Daily Comment (October 21, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. Risk markets are a bit weaker this morning but are mostly marking time after a strong week thus far. Our coverage starts with the Beige Book and moves on to confirm that Q3 was a soft quarter. Economics and policy come next with a focus on the budget process. Bitcoin is making new highs. We discuss that and other items in the crypto section. China news follows; the heavy hand of government presses harder, and the real estate sector remains shaky. We then look at international news as the EU meetings begin, and we close with a pandemic update.

On a lighter note: Yesterday, there was a Bloomberg interview where a young child photobombed the video. We have the link—check it out! It’s a hoot.

Beige Book: Yesterday, the Fed released its Beige Book, a survey of the economy performed by the regional district banks. The report offers information about the U.S. economy on a regional basis. The report confirms what the next section is signaling—for a variety of reasons, the economy has slowed recently. Supply problems are plaguing the economy, and until these kinks are resolved, the economy will continue to struggle.

- There are a couple of notes on the supply chain issues. First, there is growing evidence of double ordering; this activity is to be expected. First, during the 1970s, it was common practice to overorder, hoping that at least some of what you ordered would arrive. Just-in-time inventory methods are rapidly turning into just-in-case, which will tend to lift prices further. Second, persistent problems with orders are undermining the case for globalization. If globalization unwinds, it will result in higher prices.

- On the topic of the Fed, yesterday we noted that Fed Governor Waller suggested rate hikes might become necessary sooner than currently expected. Governor Quarles joined him in that sentiment.

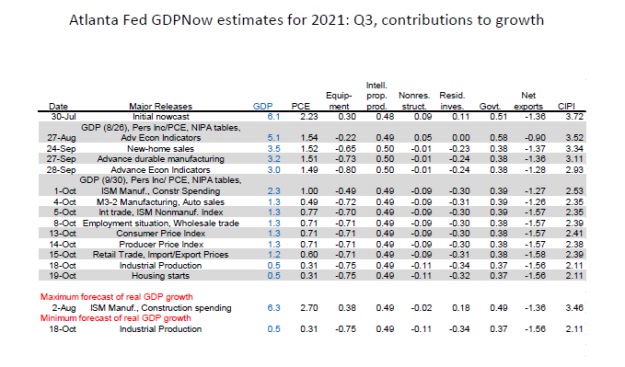

Q3 is looking weak: The Atlanta FRB’s GDPNow nowcasting model is projecting Q3 GDP growth of 0.5%. Weak industrial production and soft housing starts were the latest data to lead to a lower forecast.

This summer, when the bank began forecasting for Q3, it was projecting 6.1% growth, with inventories adding 3.7% points and consumption 1.5%. Consumption is now expected to add a small 31 bps to GDP. What is surprising to us is that when consumption falls, net exports usually become a smaller drag on growth. That isn’t the case in this model. Inventories will have a smaller contribution as well. Overall, the expectation is that Q3 will be an anomaly caused by supply chain problems. That idea is likely correct, but nearly flat GDP in Q3 is disappointing; the worry is that supply chain issues won’t get resolved until well into next year.

- A caveat to the above—high-frequency data is hinting that the worst may be over and that hiring is picking up. This data is noisy, but if current trends continue, Q3 may just be a hiccup.

- One factor that may be reducing available workers has been the continued expansion of business startups. We know that much of the pandemic relief was saved. Former workers may have decided to use those funds to start their own businesses, thus depriving current businesses workers. Surveys suggest that many of these startups are in the leisure and hospitality area, which has struggled to find workers.

Economics and policy: Talks on the budget continue.

- The budget saga continues, and since the fiscal budget is inherently a political process, politics matters. The recent uproar includes reports that Sen. Manchin (D-WV) is considering leaving the Democratic Party and becoming an independent. The senator has denied the story. We suspect this report reflects a couple of possibilities. First, Manchin is using the threat of going independent as a way to boost his bargaining leverage. With an equally split Senate, even if Manchin caucused with the Democrats, the GOP leadership would try to at least split the committee chairs. So, Manchin does have some power here. Second, Manchin may simply have been expressing frustration at the process.

- There has been a tendency to link Manchin with Arizona Senator Sinema, but they have differences on various issues, which are complicating negotiations. The latter has pushed back against the majority of the budget’s funding by opposing tax hikes that would mostly reverse the Trump tax cuts. Manchin has been more open to higher taxes on higher-income households.

- Budget negotiators are considering alternatives to rolling back the Trump tax cuts due to Sinema’s opposition. Ideas like taxing stock buybacks and a form of the wealth tax are being floated.

- At the same time, establishment Democrats want to return the SALT deductions, and this group won’t approve a budget without ending the restrictions on state and local government tax write-offs. However, restricting these deductions has increased tax revenue, and the optics are awful, given that most of the benefit goes to the wealthiest taxpayers.

- President Biden is increasing his intervention to push through his budget. Although his participation may be helpful, in reality, the problem is that with such narrow majorities, it is nearly impossible to make everyone in the party happy. So, the odds of something getting done are falling.

- A San Francisco FRB study suggests that the fiscal support package may be creating conditions that foster a normal Phillips Curve relationship. In other words, the job vacancies to unemployment ratio has become sensitive to inflation for the first time since the early 1980s.

- Amazon (AMZN, USD, 3415.06) is facing a unionization drive at its Staten Island facility. Amazon has, so far, fended off such movements, but New York is a more fertile ground for such actions. If the vote is successful, it will be worth watching to see if the efforts spread. On a different note, the company is becoming a very large player in parcel delivery.

- The Commerce Department is formulating rules that would limit the sale of hacking tools to foreigners (read: Russia and China).

- Sen Warren (D-MA) wants to give powers to bankruptcy creditors to go after private equity. Often, in a merger, private equity will burden a target with debt to extract value from the company. The company sometimes can’t service the debt and goes bankrupt. Warren’s bill would allow creditors to go after the private equity firms to claw back the equity withdrawal.

Crypto: The bitcoin ETF spurs buying.

- Bitcoin has hit a new high, moving past $66,000 on buying momentum from the newly issued ETF (BITO, USD, 43.28). The ETF is now over a billion in market cap. As we have noted in the past, crypto is becoming the debasement asset of choice, steadily unseating gold.

- Crypto miners are facing increasing scrutiny over their electricity consumption and resulting carbon emissions.

- Crypto is regularly used for nefarious purposes. Ransomware payments and money laundering are common uses of bitcoin. It is also used to circumvent capital controls, allowing citizens to protect their purchasing power in countries facing hyperinflation. The Treasury Department is also starting to realize that crypto could be used to undermine U.S. sanctions. The department is reviewing the sanctions policy in light of this development.

China news: Beijing continues to weigh on society, and real estate problems widen.

- Since General Secretary Xi began his rule of China in 2012, we have watched his steady accumulation of power. It hasn’t always been obvious what he would do with all that influence. At times, it looked as if it was simply for its own sake. Recently, though, it looks like Xi has changed his mind. He is almost certainly going to get a third term, something unprecedented in the Deng Era. The recent move to bring debt under control signals another element of control. In an interesting development, Xi now is moving to take control of China’s historical narrative. In 1945, Mao issued a resolution on the history of the party and China. Deng did something similar in 1981. Both resolutions were designed to consolidate authority and quash dissent. Although these actions, in part, are likely to prepare the ground for a third term, some of this is also to bolster his position as he tackles China’s debt problems.

- We note that as part of the narrative control, Beijing has excluded Caixin from its approved internet news list. The publication is one of the more trusted reporters on business in China, but it is sometimes critical of the government.

- Speaking of debt, real estate firms beyond Evergrande (EGRNF, USD, 0.36) are missing debt payments, often a precursor to default. Sinic Holdings (2103, HKD, 0.50) has reportedly defaulted on offshore bonds. And sadly, it doesn’t appear that conditions will improve anytime soon as the housing market in China remains weak. We note that new home prices have had their first month-to-month decline in six years. Local governments, fearing unrest, are trying to shore up home prices, but this effort may make conditions worse. The better outcome would be to allow prices to fall to where the market would clear, but the loss of wealth would bring lasting economic damage.

- Evergrande’s attempt to sell its property services unit has failed, making it increasingly likely it won’t avoid default and potentially bankruptcy. Officials are trying to contain a steadily spreading problem.

- The WTO is conducting its review of China’s trade practices. The U.S. and others are pushing to censure China, while Beijing is looking for approval.

- One area of potential conflict in the U.S. is that the political class has mostly decided that relations with China are probably not possible. On the other hand, business leaders loath to give up the opportunities to continue to do business with China. What will be interesting to watch is how the regulatory state handles this conflict. It is a well-known fact that there is a “revolving door” between business and government regulators. When working in the private sector, a middle-level executive may be trying to do business in China; when she cycles into government, she may be doing just the opposite. The problem is that such conditions create divided loyalties. How the elected political class will try to control this problem is still unclear.

- Here is an example. Sinopec (SNP, USD, 51.17) has signed a massive agreement to purchase U.S. LNG, a deal that will more than double current sales. Not only will this sale potentially reduce supply available to other nations (read: Europe), but it will make energy producers less open to sanctioning Beijing.

- China is taking aggressive measures to contain coal prices. Although prices dropped on the news, it isn’t obvious how prices can be regulated lower without further curtailing supplies. One way China is trying to boost supplies is by reopening mines.

- On the geopolitical front:

- China apparently conducted two hypersonic missile tests this summer.

- The EU is concerned about the Chinese threat to Taiwan (hint: it’s all about semiconductors). At the same time, Taiwan’s military leaders are worried they may not be able to mount an effective defense against a Chinese invasion.

International roundup: The Europeans hold meetings; Poland is the main topic.

- The European Council meetings begin this week, and the big topic is the Polish rejection of EU courts. Poland’s government was trying to bring its domestic courts under its control but ran afoul of EU courts and is now facing the threat of a cutoff of EU funds. In the past, Chancellor Merkel tended to protect states like Poland and Hungary, mostly to protect German investments there (Germany offshores production in central Europe), but with her power waning, the EU might move against Warsaw.

- The other big issue is immigration (which was, interestingly enough, a big issue in Merkel’s first council meeting in 2005). Poland is facing waves of Middle East immigration being fostered by Belarus as a way to dilute sanctions against Minsk. In an offer fraught with symbolism, Germany has offered to patrol the Poland/Belarus frontier jointly.

- NATO is also meeting this week; Germany is warning against growing sentiment for a Europe-only defense. We would, too; history suggests a Europe-only defense would devolve into the inter-Europe tensions that led to two world wars in the last century.

- As we noted yesterday, the resignation of Bundesbank President Weidmann is creating a political situation for Germany’s coalition negotiations. The SPD, FDP, and Greens are allocating power, and we suspect all three would like to put one of their own in this position. An FDP member would maintain the hawkish tradition of the Bundesbank; either other party would suggest an easier stance. Although the Bundesbank has not been able to prevent an expansion of monetary easing in recent years, a dovish German would likely open the door for even more policy easing.

- The ECB wants European banks to begin pulling activity to the continent and out of London.

- Brazilian President Bolsonaro is facing criminal charges for his handling of the pandemic.

- Although Pakistan generally welcomed the Taliban taking power in Afghanistan, it is facing an increase in Islamic insurgency activity as a result. It will be interesting to see if these insurgents target Chinese nationals who work in Pakistan.

COVID-19: The number of reported cases is 242,163,439, with 4,924,605 fatalities. In the U.S., there are 45,220,057 confirmed cases with 731,2712 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 496,915,265 doses of the vaccine have been distributed with 410,189,737 doses injected. The number receiving at least one dose is 219,381,466, while the number receiving second doses, which would grant the highest level of immunity, is 189,709,710. For the population older than 18, 68.6% of the population has been vaccinated. The FT has a page on global vaccine distribution. The Axios weekly map shows cases rising as temperatures cool across the northern tier of states. Meanwhile, the south is showing continued declines as cooler weather there allows outdoor gatherings.

- Booster shots for the three major vaccines have been approved by the FDA; patients can “mix or match” the vaccines. In related news, the CDC says it’s acceptable to get the COVID-19 vaccine and the annual flu shot on the same day. Boosters are showing a strong immune response.

- Russia has ordered a seven-day shutdown to curtail rising infection rates.

- On the other hand, the U.K. is resisting closures, even as cases rise.