Daily Comment (October 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an in-depth analysis of US intervention in the Argentine currency market. We then examine the latest strategic moves by the US and China ahead of pivotal trade talks. Our coverage continues with a discussion of the accounting controversy surrounding First Brands and explores the potential for a capital markets union in the EU. We also provide a summary of key economic indicators from the US and global markets.

US Intervenes: The United States has taken exceptional steps to stabilize Argentina’s economy, with Treasury Secretary Scott Bessent announcing a $20 billion currency swap and direct support for the peso (ARS). The intervention is a clear signal of support for President Javier Milei amid market turmoil ahead of the October 26 legislative elections. Bessent defended the policy by declaring Argentina’s free-market reforms to be of “systemic importance” to the US and promising to do “whatever exceptional measures are warranted” to ensure their success.

- This marks the first attempt to prop up a foreign currency since the 1995 financial support package for Mexico (known as the “Tequila Crisis”). While the bailout for Mexico was primarily justified as an effort to prevent a systemic financial crisis from impacting the US economy and its regional interests (like NAFTA), the measures for Argentina appear less focused on systemic risk and more overtly aimed at ensuring the viability of the current administration’s specific economic reform agenda.

- The move is a significant demonstration of US influence aimed at countering China’s deep economic ties in Latin America. China has cemented its role as a key financial partner through its currency swap line with Argentina and by increasingly becoming a major buyer of regional agricultural exports to diversify its sourcing from the US.

- Another strategic benefit of the US financial package is currency stabilization, which prevents a peso collapse that would otherwise sharply reduce the export price of Argentine goods, thereby safeguarding the global price competitiveness of US agricultural producers.

- The efficacy of the currency intervention in preventing a financial collapse is debatable, but the move signifies the US’s willingness to deploy its financial tools for geopolitical ends. This strategic use of the dollar as a lever of hegemony could undermine the dollar’s perceived credibility and neutrality. As a result, market participants may become more inclined to seek stability and diversification in other currencies, presenting a structural resistance to the dollar’s continued strength.

Trade Tensions Escalate: The US and China are continuing to escalate tensions ahead of their next meeting through a series of reciprocal economic measures. In a significant move, US senators have endorsed a bill to prohibit federal funding from reaching Chinese firms and to bar American investment from key Chinese industries. Simultaneously, Beijing has retaliated by launching an anti-trust probe into the American chipmaker Qualcomm and imposing new fees on US vessels using Chinese ports.

- We interpret these maneuvers as strategic posturing in advance of trade negotiations scheduled for later this month, suggesting no imminent setback. Both the Congressional move to ban funding and the Chinese probes into US firms are likely performative acts. Furthermore, the fees levied on US vessels at Chinese ports are a direct, reciprocal response to American charges on Chinese-built ships, reflecting China’s clear intent to counter the US push for increased use of domestically manufactured vessels.

- We remain optimistic that talks between the US and China will culminate in a significant grand bargain, one that should yield benefits for both markets. Our premise is that the agreement must improve the trade relationship, particularly in technology, by granting China greater access to advanced chips in exchange for US access to critical minerals. Crucially, we anticipate that substantial Chinese investment into the US economy will be a major component of the final agreement.

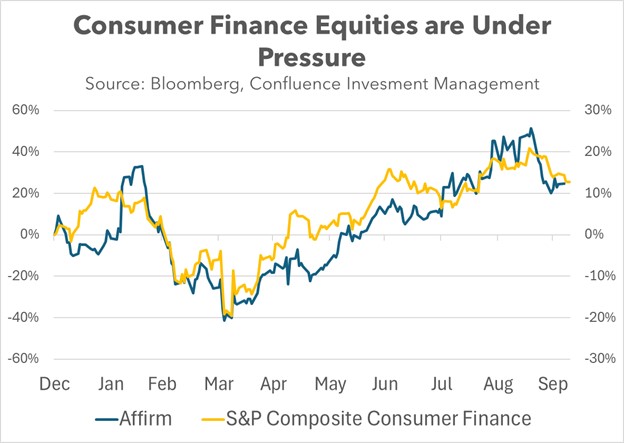

First Brands: The auto parts giant is facing a formal investigation by the Department of Justice following its bankruptcy filing amid concerns over accounting irregularities. The crisis centers on approximately $2.3 billion in undisclosed off-balance-sheet financing, a debt structure that concealed the true scale of the company’s liabilities. The failure has amplified concerns regarding the credit quality of borrowers across the private credit space, potentially casting a wider net of scrutiny on the loan portfolios of major consumer finance firms, such as Affirm.

Finally, More Data! The US government is recalling furloughed employees to ensure the release of the Consumer Price Index (CPI) report. Although the report was originally scheduled for October 15, it is now expected by the end of the month. This data is critical as it determines the cost-of-living adjustment (COLA) for Social Security. It is also vital for Federal Reserve policy; a strong inflation reading could lead the Fed to keep interest rates unchanged at its October 29 meeting.

Japan Coalition Collapse: Coalition talks between Japan’s Liberal Democratic Party (LDP) and its junior partner, Komeito, collapsed on Friday, complicating efforts to form a new government. This breakdown poses a significant challenge for new LDP leader Sanae Takaichi, who must now secure a partner to become prime minister. The difficulty in forming a stable government raises fresh concerns about political instability in a country that has had four prime ministers since Shinzo Abe stepped down in 2020.

EU Capital Markets: Germany has signaled its willingness to grant European financial regulators more authority, a significant move indicating the EU is advancing toward a capital markets union (CMU). This policy shift is expected to enhance the competitiveness of European markets against global rivals like the US and China. The CMU concept, championed by former ECB chief Mario Draghi, aims to deepen and integrate the bloc’s capital markets, potentially making European equities and investment opportunities more attractive to global investors.

Shutdown Prolonged: The political standoff over federal funding has dragged the US government into its second week of shutdown, with no resolution in sight. The core legislative fight centers on the demand by Senate Democrats to permanently extend the enhanced Affordable Care Act (ACA) tax credits as part of any stopgap funding bill. Republicans have so far refused to negotiate policy matters while the government is closed. So far, shutdown troubles have not impacted equity markets.