Daily Comment (October 23, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

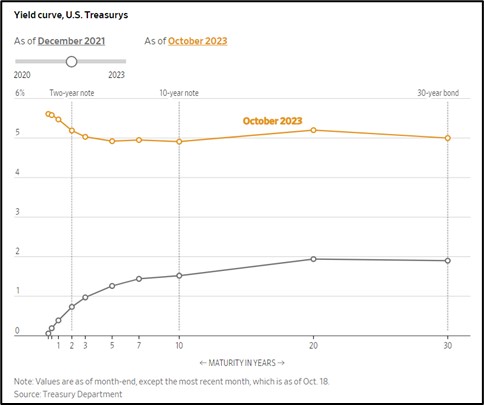

Our Comment today opens with the latest on the Israel-Hamas fighting, where we continue to keep our eyes open for signs that it could spread into a broader regional conflict. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new tensions between China and the West, and a new selloff in U.S. bonds, which has finally pushed the yield on the 10-year Treasury note decisively above the 5% mark.

Israel-Hamas Conflict: Among the top news items related to the conflict, the Israeli military continues to launch airstrikes against Hamas targets in Gaza, as well as against Hezbollah fighters in southern Lebanon in response to their missile attacks across the border into Israel. Pro-Palestinian demonstrations also continue in countries neighboring Israel, further raising the risk that attacks on Israeli interests will prompt a wider conflict, potentially including Iran. Meanwhile, the U.S. and key allies are urging the Israelis to delay their expected ground incursion into the Gaza Strip to root out the Hamas leadership and military organization there.

- Separately, the Wall Street Journal over the weekend released a detailed video analysis providing further evidence that the October 17 explosion at Gaza’s Al-Ahli Arab Hospital stemmed from an errant Hamas missile rather than an Israeli attack.

- The New York Times today acknowledged that in its initial reporting of the hospital explosion, it relied too heavily on Hamas’ statements that it was caused by an Israeli airstrike and didn’t make it sufficiently clear that those claims couldn’t be verified.

China-United States: China’s Ministry of State Security released a video purportedly revealing another arrest of a CIA spy. According to the video, the spy was recruited while he was a visiting scholar at a U.S. university and then passed secrets to the CIA when he returned home to China and began working for an important defense industry firm in the province of Sichuan. After recent moves to tighten its counterespionage laws and encourage everyday citizens to report suspected spies, the MSS has revealed numerous cases of CIA spies caught in the act.

- Publication of the successful counterespionage cases is most likely aimed at making Chinese citizens more aware of the risk of spies among them.

- It’s impossible to know if these cases are real or not. If the stories are true, they suggest that the U.S. has had some success in recruiting visiting Chinese students to spy for the U.S. once they return home.

- On the other hand, such arrests could also mean that the CIA is facing another devastating loss of its spy network in China, similar to when it lost some 30 spies from 2010 to 2012, apparently because of a Chinese mole at the CIA.

- China also continues to pressure foreign businesses with tax and regulatory probes. Today, for example, we’ve seen reports that the Shanghai municipal government has arrested several employees and former employees who worked at a unit of London-based advertising firm WPP (WPP, $41.43) on suspicion of bribery. Other reports say various provincial governments are conducting tax probes of Taiwan Semiconductor Manufacturing (TSM, $91.31).

China-Philippines: According to officials in Manila, a Chinese coast guard ship on Sunday collided with a resupply ship trying to reach Philippine marines stationed on a shoal in the disputed Spratly Islands. The Chinese coast guard and maritime militia forces have long been harassing and trying to prevent such missions as part of their effort to assert Chinese sovereignty over the area, but the event this weekend was the most serious confrontation between Chinese and Philippine forces. The incident highlights the risk of a more serious military confrontation in the region.

China-Australia: In contrast with China’s clearly deteriorating relations with the U.S. and the Philippines, there are new signs that relations between Beijing and Canberra are improving again. Australian Prime Minister Albanese said he will travel to China next month for a meeting with President Xi. In addition, Albanese said the Chinese government has agreed to “review” the punitive tariffs it slapped on Australian wine in 2020 to retaliate for former Prime Minister Morrison’s suggestion that China be investigated for its role in the global coronavirus pandemic. Since China is such a large export market for Australia, the continued improvement in relations and reduced trade barriers should be bullish for Australian stocks.

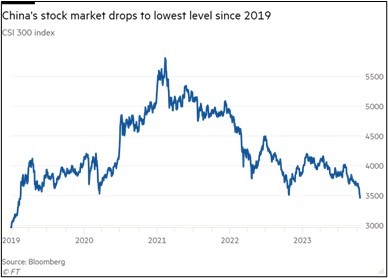

China: Chinese stock values fell as much as 1.3%, leaving them down about 15% for the year to date. The key stock indexes are also now at their lowest level since before the coronavirus pandemic. The Chinese economy and financial markets continue to struggle with a range of headwinds ranging from poor consumer demand and high debt levels to bad demographics and trade and investment tensions with the West.

Switzerland: In parliamentary elections yesterday, the right-wing populist Swiss Peoples’ Party (SVP) was projected to come in first with 29.1% of the vote, which would be its second-best showing ever. In contrast, the liberal pro-business FDP came in with just 14.5%, its worst showing. The combined share for the country’s two big Green parties fell to 16% from 21% previously.

- The parties will now embark on a period of negotiating on the makeup of parliament and the Federal Council, the country’s executive branch.

- The election results suggest Swiss policy could now shift toward greater skepticism toward Europe’s support for Ukraine in its effort to defend itself from Russia’s invasion. The SVP will likely also push harder to limit immigration into Switzerland.

Argentina: In yesterday’s first-round presidential election, Economy Minister Sergio Massa of the ruling Peronist Party unexpectedly came in first with 36.3% of the ballots, while radical libertarian Javier Milei, the leader in pre-election opinion polls, came in second with 30.1%. The conservative coalition’s candidate, Patricia Bullrich, came in third with 23.8% of the vote.

- Massa and Milei will now face off in the final round of voting on November 19.

- That sets up a contest between the statist Peronist Party, which has presided over years of poor economic growth, increased state intervention into the economy, and high inflation, against Milei and his call for radical budget cuts and the dollarization of the economy.

U.S. Politics: The House of Representatives remains in limbo as the majority of Republicans in the chamber continue struggling to agree on a new speaker. The Republicans today plan to hold a candidate forum for the half-dozen or more of its members who have thrown their hat into the ring following the recent failed candidacies of moderate Steve Scalise and right-wing firebrand Jim Jordan. The party plans to hold a new vote on the speaker’s position on Tuesday.

U.S. Bond Market: After falling just short of the 5% barrier last week, the yield on the benchmark 10-year Treasury note this morning has finally broken through that barrier. As of this writing, the yield stands at 5.021%, up from approximately 3.800% at the beginning of the year. As we note in our latest Asset Allocation Bi-Weekly Report, published today, the recent surge in bond yields could well reflect a broad-based change in the overall market regime, with global geopolitical and economic fracturing pushing up inflation and interest rates over time.