Daily Comment (October 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

With last week’s events in Israel serving as a reminder of how the world is becoming more violent and chaotic as the post-Cold War era comes to an end, today’s Comment opens with an update on the all-important risk of a Chinese move to take control over Taiwan. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including more signs that the Bank of Japan may soon intervene to support the yen (JPY) and the latest developments in the U.S. labor market.

China-Taiwan: Kyodo News recently carried a nice summary of the strategy options Beijing is likely considering to eventually achieve its long-held goal of taking control over Taiwan. Consistent with our view, the article discounts the likelihood that the People’s Liberation Army would launch an amphibious invasion of the island. Rather, the PLA’s recent exercises suggest it would establish a naval, air, and missile “quarantine” around Taiwan to cut the island off from needed supplies and pressure its government to submit to Chinese authority.

- Rather than calling the operation a “blockade,” which is an act of war against a foreign country, Beijing would say it is merely controlling access to its own territory. That assertion would aim to make it politically difficult for the U.S., Japan, South Korea, and their allies to intervene.

- Beijing could also start off with only occasional or targeted quarantine actions, perhaps using coast guard forces on ostensibly “law enforcement” missions.

- The goal for such actions would be to raise shipping insurance costs and otherwise discourage maritime traffic to the island without necessarily sparking a military response from the U.S. and its allies.

- A major risk for Beijing is that a quarantine strategy would allow the U.S. and its allies time to build up their forces in the region and develop a strategy to defeat the quarantine. Nevertheless, given China’s much closer proximity to Taiwan, it would find it much easier to sustain itself in a long stand-off.

- Even if the U.S. and its allies rapidly build up their forces and use their superior technology to sink the PLA Navy and down the PLA Air Force, China’s trump card is probably its enormous missile arsenal.

- Even after losing many ships and aircraft, China could saturate Taiwan and its nearby shipping corridors with ground-attack and anti-ship missiles to keep the quarantine in place. Chinese missiles could also threaten U.S. and allied military bases in places like Okinawa, the Philippines, and Guam. Taking out those missiles would require a U.S. or allied attack on Chinese territory, potentially sparking a nuclear war.

- In sum, Beijing has big strategic and tactical advantages around Taiwan, along with regional military superiority. If Washington wants to meet its security commitment to the island, maintain the U.S. alliance structure, and protect U.S. interests, the U.S. and allied militaries will have to be rebuild to a scale sufficient to deter China from throwing its military weight around.

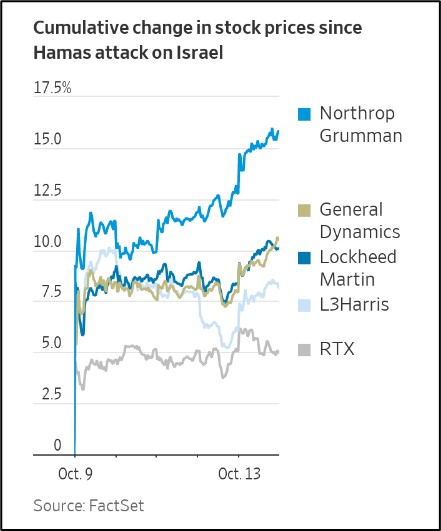

- As we have noted before, Western defense spending will likely rise for years, and domestic reindustrialization will probably continue.

- That will likely create important new investment opportunities in the industrial and defense-related technology sectors.

United States-China: White House officials say President Biden will issue new rules this week to further limit the sale of advanced semiconductors and related equipment to China. The new rules will supplement the draconian controls issued by the administration in October 2022 and in August 2023, which aim to keep Beijing from gaining a military edge from artificial intelligence and other advanced information technologies.

- The Biden administration’s technology controls also supplement the tariffs and other broad trade barriers against China that were imposed by the Trump administration and largely remain in place.

- As we have written so many times before, the clampdown on bilateral trade, investment, and technology flows are symptoms of the worsening tensions between the U.S. geopolitical bloc and the China/Russia bloc. Those tensions, and the potential for new bilateral restrictions, continue to pose risks for investors.

Japan-China: In a sign the Japanese government is becoming more concerned about Chinese aggression in the near term, Defense Minister Kihara said Japan will start buying the U.S.’s advanced Tomahawk cruise missiles in its fiscal year starting March 2025, one year earlier than previously planned. To further underscore Japan’s urgency to get the missiles sooner rather than later, the earlier acquisition date requires Japan to accept certain compromises in capabilities. The FY 2025 purchase means the first 200 missiles bought will be current Tomahawk models, while only the remaining 200 missiles, to be bought in FY 2028 and later, will be the latest Block 4 model.

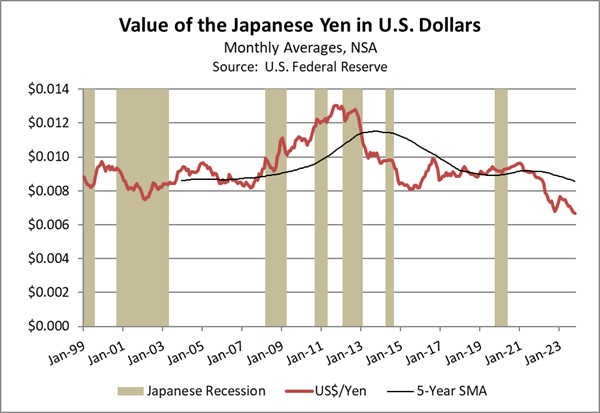

Japan: At a Group of 20 meeting on Friday, Finance Minister Suzuki warned that Tokyo may need to intervene to support the yen (JPY) as tightening monetary policy around the world continues to drive the currency lower. The statement, which followed a separate warning earlier this month, came as the JPY depreciated anew to close the week at 149.56 per dollar ($0.00669), very close to the rate of 150.00 per dollar ($0.00667) that has long been seen as the point at which Japan would step in to support the currency.

New Zealand: In parliamentary elections over the weekend, the center-right National Party came in first with about 39% of the vote, followed by its preferred coalition partner, the ACT Party, with 9%. That should allow NP leader and former business executive Christopher Luxon to become prime minister as head of a government consisting of NP, ACT, and possibly the populist New Zealand First Party.

- The new right-wing government would replace the center-left Labor Party that has ruled since 2020.

- In his campaign, Luxon said his government would emphasize fighting crime, reducing road congestion, and increasing personal responsibility.

Saudi Arabia-Israel: Sources say Saudi Arabia has now formally notified the U.S. that it will suspend its negotiations with Israel for normalizing ties between the two countries. The notification came as Israel continued to prepare for a massive ground attack on Gaza and its Hamas government to retaliate for the big Hamas terrorist attack on Israel last week. The Saudis’ suspension of normalization talks was probably a top goal for Hamas.

- Separately, Iran warned Israel over the weekend that while it doesn’t want to see further escalation of the conflict between Israel and Hamas, it will intervene if Israel proceeds with a major ground attack on Gaza. Reports also say Iranian-backed Hezbollah fighters in southern Lebanon have stepped up their missile and artillery strikes on Israel in recent days.

- The developments underscore the continuing risk that the conflict will spread. The worst-case scenario would be a regional conflict involving several states, which would likely be very negative for risk assets but positive for the dollar and crude oil.

Poland: In elections yesterday, the ruling right-wing Law and Justice Party (PiS) came in first with almost 37% of the vote, but that may not provide enough seats in parliament to stay in power, even in coalition with the country’s far-right parties. If that is borne out in the final count, it would open the door for former Prime Minister Donald Tusk and his Civic Platform Party to return to power. Since Tusk is known to be business-friendly and pro-European Union, Polish stock prices have surged so far today, as has the Polish currency.

Ecuador: In a run-off election over the weekend, center-right businessman Daniel Noboa won the presidency with approximately 52% of the vote, beating his leftist rival Luisa González. Noboa, who is only 35 years old, campaigned on a platform of encouraging foreign investment and creating better employment opportunities for younger workers.

U.S. Monetary Policy: In an interview with the Financial Times, Chicago FRB President Goolsbee insisted that U.S. price pressures are on a sustainable downtrend, despite fluctuations in the inflation data. He also said Federal Reserve policymakers are “rapidly approaching” the point where they will shift from discussing the need to raise interest rates further to discussing how long to hold rates at their current high levels. That is consistent with our view that the Fed’s monetary policy is almost as tight as it will get, but that it may remain tight for some time.

U.S. Labor Market: Healthcare giant Kaiser Permanente and its striking unions late last week reached a tentative deal on a new labor contract. We have yet to see details on the agreement, but we note that the workers had been demanding not only higher wages, but also improved staffing at Kaiser’s facilities to improve work conditions.

- Although demand continues to outstrip supply for relatively lesser-skilled workers, hiring for “knowledge workers” in areas like technology, finance, and consulting has fallen.

- As a result, an unusually large proportion of second-year MBA students are still without job offers and are starting to look for positions in other industries.

U.S. Defense Stocks: The Wall Street Journal today carries a nice summary of the current challenges and future opportunities in defense stocks. Despite some current headwinds, such as uncertain funding amid the political polarization in Washington, the article echoes our view that longer-term trends toward a more chaotic, tension-filled world will likely be positive for defense stocks going forward (although we think the new, fractured, tension-filled world will also be positive for firms in defense-related technology, energy, mining, and commodities).