Daily Comment (October 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that US and Chinese officials have struck a “framework” trade deal that President Trump and General Secretary Xi can approve when they meet later this week. Since the deal should help ease US-Chinese tensions, the news has given a big boost to global stock prices so far this morning. We next review several other international and US developments that could affect the financial markets today, including a big midterm election win for Argentina’s libertarian president and new fears that avian flu could boost US price inflation.

United States-China: US Treasury Secretary Bessent and Chinese Vice Premier He said they struck a preliminary trade deal at their latest talks in Kuala Lumpur over the weekend. If so, having the outline of a US-China trade deal could help de-escalate tensions, potentially giving a boost to global risk assets. If President Trump and General Secretary Xi sign off on the deal when they meet on Thursday, officials from both countries would then work to flesh out the details, likely leading to a detailed, final agreement sometime in the coming months.

- Speaking about the preliminary deal in a television interview on Sunday, Bessent said he thought “the threat of the [added]100% tariff [on Chinese imports] has gone away, as has the threat of the immediate imposition of the Chinese initiating a worldwide [rare earths] export control regime.”

- Bessent also hinted that China would commit to restarting large-scale imports of US soybeans. According to Bessent, US soybean farmers are going to be “extremely happy with this deal for this year and for the coming years.”

- We have been arguing that a broad deal that defuses US-China tensions would likely be especially positive for US and Chinese stocks. As of this writing, Chinese stock prices have risen more than 1.0%, while premarket trading suggests US stock prices will rise by more than 0.8%.

United States-Thailand-Malaysia-Cambodia: On the first day of his weeklong trip to Asia, President Trump yesterday said he had struck deals with Thailand, Malaysia, and Cambodia under which they will cooperate with the US on export controls, sanctions and access to critical minerals. However, the deals evidently do not reduce the 19% import tariffs that the Trump administration has already imposed on the countries.

- The deals appear aimed at least in part to weaken China’s ability to leverage its near monopoly on critical minerals and other trade advantages.

- All the same, it’s not clear if the new deals were helpful in reaching the US-China framework deal mentioned above.

United States-Canada: President Trump on Saturday said he’ll impose an additional 10% tariff on imports from Canada to punish it for US television ads placed by the province of Ontario that featured anti-tariff audio by President Reagan. Current US tariffs haven’t been applied to Canadian goods compliant with the US-Mexico-Canada trade deal, so about 85% of Canadian imports are duty-free, with the rest subject to the administration’s new tariff of 35%. It isn’t yet clear whether the new 10% tariff will apply even to USMCA-compliant imports.

Argentina: In legislative elections yesterday, preliminary results show President Milei’s libertarian Liberty Advances party came in first with 40.8% of the vote, beating the Peronist opposition alliance with 31.7%. The results should help calm fears of a Peronist resurgence, which sparked a run on the peso last month and prompted the US to offer a bailout centered on a $20-billion currency swap facility. Reflecting renewed confidence that Milei can keep pushing through his reforms, Argentina stock, bond, and currency values are surging so far today.

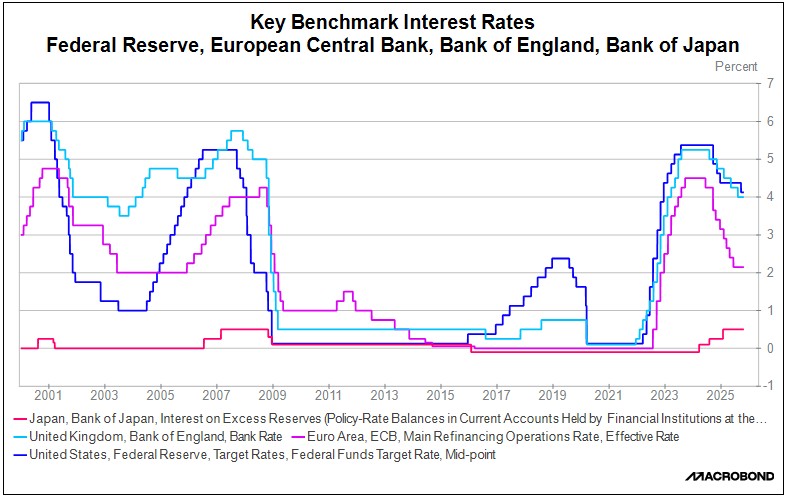

US Monetary Policy: The Federal Reserve tomorrow begins its latest two-day policy meeting, with the decision due on Wednesday at 2:00 PM ET. Based on interest-rate futures prices, investors are nearly unanimous in expecting the policymakers to cut their benchmark fed funds rate by 25 basis points to a range of 3.75% to 4.00%. Investors will also be looking for confirmation that the officials will keep loosening policy in the coming months, as we expect, during the policy statement and Chair Powell’s post-decision news conference.

US Consumer Price Inflation: Agriculture and public health officials say avian influenza is surging in commercial flocks and herds this fall, raising the prospect of renewed tight supplies and higher prices for eggs and other farm products. Wholesale turkey prices are reportedly already up 40% year-over-year, just a month before the Thanksgiving holiday. An additional risk this time around is that the US Department of Agriculture may be understaffed to respond to the crisis if the flu continues to spread.

Eurozone: In contrast with the Fed, the European Central Bank’s policy committee is widely expected to hold its benchmark interest rate unchanged at 2.0% when it meets later this week. That would mark the third straight meeting at which the ECB held its benchmark rate steady, reflecting ECB chief Lagarde’s desire to keep rates on hold for an extended period now that the institution has struck a balance between modest economic growth and lower price inflation.

Italy: Prime Minister Meloni’s plan for a 13.5-billion EUR ($15.7 billion) bridge to connect the Italian mainland to Sicily appears to be hitting a legal roadblock after a court questioned whether the mothballed project — which held its first tender in 2005 — can be restarted without a new tender. If Meloni can pull off the project, it is expected to provide a significant boost to Italy’s economy. Since the bridge could also conceivably aid military mobilization, Rome has also floated it as a boost to Italy’s defense spending to help appease US demands.

Japan: As investors, we all fear bear markets. But what about real bears? Because of factors ranging from its declining population to climate change, Japan is suffering from a spate of bear attacks, with a record nine people killed by the animals so far this year, including one killed and four injured just on Friday. We don’t know about you, but we’ll take the occasional bear market in stocks over a bear mauling any day of the week!