Daily Comment (October 20, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a rough start, while the Houston Astros and Texas Rangers are tied in the ALCS. Today’s Comment begins with our analysis of Fed Chair Jerome Powell’s comments at the Economic Club of New York. We then explain why forecasters have become more optimistic about the economy, discuss the upcoming presidential election in Argentina, and provide other financial market news. As always, our report includes an overview of the latest domestic and international data releases.

Powell’s Message: During his speech at the Economic Club of New York, Fed Chair Jerome Powell sent mixed messages about the path of future policy.

- Powell signaled that the central bank is unlikely to raise interest rates again unless economic growth clearly undermines progress on inflation. He also said that he does not believe current rates are too tight, suggesting that the Fed may not be finished with its hiking cycle. The Fed Chair’s comments reassured investors that the Fed will likely hold rates steady at its next meeting, but they did little to clarify the path of policy for the following year. Markets initially responded positively to his comments but then turned negative over the course of the day. The S&P 500 dropped by 0.8% on the day, while yields on the 10-year Treasury rose sharply.

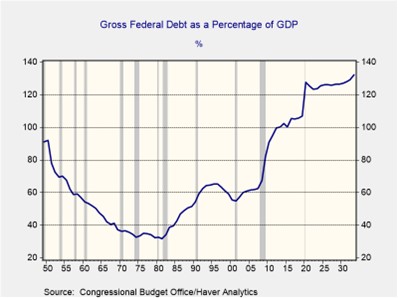

- Policymakers are likely to pay close attention to several market events before deciding whether to pause or hike interest rates. One key event to watch is the conflict in Israel, which has expanded outside of Gaza and into Lebanon, prompting the U.S., U.K., and Germany to advise their citizens to leave the region. Conflict in the Middle East can potentially lead to a reacceleration of inflation. Additionally, Thursday’s initial jobless claims data suggests that the labor market may be too tight for policymakers to take their foot off the pedal. Lastly, Powell may also be paying close attention to government debt talks as he has mentioned that the fiscal path is unsustainable.

- Fed Chair Jerome Powell is likely to remain tight-lipped over the next few months about his plans, as investors eagerly await any signs of a pivot. Powell has stated that the Fed intends to keep rates higher for longer, but he has not explained what that means in practice. The September FOMC dot plots shows that members are aiming to cut rates by 50 basis points next year, suggesting that policymakers’ “higher-for-longer” stance does not mean they will not cut rates, but rather that they will be cautious in easing policy. As a result, investors should not expect rates to fall significantly over the next few months unless there is a major crisis.

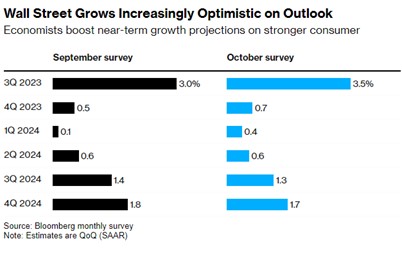

Economic Resilience: Economists have dialed back recession fears as data consistently surprises to the upside.

- Several GDP forecasts have been revised up for the third quarter of 2023, suggesting that the U.S. economy grew strongly during that period. Bloomberg surveys show that analysts have raised their estimates for Q3 GDP growth from 3.0% in September to 3.5% in October. These revisions reflect the optimism generated by the Atlanta GDP Nowcast, which estimates that the economy grew 5.4% from July to September. Much of the optimism is related to expectations that consumption rebounded after slowing to a seasonally adjusted annualized rate of 0.8% in the second quarter.

- A growing shift in recession expectations is underway. At the start of the year, most economists expected the U.S. to fall into recession sometime in 2023. However, with two months remaining in the year, economists are becoming more optimistic about avoiding a recession altogether, thanks in part to the continued tightness of the labor market. The latest surveys show that the consensus estimate is the U.S. economy will not contract until at least 2025. While some economists still believe that a mild recession could occur in late 2023 or early 2024, the overall outlook has improved significantly.

- Investors should keep in mind that predicting recessions is a very difficult task, and no one has perfect timing. A 2018 study by the International Monetary Fund (IMF) found that public and private sector forecasters missed a majority of the 153 recessions that occurred in 63 countries between 1992 and 2014. While economists cannot predict recessions with perfect accuracy, they can identify conditions that would make an economy more vulnerable to a recession. For example, the 1990 and 2000 recessions may have been avoided if it weren’t for the 9/11 terrorist attacks and the Gulf War. As a result, investors should still be vigilant, as geopolitical and domestic risks still pose a threat to the expansion.

Argentine Elections: Investors are already seeking safety assets in anticipation of a controversial candidate winning the presidency.

- Far-right candidate Javier Milei is currently leading in the polls, closely followed by Sergio Massa and Patricia Bullrich. Milei is an extreme candidate who has vowed to ditch the Argentine peso (ARS) for the U.S. dollar. Additionally, he has also promised to privatize state-owned businesses and get rid of the country’s central bank. His potential victory has concerned investors since his policies are so extreme. Companies have halted sales, fearing that the election result could lead to a drop in currency values, which will wipe out their revenues. Additionally, exchange-traded funds tracking Argentine stocks have experienced their biggest outflow in more than two years as investors flee for safety.

- The next president of Argentina will inherit a struggling economy, with triple-digit inflation, a recession, and a growing risk of government debt default. The other two candidates, Patricia Bullrich from the center-right Juntos por el Cambio coalition and Sergio Massa from the center-left Unión por la Patria coalition, have offered more traditional solutions to the economy, such as implementing austerity to reduce inflation or cutting taxes for businesses to boost growth. However, a growing share of the population, particularly young men, are drawn to anti-establishment candidates like Javier Milei. Polls show that he is most popular among men under the age of 44.

- Despite his popularity, Javier Milei’s victory in Argentina’s presidential election is far from assured. To avoid a runoff, he would need to win over 45% of the vote outright, or 40% with a 10-point lead over his closest rival. The most optimistic polls show that Milei has a 3% lead over Massa and a 10% advantage over Bullrich. However, another poll shows that he is down 5% against Massa and is virtually tied with Bullrich. Surveys show that Milei would defeat Massa by 2 points in a run-off but lose to Bullrich by 5 points in a runoff. An upset loss for Milei would likely lead to a rally in the country’s stock market and currency.

Other news: Delinquencies are rising in the U.S. as borrowers struggle to repay pandemic loans, suggesting that households are under increasing strain despite rising consumption. The United Nations is having a hard time sending aid to Gaza, thus raising the likelihood of a humanitarian crisis in the Middle East and refugee problems for neighboring countries Egypt and Jordan. Republican nominee Jim Jordan is expected to fail in his third bid for House speaker, exacerbating concerns about growing U.S. political dysfunction and raising the likelihood of another credit downgrade.