Daily Comment (October 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures are pointing higher this morning. Today’s report begins with our thoughts on EU and U.K. trade relations. Afterward, we review international news followed by U.S. economics and policy coverage. China news is next, and we end the report with our pandemic coverage.

U.K.- EU: The ongoing row between the U.K. and the EU over the Northern Ireland issue appears to be heading to a point of no return. On Thursday, EU leaders urged Maros Sefcovic, Brexit negotiator for the EU, to draw up retaliatory measures if the U.K. decides to trigger Article 16 of the Northern Ireland Protocol. The protocol allows goods to move freely between the EU and Northern Ireland and from Northern Ireland to Great Britain. However, goods from the U.K. into Northern Ireland must go through customs. Invoking Article 16 would allow the U.K. or EU to suspend this arrangement if either side believes that the arrangement is causing “economic, societal, or environmental difficulties.” Earlier this year, the EU threatened to invoke Article 16 to deal with its vaccine shortage but backtracked days later.

Since coming to terms over the Northern Ireland issue, the two sides have struggled to make the deal work. Rivaling factions within Northern Ireland have made the protocol less tenable as Unionist and Loyalists, who consider themselves British, resented the restrictions placed on U.K. goods. In an attempt to appease critics of the protocol, Prime Minister Boris Johnson has openly pushed to revisit the agreement but Brussels has expressed little appetite for doing so. The unwillingness of Brussels to discuss the matter further has likely put the two sides on a collision course as calls for its removal have become louder.

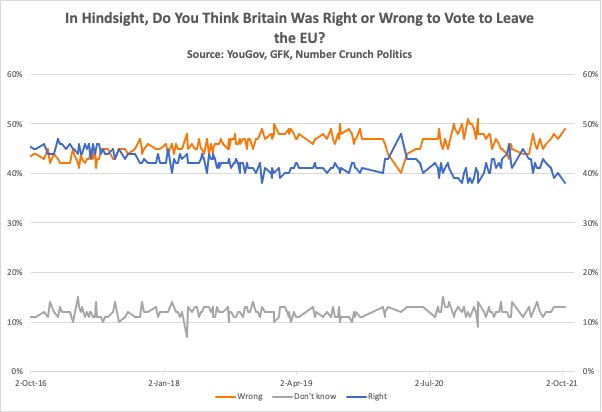

The rise in tensions between the two sides indicates a growing trend that could lead to a potential hard break between the EU and the U.K. Although we suspect that neither side wants to scrap the Brexit agreement, political constraints may make it difficult for the two sides to coexist. PM Johnson’s credibility and legacy are dependent on not only navigating the U.K. away from the European Union but also selling the public that it was the best decision for the country. Additionally, leaders of countries within the European Union need to convince their constituents that leaving the bloc is a bad idea. As a result, the path of de-escalation is becoming increasingly difficult. Recent polls suggesting the British people have soured on Brexit likely add to PM Johnson’s woes. The fall in sentiment is partially related to the increase in food and energy shortages.

International news:

- French Finance Minister Bruno Le Maire said that the European Union and the U.S. are not on the same page when it comes to engaging with China. Speaking to Bloomberg News, Le Maire stated that “the U.S. wants to oppose China, Europe wants to engage China.” The differing views on China highlight the growing friction between the U.S. and Europe. Up until recently, Europe has generally followed the U.S. lead when it comes to foreign policy. However, the U.S. appears to be souring on its relationship with Europe. The AUKUS pact between Australia, the U.K., and the U.S. that led to France losing a submarine contract was the latest evidence of this shift.

- Japanese Prime Minister Fumio Kishida dissolved the country’s House of Representatives to pave the way for new elections on October 31. Kishida is seeking a mandate to push his policies through the government. Currently, the country is dealing with a potential resurgence of COVID-19 and a sluggish economy. The move to dissolve the government is rather risky given Kishida’s declining approval ratings since taking office 11 days ago.

- In a recent interview with the Financial Times, Kishida took a veiled shot at former Japanese PM Shinzo Abe in which he argued that his predecessor’s brand of economics didn’t do enough to support the broad economy.

- Protests over an inquiry into last year’s port explosion turned into armed clashes in Beirut on Thursday. The violence underscores the growing tensions within Lebanon that threaten the newly formed government.

Economics and policy:

- A heightened chance of La Niña could lead to more issues for the global economy. The U.S. Climate Prediction Center stated that conditions favor a La Niña event to take place sometime between December 2021 and February 2022. If accurate, this could mean drier conditions in South America and increased flooding conditions in Indonesia. As a result, agricultural crops would be negatively affected.

- Arizona Senator Kyrsten Sinema (D-AZ) reportedly told Democrats in the House of Representatives that she will not vote for the social spending bill. The Democrats are facing a time crunch to get a bill passed before the debt ceiling expires on December 3, and they are still struggling to cobble together the votes needed to push the bill through Congress.

- Around 10,000 unionized workers at Deere & Company (DE, $329.77) went on strike on Thursday after rejecting a contract proposal settled with the company and the United Automobile Workers union.

China:

- LinkedIn is removing the social media components of its website in China. The site will be replaced and rebranded as a new job-board service called “InJobs.” Recently, LinkedIn was embroiled in a lot of controversy after blocking the profiles of activists and journalists in China who were critical of Beijing. The decision to remove the social media component highlights the growing scrutiny that social media platforms are receiving from governments around the world. Prior to removing the social media component, Chinese regulators were pressuring LinkedIn to clean up its online content. Given the fact that a large share of new social media users are coming from developing markets, moves like this suggest that these firms may struggle to attract more users to their sites in the future.

- The People’s Bank of China has stated that the fallout from Evergrande (EGRNY, USD, 8.88) is controllable and unlikely to spread. However, the central bank’s decision to loosen restrictions on home loans has stirred speculation that the Evergrande fallout could be worse than China is letting on.

COVID-19: The number of reported cases is 239,642,888 with 4,882,474 fatalities. In the U.S., there are 44,768,043 confirmed cases with 721,567 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 490,951,045 doses of the vaccine have been distributed with 405,444,558 doses injected. The number receiving at least one dose is 217,953,275, while the number receiving second doses, which would grant the highest level of immunity, is 188,281,747. The FT has a page on global vaccine distribution.

- An advisory panel recommended that the Food and Drug Administration should authorize an extra dose of the Moderna (MRNA, $331.88) vaccine to adults 65 years and older as well as those who are younger and at risk. A panel is expected to meet to discuss the booster for Johnson & Johnson (JNJ, $160.11) on Friday.