Daily Comment (October 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. It’s Columbus Day and Indigenous People’s Day. Being a commercial bank holiday, the Treasury market is closed, although Treasury futures are trading and would suggest interest rates will continue to rise. It’s also a government holiday, meaning there are no government economic reports today. U.S. equity futures are pointing to a lower open as oil prices continue to ratchet higher. West Texas Intermediate prices are now above $80 per barrel. Our coverage begins with the international roundup. Up next we have a China update and the latest on crypto. Economic and policy news follows, and we close with the pandemic report.

International roundup: There was an election surprise in the Czech Republic; Chancellor Kurz is out, and the IMF Managing Director remains under fire.

- In weekend elections in the Czech Republic, the center-left coalition led by PM Andrej Babiš suffered a surprise defeat by the center-right SPOLU coalition. This election featured the Pirate party, who had been polling strongly into the election but underperformed. Babiš had been named in the Pandora Papers, and it is quite possible the revelation hurt his electoral performance. The narrow loss by the center-left doesn’t necessarily mean the end of Babiš’s term as PM. The vote was close enough that there may be a grand coalition with the center-right. Still, Babiš may turn out to be the first political victim of the Pandora Papers. As the election results came in, Czech President Miloš Zeman was hospitalized.

- Austrian Chancellor Sebastian Kurz resigned over the weekend as he faces corruption charges. According to reports, Kurz allegedly used public funds to generate favorable polling. By resigning, Kurz’s coalition won’t necessarily face elections, and he will maintain some degree of influence within his party.

- IMF Managing Director Kristalina Georgieva remains under investigation on charges she, while working at the World Bank, participated in manipulating data to improve China’s standing in the “Doing Business” report. The bank has suspended the report for now. IMF officials are continuing to review the charges. Although the row is something of a tempest in a teapot, given the charges, we don’t see how she can maintain her position. If she does leave office, look for the EU to push for a European replacement.

- Last week, we reported Polish courts ruled that Polish law overruled EU law, generating talks of “Polexit.” Over the weekend, there were widespread protests against the possibility of Poland leaving the EU. Polls suggest overwhelming support for remaining in the union. However, we don’t see an easy path to reconciling the issues over legal authority.

- There were elections in Iraq over the weekend. Reflecting the level of disenchantment with the government, turnout was historically low. The election may determine U.S. troop strength in the country.

- Although we haven’t reported on the situation with India’s farmers for a while, it is far from resolved. To recap, the Modi government is trying to end price supports for various crops to allow market forces to determine production. This policy will almost certainly improve productivity and efficiency. These gains will almost certainly come from consolidation, meaning farmers will be forced from their small plots. Facing this pressure, farmers continue to protest the policy, and the courts have suspended the new law for now.

- Moscow is urging the EU to become more cooperative with Russia; if it does, gas supplies might rise.

- The U.K. and EU are coming closer to a trade war over the Northern Ireland border. It appears to us that if Westminster continues on its current path, a hard border will be unavoidable. If a hard border returns, the Good Friday Agreement will almost certainly rupture, and U.K. and EU relations will be in jeopardy. We should also note, the U.S. won’t look favorably on PM Johnson if this occurs.

- A.Q. Khan, the founder of Pakistan’s nuclear weapons program and the likely source of Iran and North Korea’s nuclear program, died over the weekend.

- The U.S. arrested a Navy engineer and his wife for attempting to sell U.S. nuclear submarine secrets.

China news: Taiwan tensions remain elevated, and real estate problems persist.

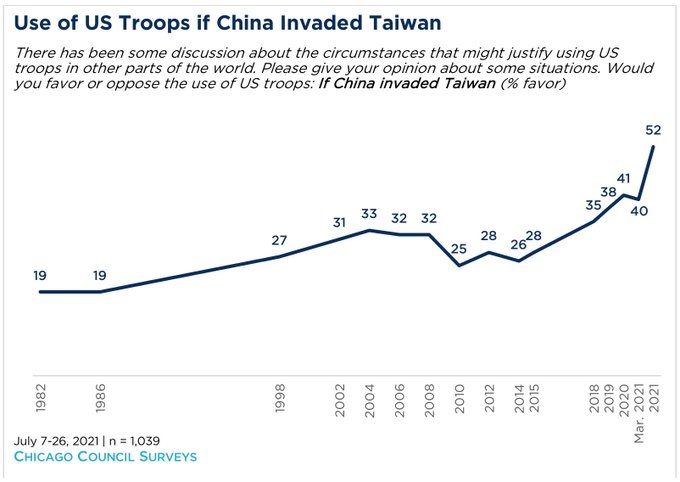

- Tensions over Taiwan continue. After a week where over 100 air sorties were conducted over Taiwan, General Secretary Xi says he wants a “peaceful” unification of the island. President Tsai of Taiwan says her country won’t “bow to pressure” from Beijing. We continue to monitor this situation closely, and what we see continues to suggest no reduction of tensions. Recent polling in the U.S. indicated that, for the first time, the majority of Americans support the U.S. defending Taiwan if there is an invasion of China.

(Source: Chicago Council on Global Affairs)

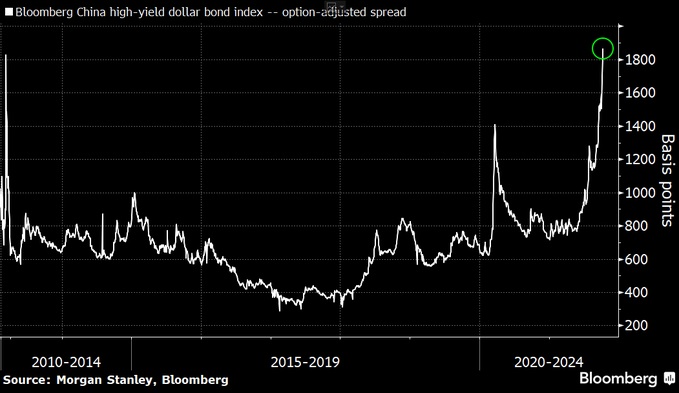

- There is growing evidence that the problems of Evergrande (EGRNF, USD, 0.36) are spreading to other property developers. Modern Land (1107, HKD, 0.465), another property developer, has asked to defer a bond payment. China is trying to manage what looks like the end of a debt-fueled property boom. On the one hand, the goal is to bring down debt levels and curb home prices. However, property is a key pillar of household wealth, and if prices fall, the result could be social unrest and weakening consumption. We are seeing stress in China’s high-yield dollar market. Bondholders of China’s dollar bonds will likely be the “last in line” during liquidations.

(Source: Bloomberg)

- U.S. companies want tariff relief from the Biden administration; it doesn’t look like they are going to get it. Overall, businesses are trying to manage the deteriorating geopolitical situation with China and the U.S. with some degree of decoupling and continuing to invest in China.

- As Beijing tries to improve air quality, restrictions on coal-fired factories and electricity are leading to widespread shortages. It appears that environmental rules will be relaxed.

Crypto: In trying to determine when the next financial crisis will emerge, our best guess is from the crypto space, specifically from stablecoins. These coins purport to hold an equal amount of dollars to the stablecoin. They are useful to crypto traders because if a trader wants to take profits on a position, they can liquidate, say bitcoin, and move it to a stablecoin, likely avoiding a taxable event. Regulators have expressed concern that stablecoins are effectively unregulated money market funds, and without transparency on what is being held as assets to produce the stablecoin, runs are possible. Recent reporting on Tethercoin suggests the holdings are a bit dodgy, which raises fears that if holders move to liquidate, there won’t be adequate assets to meet demand.

Economics and policy: Global supply chains continue to weigh on growth and lift inflation.

- Global supply chains remain broken, and there is growing evidence the logistical problems are contributing to inflation and slowing economic growth. No one policy will resolve the logistics issues because there are multiple causes, including lack of workers, COVID-19 outbreaks, industry concentration, and consumer behavior. Large retailers are reportedly chartering their own ships to secure goods. However, even getting secure shipping doesn’t necessarily mean the ships can be unloaded easily, although the retailers are using much smaller vessels that can be unloaded at minor ports. Even though the costs are higher, at least supplies can be secured. This process could further pressure smaller retailers and result in additional industry concentration.

- As home prices rise, borrowers are finding their home appraisals are violating covenants and killing purchase agreements. In the past, eventually, appraisals rose, but in the aftermath of the 2005-08 housing bubble, that may not be the case going forward. Meanwhile, younger homebuyers are pooling resources to buy homes; it remains to be seen how durable these arrangements will be as buyers’ lives change.

- Last week, Ireland agreed to a 15% minimum global corporate tax, ending one of the more notable holdouts to the OECD agreement. A minimum corporate tax is probably a necessary requirement for a rise in the U.S. corporate tax rate. Even with this agreement, Congress may still not approve a tax hike.

COVID-19: The number of reported cases is 237,956,055, with 4,853,764 fatalities. In the U.S., there are 44,340,408 confirmed cases with 713,354 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 487,277,035 doses of the vaccine have been distributed, with 401,819,240 doses injected. The number receiving at least one dose is 216,889,814, while the number receiving second doses, which would grant the highest level of immunity, is 187,215,471. For the population older than 18, 67.8% have been vaccinated. The FT has a page on global vaccine distribution.

- For fully vaccinated adults, or those who have been vaccinated and infected, the need for booster shots is low.

- Although western Europe has seen rising vaccination rates, they lag in Central and Eastern Europe, leading to higher levels of virus disruption.