctant to ditch their monetary-easing tools as they seek to fight inflation and promote growth.

- The European Central Bank is sending mixed signals to the market about its commitment to fighting inflation. The ECB hiked rates by 75 bps, scaled back support for banks, and maintained quantitative easing. The last of the three measures likely fueled Thursday’s sell-off of the euro as investors worried that the bank will not be able to restore price stability to the Eurozone. Additionally, it is widely speculated that the ECB may scale back the rate hikes. The bank’s lack of aggressiveness could mean inflation will likely stay elevated for longer.

- There is no backing down in Japan as the Bank of Japan maintained its ultra-accommodative monetary policy and plans to increase the frequency of bond purchases next month. The central bank’s refusal to cave to pressure to tighten monetary policy has led to a sell-off in the yen. Additionally, Prime Minister Fumio Kishida proposed a $199 billion stimulus package. The country’s yield-curve control policy will likely shield the government from rising borrowing costs; however, a depreciating yen should add to inflation, especially as the country continues to import commodities.

- Central banks’ wariness to abandon bond-buying programs is related to concerns about debt markets. A lack of intervention from the ECB could lead to fragmentation, while Japan’s heavy government debt burden requires its central banks to manage bond yields. These banks’ unwillingness to fully commit to tightening has led investors to seek haven in the U.S. dollar. Thus, we can see the greenback’s strengthening continuing into next year as investors seek refuge in the dollar due to the Federal Reserve’s hawkishness, the slowing global economy, and the war in Europe.

Global Chess: Countries have shifted their priorities as they prepare for a world that is more hostile and less friendly to globalization.

- Brazilians will take to the polls on Wednesday for run-off elections. Although former President Luiz Inácio Lula da Silva leads his right-wing rival Jair Bolsonaro in polls, there is still the possibility for an upset. Both candidates have pledged to be fiscally responsible if elected as the country deals with stubbornly high inflation. However, the two have different approaches to achieving growth and maintaining price stability. Bolsonaro has pledged to privatize state-owned firms and cut taxes; meanwhile, Lula wants to make the country self-sufficient in oil and force the wealthy to pay more taxes.

- This election can serve as a bellwether for sentiment within the broader regions of South America. If Lula wins, as suspected, it could mean that the continent may be returning to the pre-Washington Consensus era when countries prioritized equality over efficiency. However, a Bolsonaro upset would signal that conservative policies may be staying put longer. The latter is the most favorable for equities within the region.

- Putin is possibly looking for an off-ramp to the war in Ukraine if he can save face while doing so. On Thursday, Russian President Putin advocated for talks with the West about a possible ceasefire. The gesture comes as Ukraine makes continued headway in the southern and eastern parts of the country. Although investors might view the remarks as positive, it is not. Putin refuses to acknowledge Ukraine as an independent nation, instead implying that the country is a Russian state. As a result of his inability to recognize Ukraine’s sovereignty, negotiation between the two sides is not truly possible.

- In a veiled threat, a Russian official cautioned that U.S. satellites could be legitimate targets. The warning could pave the way for direct conflict between the U.S. and Russia.

- Lastly, the U.S.’s decision to withdraw fighter jets from Japan confused its Pacific allies. The Air Force’s plans to replace the fleet with a rotational force have led to accusations that the U.S. is sending the wrong message to China. The move may be a way to convince Japan to invest more in its own military. Whatever the case, the gesture suggests that the U.S. may not be fully committed to footing Japan’s defense expenditure bill. As a result, this could lead Japan to ramp up its military spending to defend itself from a more assertive China.