Daily Comment (October 20, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our explanation as to why unorthodox policies can lead to currency weakness. Next, we discuss how the possibility of a withdrawal of Western support could help end the war in Ukraine. We end the report with our thoughts on rising inflation’s impact on earnings and its implications for economic growth.

It’s the Economy: Japan and the U.K. are facing backlash as the countries’ unorthodox policies continue to stir controversy.

- U.K. Prime Minister Liz Truss was forced to resign from her position on Thursday. Truss’s failed attempt to push through a controversial set of tax cuts designed to stimulate the economy has led her party members to question her leadership. Her removal from office led to a rally in the pound, but we suspect that uncertainty over her possible replacement could lead to a reversal. Additionally, another reshuffling of the party’s leader may erode Tory support among the general populace. The resulting chaos has led rival parties to call for new elections. The latest polls show that the Labour party would be heavily favored if there were another election.

- The 10-year yield on Japanese Government Bonds exceeded the Bank of Japan’s target on Thursday, forcing the bank to intervene. The BOJ offered to buy an unlimited amount of 10-year notes at 0.25%. The surprise action helped push the yen to 150 per dollar, a multi-decade low. It is unclear whether the Bank of Japan will end its ultra-low policy accommodation; however, it is becoming clear that the market believes it has no other choice.

- In the meantime, the bank may be forced to offload some of its U.S. Treasury holdings as it looks to recoup dollars to meet its cash needs. Thus, this situation could further worsen the U.S. government’s securities liquidity problem within the banking system.

- Market pushback against Japan and the U.K. may explain why central banks may be hesitant to end policy tightening prematurely. As the impossible trinity shows, a central bank has three policy options: fixed exchange rate, sovereign monetary policy, and free capital flow, but it can only choose two. Because Japan and the U.K. have decided to maintain the latter two, they are forced to grapple with sudden changes in their exchange rates when they go against the market. This problem is particularly an issue as the Fed raises rates because it gives investors a higher-yielding and safer alternative. As a result, we suspect global tightening will likely continue as long as the Fed feels it is appropriate to continue raising rates.

Higher Prices, Higher Profits: Rising inflation has helped boost earnings; however, this trend is unlikely to last forever.

- High inflation figures in the U.K., Canada, and the Eurozone suggest more global monetary tightening is on the way. The September Consumer Price Index rose 10.1% from the prior year in the U.K. and 6.5% for the same period in Canada. Meanwhile, the revised CPI report for the Eurozone showed prices rising 9.9% since September 2021, down 0.1% from the previous report. The persistent inflationary pressures will force central banks to raise rates to restore price stability. These three countries control half of the world’s six most traded currencies. As a result, foreign countries that repay debt using these currencies could see their interest payments increase due to the fluctuation in exchange rates.

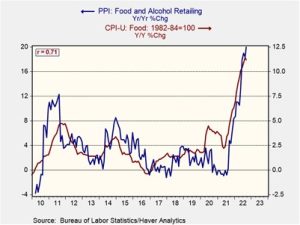

- U.S. firms still have significant pricing power. On Wednesday, consumer goods companies Procter & Gamble (PG, $130.14) and Nestle (NSRGY, $105.70) posted better-than-expected earnings thanks to price increases. These companies’ ability to push costs onto consumers suggests that inflation may be stickier than initially thought. This relationship is exemplified when comparing the prices paid by retail producers for food and alcohol and the prices paid by consumers for the same goods. We expect that the economic slowdown and margin contraction will not sustain the current price trend. Thus, we do believe that inflation could be heading down faster than most investors realize.

- As inflation becomes more of a problem, central banks will respond by raising rates. The Federal Reserve has already increased its benchmark rate by 300 bps this year and could hike it by at least another 100 bps by December. Although the Bank of England and the European Central Bank have not tightened as aggressively as the Fed, both banks are expected to have similar hikes. Moreover, tightening financial conditions will worsen the economic slowdown and hurt company profits. We believe that as global growth slows and inflation remains high, it will be favorable for commodities.

Under Pressure: Despite Ukraine’s recent successes on the battlefield, it is now facing political headwinds from the West.

- As the U.S. prepares for midterm elections, Kyiv frets over whether it can rely on American aid to sustain its war efforts. On Wednesday, House Minority Leader Kevin McCarthy warned that if Republicans take over the House, Congress will not write Ukraine a blank check to help fight its war. This message caught many Ukrainian officials off-guard as it had received previous assurances from the lawmaker that nothing would change if Republicans won. The lack of U.S. support will make it difficult for Ukraine to maintain its current momentum. As a result, Ukraine forces may look to consolidate their territorial gains now.

- Meanwhile, energy supply constraints could weaken the European Union’s support for Ukraine. In Italy, the likely new Prime Minister Giorgia Meloni is expected to navigate the EU’s third-largest economy away from the economic abyss. Although she favors aiding Ukraine in its war efforts, her likely coalition partners, Silvio Berlusconi and Matteo Salvini, do not, especially if it means no Russian gas for Italy. The lack of unity around this issue suggests that Italy may not be much help to Ukraine.

- The German Chancellor Olaf Scholz expressed concern over implementing an EU-wide cap on gas prices. He warned that the plan could backfire. Although not a surprise, given Deutschland’s dependence on Russian energy, his comments reflect a growing hesitancy among EU members to support Ukraine.

In short, an indefinite war for Ukraine may be out of the question. If it wants to continue fighting, it needs to tighten its fiscal belt now because it cannot rely on the West’s support in the future, especially as these countries head toward recession. That said, there is a silver lining. Ukraine could be forced to the negotiating table next year, in which it may have to accept some territorial losses in order to maintain its sovereignty. If we are right, the situation could pave the way for Russian commodities to enter the market, thus providing much relief for struggling countries. At the same time, EU energy consumers can never look at Russian supplies the same way again. Even if Russian oil and gas returns to Europe, there will still be an incentive for redundant supply sources. It would not be inconceivable to see quotas on Russian oil and gas flows. Thus, even if the hostilities end, the reverberations will continue.