Daily Comment (October 26, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Concerns over earnings are weighing on equities, and Astros manager Dusty Baker announced that he is retiring. Today’s Comment begins with a discussion about the ECB’s latest rate decision. Next, we analyze the recent plunge in the yen and assess how political realignment may impact support for Ukraine. As always, our report includes an overview of the latest domestic and international data releases.

Throwing in the Towel? With high inflation and a looming recession, the European Central Bank is reluctant to predict the future path of policy.

- European policymakers held policy rates steady at their October 26 meeting, following 10 consecutive hikes. The decision to keep rates at their current levels comes amidst signs that euro area inflation has dropped. In September, the consumer price index rose 4.27% year-over-year, well below the previous month’s rise of 5.01%. At the press conference, ECB President Christine Lagarde reiterated the central bank’s commitment to containing inflation and its readiness to raise rates if necessary. While confident that inflation will continue to make progress, ECB President Christine Lagarde stated that the central bank will take a wait-and-see approach before deciding whether to hike rates again.

- In addition to interest rate uncertainty, the European Union faces concerns about implementing a bloc-wide 3% deficit-to-GDP target and a 60% debt-to-GDP ratio by its self-imposed January 2024 deadline. Although there isn’t an agreement in place, the plan is for EU members to resume their deficit and debt targets, which were temporarily suspended during the pandemic, and amend the fiscal rules to allow governments more flexibility in meeting targets over four years, with a possible seven-year extension in exchange for reforms and investments. Details of the arrangements are still being negotiated, with the sides far apart. The lack of guidance may force policymakers to hold rates tighter for longer to prevent inflation from arising from fiscal spending.

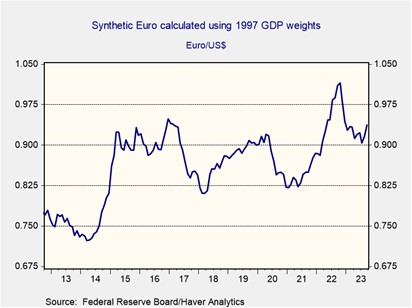

- The European Central Bank faces a more precarious predicament than the Federal Reserve when deciding future policy. Eurozone inflation is higher and growth is slower than in the United States, limiting policymakers’ flexibility to raise rates. On the other hand, policymakers may be reluctant to ease monetary policy on concerns that currency depreciation due to interest rate differentials could counterintuitively push up inflation. As a result, the ECB is more likely to hold policy steady for longer than the Federal Reserve, and rely more on other tools for tightening, such as raising the minimum reserve requirement.

Yen Troubles? The Japanese currency dropped to a 33-year low against the dollar on Wednesday, raising the likelihood of intervention from the Bank of Japan (BOJ) and a policy shift.

- The yen (JPY) closed at 150.25 per dollar on Wednesday, its lowest level since August 1990. The BOJ has stated that it was willing to intervene in exchange rate markets to prevent extreme swings in currency movements. Last October, the Bank of Japan intervened by selling dollars and buying yen, worth about $42 billion, after the JPY breached 150 to the dollar. Although BOJ officials have been mum about whether it is weighing another intervention, the central bank’s reputation of being the “widowmaker” has prevented analysts from betting big against the currency.

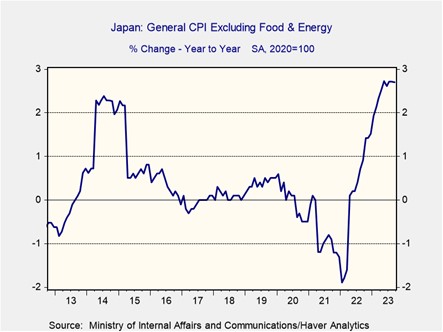

- The BOJ may tweak its yield curve control (YCC) policy at its next meeting on Monday, as currency weakness and rising inflation have fueled speculation about an end to its ultra-accommodative monetary policy. The 10-year Japanese government bond (JGB) yield is trading at 0.87%, its highest level in over 13 years, with the current YCC band set at 1.0%. A possible readjustment to the YCC band could reduce pressure on the currency and inflation, while also signaling to the market that the BOJ is transitioning away from its ultra-accommodative stance.

- The BOJ is likely to phase out its ultra-accommodative monetary policy in 2024, as inflation becomes a political problem for the ruling party. Earlier this week, the government announced that it plans to extend utility and gasoline subsidies through April to protect households from rising price pressures. This shift will impact global bond yields, as JGBs will offer more competition to other government debt, such as the U.S. Treasury. It will also hurt investors in the yen carry trade, as the resulting currency appreciation will make debt payments more expensive for borrowers that hold foreign currencies. Additionally, the change should act as a headwind for the USD.

War Fatigue? Political parties pushing to reduce financial support for Ukraine in its conflict with Russia are gaining popularity across the West.

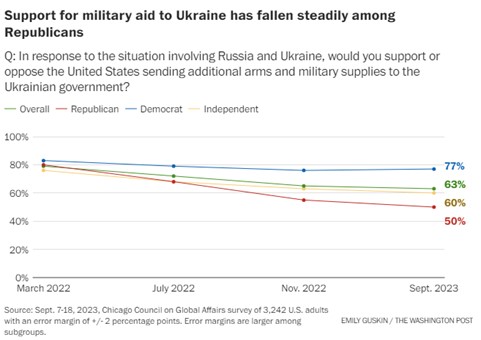

- The U.S. elected its new House speaker following the end of a 22-day stand-off. Republican Representative Mike Johnson from Louisiana won the election to become the 56th Speaker of the House. Despite having a relatively low profile prior to his win, he has been labeled the most conservative speaker by some publications. After taking the gavel, his first move was to approve aid for Israel in its conflict with Hamas. He is also expected to hold budget talks with the White House, which will likely include discussions on aid for Ukraine. While he has expressed support for Ukraine, he has been skeptical of using U.S. taxpayer money without proper oversight.

- Speaker Johnson is not alone in expressing concerns about how aid to Ukraine is being spent, as politicians in the United States and abroad have also raised doubts. Republican presidential candidate Vivek Ramaswamy has made opposing aid one of the tenets of his presidential campaign. Meanwhile, Germany’s populist AfD party has seen a surge of support in recent months and Slovakia has elected a president that is likely to push back against additional aid to Ukraine. While public support for Ukraine remains strong, public interest is waning.

- War funding is poised to become a central issue in the coming months, as governments grapple with a slowing global economy and elevated budget deficits. The U.S. budget talks will provide a glimpse into how other governments will handle this issue. If U.S. lawmakers struggle to reach a consensus, given their resilient economy, it will be even more difficult for EU countries on the brink of recession to do so. It is too early to gauge the West’s long-term support for Ukraine, but next year’s U.S. presidential election and EU parliamentary elections may provide some clues. Regardless of the outcome, the market will likely favor a quick resolution.

Other News: The U.S. found that a chip made by Huawei may have been made using machines subject to export controls. This discovery suggests that China may not have made as much advancement in semiconductor manufacturing as once feared, but it also raises questions about the effectiveness of export restrictions. Separately, the United Auto Workers (UAW) has reached a tentative agreement with Ford Motor Company (F, $11.54). The deal is likely to pressure other automakers to reach agreements with the UAW as well. Lastly, Israel is preparing to carry out its ground invasion of Gaza. The move raises the likelihood of a broader Middle Eastern conflict.