Daily Comment (October 12, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start and the Dodgers are out of the playoffs. Today’s Comment begins with a discussion of the increased scrutiny facing social media companies, our analysis of the latest FOMC meeting minutes, and an update on ongoing bank woes. As usual, our report also provides an overview of the latest domestic and international data releases.

Silicon Valley Headaches: Sovereign states are once again warning companies to crack down on the spread of disinformation, a hot topic that is only becoming more pressing as the conflict between Israel and Hamas continues.

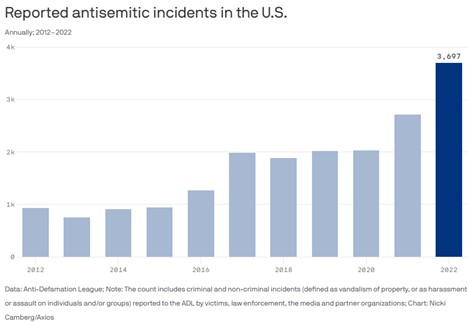

- European Commissioner Thierry Breton has warned social media giants Meta (META, $327.82) and X (formerly Twitter), to crack down on disinformation surrounding the Israeli-Hamas conflict. His warning reflects the growing concern over the spread of false and inflammatory content, such as clips from video games, older videos of conflict, and extreme rhetoric from posters looking to stir tensions between the two sides. The controversy surrounding these posts has revived the debate over the responsibility of tech firms to moderate content on their platforms, especially as hate crimes are on the rise and deepfakes are becoming more prevalent.

- The scrutiny of social media firms poses a threat to tech earnings as governments around the world look to curb controversial speech. Tech firms in the U.S. have been able to shield themselves from legal liability for user-generated content under Section 230 of the Communications Decency Act. However, this loophole may come under renewed scrutiny if Israeli-Hamas misinformation leads to an increase in the harassment of underrepresented groups. Meanwhile, the European Union has already threatened to fine these companies under its Digital Services Act for not taking down certain content. On Wednesday, EU regulators gave X and Meta 24 hours to remove terroristic content from their platform to avoid a penalty.

- The pressure on social media companies to find a balance between free speech and content moderation is likely to grow in the coming year, when both the European Union parliamentary elections and the U.S. presidential election are scheduled to take place. Failure to meet these standards could pose a threat to companies’ earnings, as they may be forced to pay fines or face litigation over posts. While the probability of this severely impacting the trajectory of the sector over the next few months is low, it does reflect the regulatory risks that social media firms face in the future as governments become increasingly skeptical of their influence over the public.

Policy is Different: Although the Fed minutes showed that policymakers favored at least one more rate hike, the market remained unconvinced.

- Minutes from the September 19-20 Federal Open Market Committee (FOMC) meeting showed that a majority of policymakers agreed that another rate hike would be needed before the end of the year to keep inflation on a downward trajectory. While all FOMC members agreed that rates should remain at a restrictive level, they also stressed the need to proceed cautiously and be data-dependent over the next few meetings. This shift in central bank thinking reflects that policymakers are now more focused on when to stop hiking rates instead of how high to raise rates.

- The market largely shrugged off the FOMC minutes, as investors seem to believe that the economic environment has changed since the group last met. Following Friday’s job report, which showed the economy added over 300,000 jobs in September, interest rates on long-duration Treasury bonds rose to a near two-decade high, leading some central bankers to argue that further rate hikes may not be necessary. Additionally, the risk of a broad Middle Eastern conflict has raised concerns that the economy could be susceptible to an oil price shock. As a result, the latest forecast from fed futures contracts shows that investors still believe that there is a more than 70% chance that policymakers are finished hiking, remaining relatively unchanged from the previous day.

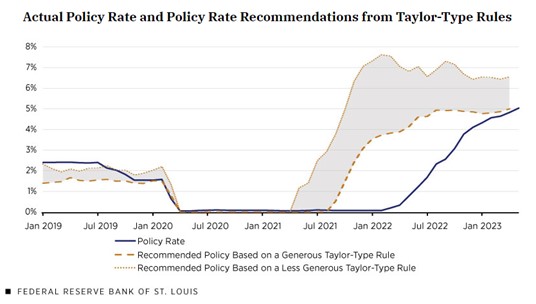

- That said, we suspect that the Fed’s talk of “higher for longer” may be less hawkish than some investors fear. Depending on how neutrality is measured, the restrictive rate could vary depending on the model used to gauge policy tightness. Former St. Louis Fed President James Bullard’s model suggests that restrictive territory may be closer to 5.0%, while current San Francisco Fed President Mary Daly, a voter on next year’s committee, estimates that the range is likely above 3.0%. This suggests that investors should not rule out the possibility that the Fed could cut rates next year by more than the forecasted 50 bps outlined in the latest Fed dot plots.

Banks Woes: Financial institutions are starting to feel the squeeze of higher interest rates as credit quality deteriorates.

- The four biggest banks are expected to write off more loans in the third quarter than any other period since the start of the pandemic. According to data collected by Bloomberg, the banks, which are scheduled to release their earnings reports starting on Friday, are expected to write off nearly $5.3 billion in loans. The increase in net charge-offs is due to concerns that higher interest rates will make it more difficult for banks to find qualified borrowers. Citigroup (C, $41.33) CEO Jane Fraser said that higher interest rates have been particularly burdensome for borrowers with weak credit scores and shrinking savings.

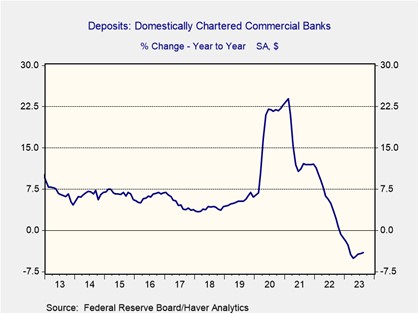

- Rising interest rates are making it more expensive for banks to attract and retain deposits, as savers seek out higher yields elsewhere. While deposits have stabilized in recent months, they remain below pre-March regional bank turmoil levels, according to Federal Reserve data. To attract and retain savers, banks have been forced to sacrifice some of their net interest margin by raising deposit rates. This adjustment has hurt financial institutions, as they were not prepared for a rapid increase in borrowing costs, having purchased long-dated Treasuries when rates were low. Some of the major banks, despite their greater sophistication, were also caught off guard by the rapid rise in interest rates.

- Despite challenges within the banking sector, there is still little evidence of an imminent crisis. In March, the Federal Reserve showed its willingness to provide banks with as much liquidity as needed to stay afloat, reducing the likelihood of another 2008 event. Additionally, government regulations have forced banks to have contingency plans in case of a possible run. However, policymakers are closely monitoring the rise in charge-offs, as the Fed may be forced to act if default rates start to spread throughout the economy. The chances of this happening this year are not great, but they will increase as long as the central bank keeps interest rates high.

Update on the Israeli-Hamas Conflict: National security officials are increasingly concerned that the war in Israel could expand, with Iran potentially targeting U.S. troops. At the same time, border clashes have led to speculation that Hezbollah may join the conflict. The U.S. has sent officials over to help mitigate the risk of a broader conflict. While we remain optimistic that the conflict will be contained, we acknowledge that the risk of a wider war is elevated.

Other News: House Republicans have nominated Steve Scalise to take over as speaker; however, it is unclear if he has enough support in his party to take over the job. Congressional members’ inability to choose a leader boosts the chances of another government shutdown, which could hurt bond prices. Additionally, it appears that Hollywood actors and studios are struggling to come to an agreement on a new contract. The ongoing discussion reflects a broad trend in labor relations and shows how firms may struggle to increase profit margins without increasing their prices.