Daily Comment (October 13, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are up slightly, and the Atlanta Braves are out of the playoffs. Today’s Comment starts with our thoughts on the inflation report. We then follow with discussions on rising global borrowing costs, the Polish Parliamentary elections, and provide an update on Hamas/Israel. As usual, our report also provides an overview of the latest domestic and international data releases.

Inflation Losing Momentum? September’s CPI report spooked investors, raising concerns that stubborn price pressures could persist.

- Consumer prices rose 3.7% in September, unchanged from August and above expectations. Treasury yields rose sharply following the report, with the 10-year yield increasing 11 basis points to 4.71% on Thursday. The S&P 500 and Nasdaq Composite fell roughly 1% on the day. The sell-off in financial assets reflects investors’ concerns that the Federal Reserve will continue to tighten monetary policy to combat inflation. The CME FedWatch Tool now projects a 30% chance of another rate hike before the end of the year, up from 25% the day before.

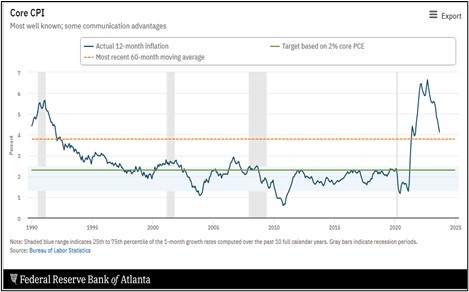

- Despite the market’s negative reaction, the CPI report offers some grounds for optimism about inflation. The surprise increase in shelter prices, which spiked 0.6% last month, was a key contributor to the overall rise in inflation. However, we are skeptical that this trend will continue into next year. The core CPI, which excludes volatile food and energy prices, continued its downward trend, with the year-over-year change falling from 4.3% in August to 4.1% in September. Additionally, if the trend of the past six months continues, inflation is likely to fall below its five-year average within the next few months.

- The Federal Reserve is likely to face turbulence as it works to move core inflation below 4%, which is expected to happen this year. Fed officials are aware of this and will likely plan to hold rates steady before gradually reducing them over time. However, the decision to hike rates again could change if the October and/or November job reports continue to show that the labor market remains strong. As a result, the latest CPI report is unlikely to be enough to shift the sentiment of policymakers, and another rate hike cannot be completely ruled out.

Global Credit Squeeze: The lack of available liquidity is starting to impact major economies.

- Countries are struggling to cope with rising global interest rates. UBS (UBS, $24.50) warned on Friday that the rapid increase in unsecured personal loans in India raises the likelihood of a rise in defaults. Bank of England Governor Andrew Bailey has warned that U.K. interest rates have risen to “restrictive” levels and that he will be closely monitoring how policy impacts the country’s mortgage market. Meanwhile, Italian bond yields have surged over the last few weeks, raising concerns that the European Central Bank may need to scale back plans to shrink its balance sheet to prevent financial fragmentation.

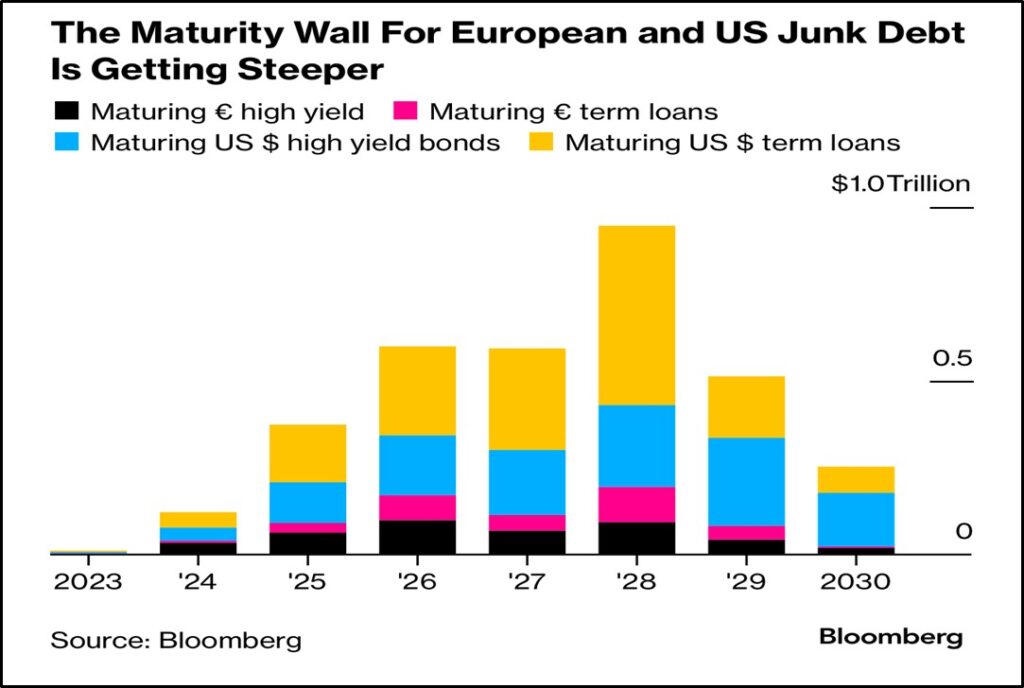

- Although the largest economies have avoided recession so far, there are signs of growing financial stress. S&P Global projects that the U.S. junk bond default rates will jump from 3.2% to as high as 6.5% by June 2024, while European junk bond defaults may jump to 5.5% next year from the current 3.1%. This unexpected surge in charge-offs assumes that interest rates remain relatively high, and that economic growth decelerates in the coming months. However, the doomsday scenario may be avoided if central banks are able to act quickly enough.

- One of the biggest mysteries since central banks began tightening monetary policy is how policymakers will react if inflation remains high and the economy falls into recession. Adding to the uncertainty is the expectation that refinancing activity will surge in 2024 to compensate for the loans that are expected to come due that year. Data collected by Bloomberg suggests that firms are in for a rude awakening if rates remain elevated. So far, policymakers have consistently denied that they are considering pivoting away from their current hawkish stance and have only signaled the possibility of a pause in rate hikes. However, their tone may change if economies start to fall into recession.

Polish Elections: Parliamentary elections will happen this weekend in Poland, in what could be the most divisive election since the fall of communism.

- Poland’s upcoming parliamentary election will be a clash of two opposing ideologies: the right-wing, populist Law and Justice (PiS) party and the centrist, pro-European Civic Platform (PO) party. A win for the former could see the country slide further away from democracy, while a win for the latter would likely bring it back in line with European norms. Neither party is expected to win an outright majority, so the outcome of the election is likely to depend on the performance of smaller parties.

- Dethroning the PiS will likely be a difficult task, but it will be necessary for Poland to regain access to much-needed EU funding. In 2019, Poland passed laws that undermined the independence of its Supreme Court, drawing the ire of the European Commission. These laws prevent judges from assessing each other’s compliance with EU standards and questioning the composition of a tribunal, and they give the disciplinary chamber of the Supreme Court the power to penalize judicial officials for the content of their verdicts. Warsaw claims that the changes were necessary to prevent the return of communism, but the European Court of Justice has ruled against it and has fined the Polish government.

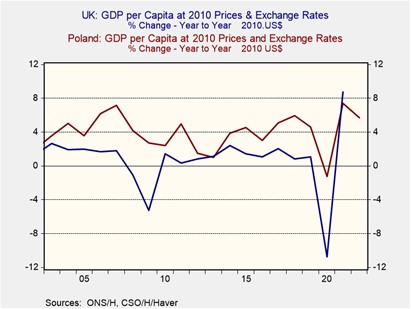

- Despite its relatively small size, Poland has the fifth-largest economy in the European Union, and its GDP per capita is expected to overtake that of the U.K. in a little over a decade. However, if it continues on its current path toward authoritarianism, it may become the second country to leave the bloc, and the first to be forced out. An exit of Poland could further undermine the bloc’s legitimacy, as the decline in membership will raise questions about whether it can remain together. Additionally, having a potentially hostile country outside the bloc will likely need to be addressed. As a result, a victory by the PiS could negatively impact the euro.

Israel/Hamas Update: Israel has told people to leave Gaza as tensions rise in the region. The announcement reflects escalating tensions in the Middle East and raises the likelihood of a broader conflict. Iran and Saudi Arabia are in constant communication to prevent miscalculation by either side. Meanwhile, Jordan has cautioned Palestinians from going to Egypt.