Daily Comment (October 24, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Israel-Hamas conflict. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including weak economic indicators in the eurozone and the United Kingdom, and a discussion of the U.S. government’s deficit situation as shown in a new data release.

Israel-Hamas Conflict: The Israeli air forces and intelligence services continue working to set conditions for their expected ground assault against Hamas in the Gaza Strip, while Western leaders urge steps to minimize civilian casualties. Meanwhile, U.S. Defense Department said the USS Dwight D. Eisenhower and her strike group will now be sent to the waters around the Persian Gulf and Red Sea, rather than joining the USS Gerald R. Ford and her strike group in the eastern Mediterranean as originally planned. The U.S. will also deploy additional air defense systems to the region.

- The moves follow a series of small attacks on U.S. forces in Syria, Iraq, and near Yemen. They also highlight how the Israeli-Hamas fighting could broaden if regional Islamist groups escalate their sympathy attacks on U.S. interests or military units in the region.

- In the event of a substantial Islamist attack on U.S. interests or military units in the region, a self-defensive or retaliatory attack by U.S. forces could potentially prompt Iranian forces to join the fray. And even worse scenario would be if the half-dozen or so Chinese navy ships in the region came to the aid of the Iranians or the Islamist fighters.

China: President Xi today officially signed an order firing Defense Minister Li Shangfu, nearly two months after he disappeared from public view. Xi also signed an order removing former Foreign Minister Qin Gang, who was sacked in a similar way in July, from the State Council. The Li and Qin cases have sparked rumors of corruption and misbehavior, but they could also reflect internal power politics. Given China’s opaque leadership, it is impossible to know for sure at this point.

Hong Kong: Recent data shows Western firms are increasingly leaving Hong Kong on fears that it is being subsumed into the Chinese economy and legal system. The city’s own data shows the number of U.S. companies operating in Hong Kong has now fallen for four straight years, to 1,258 in June 2022. Mainland Chinese firms with regional headquarters in Hong Kong now outnumber U.S. firms with regional offices there, for the first time in at least three decades. While we often note how China’s geopolitical, economic, and legal environment are becoming less amenable to investment, it appears that Hong Kong is now in a similar situation.

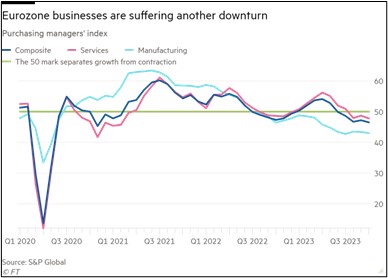

Eurozone: The S&P Global “flash” composite purchasing managers index for October fell to a 35-month low of 46.5, significantly below the consensus expectation of 47.4 (all in seasonally adjusted terms). As shown in our “Foreign Economic News” section below, the decline in the composite index reflected weaker readings in both the manufacturing and the service-sector indexes. Like most major PMIs, this one is designed so that readings below 50 indicate declining activity.

- Today’s reading will therefore raise concerns about a further economic slowdown in Europe and stronger headwinds for European stocks because of factors such as high inflation and high interest rates.

- The data is adding to speculation that the European Central Bank will hold interest rates steady at its meeting later this week. Nevertheless, ECB chief Lagarde continues to suggest rates will remain high and won’t be cut again for some time.

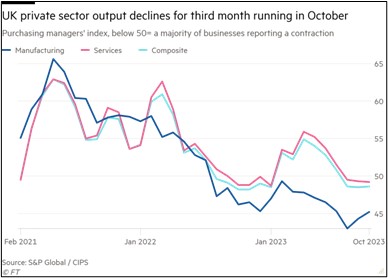

United Kingdom: Similar to the eurozone’s data, the U.K.’s S&P Global/CIPS composite PMI for October came in at a seasonally adjusted 48.6, nearly as weak as the September reading of 48.5 and enough to indicate continued weakness in the British economy.

U.S. Politics: In the House of Representatives, the majority Republicans yesterday held a forum for the nine candidates now seeking to be speaker, with each laying out their strategy for pushing forward party priorities such as cutting federal spending.

- No single candidate appeared to have a lock on the party, but press reports say the strongest support is swinging toward:

- House Majority Whip Tom Emmer of Minnesota,

- Republican Study Committee Chair Rep. Kevin Hern of Oklahoma,

- House Republican Conference Vice Chair Rep. Mike Johnson of Louisiana, and

- Byron Donalds of Florida, an ally of former President Donald Trump.

- The Republicans will vote to select their candidate for Speaker this morning, with a floor vote planned in the coming days.

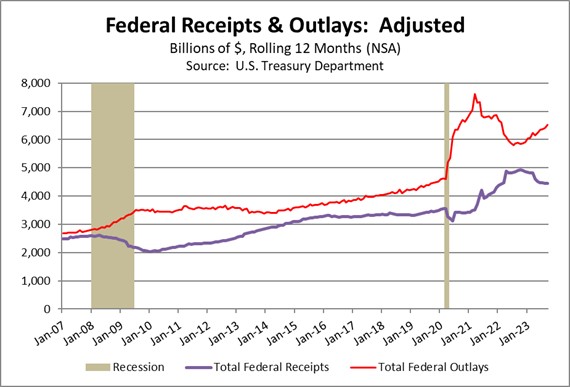

U.S. Fiscal Policy: The Treasury Department has finally released its report on federal revenues, outlays, and deficits for the fiscal year ended in September. However, the overall deficit figures for FY 2023 and the prior year are distorted because of the way the department accounted for the entire cost of the administration’s proposed student-loan forgiveness program in just one month, i.e., September 2022, as we showed in a recent Asset Allocation Bi-Weekly Report. After the courts negated that program, the department reversed its accrual all in August 2023. The budget deficit therefore looks bigger in FY 2022 than it really was on a cash-accounting basis, and narrower in FY 2023.

- As reported, federal receipts in FY 2023 totaled $4.439 trillion, down 9.3% from the previous year. Federal outlays totaled $6.134 trillion, down 2.2% from the prior year. That resulted in a reported deficit of $1.695 trillion, versus a shortfall of $1.375 trillion in FY 2022.

- One simplistic way to correct for the student-loan program’s accrual accounting would be to strip out its recognized cost of about $383 billion from the monthly figure for September 2022 and add it back in August 2023. Doing so would result in a FY 2022 deficit of roughly $1.312 billion and a FY 2023 deficit of about $1.758 billion. The chart below shows how the rolling 12-month totals for federal receipts and outlays would look with this adjustment.

- The adjusted chart clearly shows the widening gap between federal outlays and receipts. As we noted in our Asset Allocation Bi-Weekly Report, we still think there will be some fiscal tightening in the coming quarters from developments like the end of the temporary student-loan payment moratorium. Nevertheless, the current expansion in the federal deficit is likely an important reason for the recent surge in bond yields.

U.S. Labor Market: The United Auto Workers yesterday announced the union would expand its strike against the major automakers to include the largest pickup-truck factory of Stellantis (STLA, $18.94). The move came despite the company’s offer last Thursday to boost wages by 23% over the life of the new contract being negotiated, and to increase the firm’s retirement plan contributions by 50%, along with added job security. The UAW’s tough bargaining reflects how the tight labor market has strengthened labor’s bargaining power and likely portends continued sharp increases in wage rates and higher consumer price inflation in the coming years.

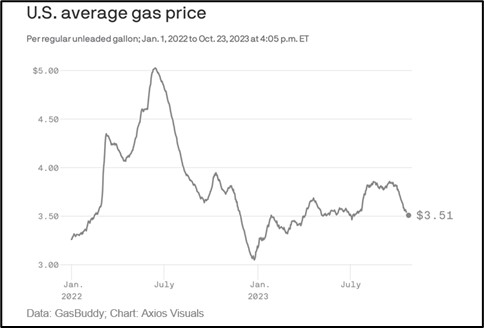

U.S. Energy Markets: Helped on by the seasonal transition to cheaper winter blends, average prices for unleaded gasoline have fallen recently to just $3.51 per gallon, close to the lowest levels of the year. The fall in gas prices could help offset the recent rise in interest rates and student loan repayments, thereby buoying consumer spending in the coming months.