Daily Comment (October 12, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with several big and broad crises, including the global energy crunch, China’s clampdown on private firms, and Chinese debt issues. We also cover other foreign and U.S. developments, and we wrap up with the latest on the coronavirus pandemic.

Global Energy Crisis: As natural gas, crude oil, and other energy prices continue to rise in response to recovering demand and faltering supplies, we see many new examples of the negative economic and political impact.

- In Europe, President Putin’s government is using the crisis to bolster its image and argue for a less adversarial relationship. Russia’s ambassador to the EU, Vladimir Chizhov, said, “Change ‘adversary’ to ‘partner’ and things get resolved easier . . . when the EU finds enough political will to do this, they will know where to find us.”

- Separately, Moldova is requesting emergency gas supplies from EU countries after Russian state-controlled exporter Gazprom slashed its shipments to the country. Moldovan officials are unwilling to agree to new terms with Gazprom at the significantly higher price the company is demanding.

- In China, desperate factory owners facing blackouts from the state energy grid are increasingly turning to diesel generators to keep their businesses going, threatening both the country’s economic growth and its green ambitions.

- Smaller semiconductor firms in China say they’ve had to suspend production because of inadequate power supplies.

- Also in China, the government said it would allow the price of coal-fired power to rise more sharply, hoping that market forces can address the country’s power crunch.

Chinese Financial Industry: In an exclusive report, the Wall Street Journal said President Xi launched a sweeping examination of major state-owned banks, investment funds, and financial regulators to determine whether they’ve become too chummy with private firms, such as the technology giants that Beijing has been working to rein in over the last year. China’s top anticorruption agency leads the examination and focuses on 25 financial institutions at the heart of the Chinese economy. It is part of his broad effort to steer China’s economic system away from Western-style capitalism in the run-up to a leadership transition late next year when Xi is expected to sidestep convention and continue his rule beyond the usual two five-year terms.

- By expanding his economic campaign, Xi risks unleashing dynamics that could severely cut into growth in the coming months. Amid the uncertainty, many banks are already pulling back from lending to private developers and other businesses, according to analysts.

- With major crackdowns now being imposed on real estate developers, technology firms, and the companies that finance them, any substantial slowdown in economic activity could prompt the government to try to reinvigorate growth through its traditional playbook of debt-driven investment. If so, Xi’s program could worsen some of the debt distortions that are already very concerning for the Chinese economy.

- For U.S. investors, Xi’s crackdowns, therefore, imply a wide range of risks, from heavier regulation of targeted industries to reduced lending activity and worsening debt dynamics. That’s on top of the risks arising from U.S. policies, such as tighter regulations on U.S. investment in companies that support the Chinese military. In sum, it’s looking riskier and riskier to invest in Chinese assets.

Chinese Debt Crisis: Heavily indebted developer Evergrande (EGRNY, USD, 9.06) has apparently missed making three more offshore interest payments due to be paid at noon today in Hong Kong. The interest payments total $148 million, on top of the $83.5 million in offshore interest payments the company missed last month, which set off a 30-day grace period before the company formally defaults.

- Separately, developer Sinic Holdings (2103, HK, 0.50) said yesterday evening that a default on its bonds coming due this month would “likely occur” because the company does not have enough “financial resources.”

- Also, developer Fantasia Holdings (1777, HK, 0.56) said two of its nonexecutive board members, including the chair of its audit committee, have resigned just days after the company unexpectedly missed a bond payment last week.

- Finally, many big developers in recent days have reported sharply lower sales in September, as curbs on property lending and worries about developers’ financial health start to sideline house buyers. Slowing home sales will likely exacerbate the heavily indebted developers, who often rely on presales for their operations and debt service.

- The recent developments will certainly feed further fears about major Chinese bond defaults, slowing Chinese economic growth, and the potential for some financial contagion.

Japan: Even though much has been made of new Prime Minister Kishida’s trial balloon regarding a hike in the country’s capital gains tax, which has weighed on Japanese equities despite the prime minister’s effort to walk back the idea, both the ruling Liberal Democratic Party and the opposition are arguing for greater income redistribution ahead of the October 31 parliamentary elections. In a recent parliamentary debate, Constitutional Democratic Party leader Yukio Edano vowed to provide those with low incomes a yearly ¥120,000 cash handout along with other immediate financial benefits and effectively exempt from income tax individuals whose annual salary is about ¥10 million or less per year.

United Kingdom: Prime Minister Johnson’s office confirmed that Chancellor of the Exchequer Sunak is considering a rescue plan to help the steel industry and other energy-intensive sectors through a winter of soaring gas prices. Sunak is reportedly considering a proposal that will include loans and other support with a value in the low hundreds of millions of pounds.

U.S. Debt Limit: The House of Representatives today is set to vote on last week’s Senate-passed legislation raising the federal government’s borrowing limit into December, temporarily staving off default while lawmakers battle over setting a new ceiling for U.S. debt. The bill would increase the debt ceiling by $480 billion, an amount that the Treasury Department has said would allow the U.S. to pay its bills through December 3, assuming it had also exhausted all of its cash-conservation strategies.

U.S. Fiscal Policy: As Congressional Democrats debate how to cut the size of their big antipoverty and climate change bill, House Speaker Pelosi last night wrote in a letter to her colleagues that they should focus on providing rich funding for a limited number of initiatives, instead of spreading the available funding too broadly or for too short of a period.

Green Investing: Against rising popular demand to clamp down on fossil fuel emissions, a renewed appreciation for nuclear energy and a roughly 37% jump in uranium prices has prompted hedge funds back into the sector for the first time since the Great Financial Crisis. As one example of renewed interest, President Macron has said France would invest €1 billion in nuclear power by the end of this decade as Europe’s energy crisis spurs renewed interest in the source of power.

- Separately, Oak Hill Advisors, which manages $52 billion and is best known as a big debt investor, is teaming up with a partner to buy roughly one million acres of North American woodlands and manage the properties to generate so-called forest offsets, i.e. tradable assets representing a metric ton of carbon that has been sequestered in standing trees.

- Companies that buy offsets use them to negate emissions on the internal carbon ledgers they keep to show investors their progress toward climate goals.

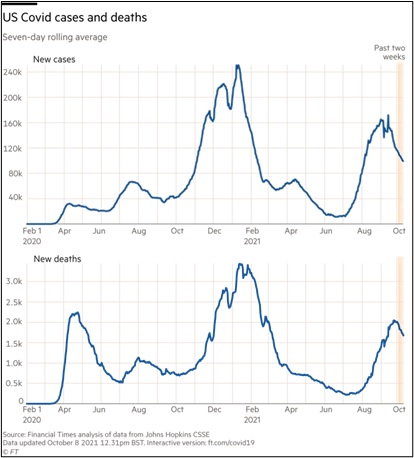

COVID-19: Official data show confirmed cases have risen to 238,384,951 worldwide, with 4,859,881 deaths. In the United States, confirmed cases rose to 44,456,936, with 714,064 deaths. Vaccine doses delivered in the U.S. now total 487,277,035, while the number of people who have received at least their first shot totals 216,889,814. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- According to the latest CDC data, 65.3% of the U.S. population has now received at least one dose of a vaccine, and 56.4% of the population is fully vaccinated.

- Against the background of rising vaccinations and the usual two-month cycle of infection waves, there are signs the latest Delta surge in the U.S. may be fizzling out. The number of new COVID-19 cases reported has fallen approximately 22% in the past two weeks, while hospitalizations have fallen by a fifth. The pace of deaths has also slowed.

- AstraZeneca (AZN, USD, 60.80) said its antibody cocktail cuts the risk of severe disease or death in patients by half. The drug AZD7442 had previously shown a significant effect in preventing any symptoms of coronavirus.

Economic and Financial Market Impacts

- As infection rates fall again, private high-frequency data suggests workers are trickling back to the office at the highest rate since the pandemic began. Data from security company Kastle Systems shows some 36% of office workers in ten major cities were back in the office in the week ended October 8, versus 35% in the week ended October 1 and just 31% in the week of Labor Day.

- In Europe, high vaccination rates and a budding recovery from the latest infection wave have allowed business travel to start snapping back even faster than in the U.S.