Daily Comment (October 18, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news of further U.S. restrictions on the sales of advanced semiconductors and related equipment and services to China—a move that is sure to put additional strains on the U.S.-China relationship and keep investors on edge. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the latest on the Israel-Hamas conflict, sticky consumer price inflation in the U.K., and the prospect for new financial regulation in the U.S.

United States-China: As we flagged in our Comment on Monday, the Biden administration issued new rules yesterday to further limit the sales of advanced semiconductors and related equipment and services to China. According to the administration, the new rules are designed to maintain the effectiveness of the draconian controls issued by the administration in October 2022 and August 2023. They are also designed to close loopholes in those rules and ensure they remain durable over time. Overall, the evolving controls aim to keep Beijing from gaining a military edge from artificial intelligence and other advanced information technologies.

- The new rules will ban the export of additional types of semiconductor manufacturing equipment to China and expand the licensing requirements for shipping such equipment.

- It appears that the tightened requirements will be especially hard-hitting for high-flying chipmaker Nvidia (NVDA, $439.38), whose stock price has surged this year on the strength of its advanced chips used in artificial intelligence applications. Last year, Nvidia began offering Chinese customers chips specifically designed to get around the original controls, but these new rules appear to close off that option.

- As we noted on Monday, the new controls not only update the technology-transfer rules issued last year, but they also supplement the tariffs and other broad trade barriers against China that were imposed by the Trump administration, which largely remain in place.

- As we have written many times before, the clampdown on bilateral trade, investment, and technology flows are a symptom of the worsening tensions between the U.S. geopolitical bloc and the China/Russia bloc. Those tensions, and the potential for new bilateral restrictions, continue to pose risks for investors.

United States-Marshal Islands-China: In another move to hinder China’s growing military and political power in the southwestern Pacific Ocean, the U.S. this week struck a deal with the Marshal Islands to renew the two countries’ longstanding security relationship. Under the updated pact, the U.S. will provide $2.3 billion in aid to the archipelago over the next 20 years in return for continued military access to its land, air, and maritime territories. The new deal follows the renewal of similar pacts with Palau and Micronesia earlier this year.

China: Key sectors in the country’s domestic economy continue to falter, with major real estate developer Country Garden (CTRYY, $2.39) today apparently missing its final deadline to make a $15.4-million interest payment on one of its dollar-denominated bonds. That’s likely to spark a wave of cross-defaults on the rest of its $15.2 billion or so of international bonds and loans. In turn, that will likely further undermine confidence in China’s huge property sector, hold back investment, and weigh on the country’s asset values.

- Despite Country Garden’s default, regular data out today showed some modest near-term improvement in economic activity. According to official data, gross domestic product rose by a seasonally adjusted 1.3% in the third quarter, after a rise of just 0.8% in the second quarter. GDP in the third quarter was up 4.9% from the same period one year earlier.

- In September, consumer lending jumped by approximately $44 billion, suggesting an improvement in mortgage lending and home purchases. The growth in retail sales also accelerated, while the unemployment rate ticked down slightly.

Israel-Hamas: Last night, Jordan canceled the planned Wednesday summit between President Biden and regional leaders after an explosion reportedly killed hundreds of civilians at a hospital in Gaza. Both Israel and Palestinian leaders in Gaza blamed each other for the apparent missile strike. In addition, Muslim countries ranging from Turkey to Saudi Arabia pinned the blame on Israel, and Palestinians in the West Bank launched massive protest demonstrations, all of which illustrate the risk that the event will lead to broader regional hostilities.

- Upon his arrival in Israel today, President Biden said he believes the Palestinians were responsible for the blast and suggested the U.S. has at least some intelligence pointing in that direction.

- Some observers have suggested that the hospital blast could have come from a misfired Palestinian rocket. Hamas militants also have a reputation for hiding weapons in hospitals and using civilians as human shields.

- In any case, Biden’s continued strong support for Israel is probably working for him in political terms right now, both internationally and domestically. He is therefore likely to keep supporting Israel in the near term. Nevertheless, the risk of the conflict broadening out to the rest of the region remains significant.

United Kingdom: The September consumer price index was up 6.7% from the same month one year earlier, matching the rise in the year to August and dashing expectations that the inflation rate would decline a bit to 6.6%. Excluding the volatile food and energy categories, the September core CPI was up just 6.1%, decelerating from the 6.2% rise in the year to August, but the report was still seen as encouragement for the Bank of England to keep hiking interest rates.

U.S. Bond Market: Yesterday’s strong report on September retail sales prompted investors to bail out of bonds, boosting the yield on the two-year Treasury note to a 17-year high of 5.20%. The yield on the 10-year Treasury note rose to 4.85%, also near its highest level since 2006. The retail report has rekindled fears that continuing supply-chain disruptions, labor shortages, rising wage rates, and high demand will keep price inflation high and prompt the Federal Reserve to keep hiking interest rates.

U.S. Financial Market Regulation: The Fed yesterday said it will hold a meeting next week on whether to revise its cap on the fees that merchants pay to debit card issuers when customers make purchases with their cards. Under the Fed’s current rules, merchants pay large card issuers up to $0.21 plus 0.05% of the transaction amount, but the policymakers are considering lowering that cap. If the Fed proposes to cut the fees, it would modestly reduce costs for sellers but would likely generate strong pushback by card issuers and some members of Congress.

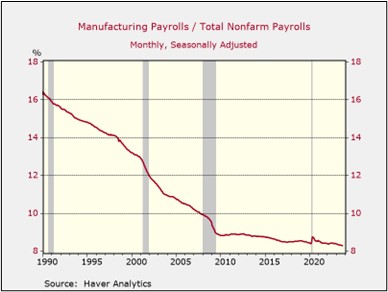

U.S. Labor Market: In an interview with the Financial Times, a member of the White House Council of Economic Advisors predicted that the current boom in U.S. factory construction, which we’ve been reporting on, will produce further gains in well-paid manufacturing jobs. Indeed, the employment report for September showed the number of U.S. manufacturing jobs has surpassed 13 million for the first time since 2008. Nevertheless, we would note that manufacturing employment as a share of total nonfarm payrolls hasn’t yet started to turn up.