Daily Comment (October 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the situation in Israel, where the country’s military is poised to launch a ground attack on Hamas fighters in the Gaza Strip and all eyes are watching for a potential widening of the conflict. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a likely new anti-subsidy investigation by the EU against China and the latest on U.S. labor market unrest.

Israel-Hamas: In response to the weekend attack by the Hamas government in the Gaza Strip, the Israeli government yesterday announced a “complete siege” of the territory, vowing to stop any food, water, electricity or other supplies from entering. After mobilizing some 300,000 reservists, the military also looks set to launch a full-scale ground invasion of Gaza, likely in an effort to destroy Hamas. Meanwhile, Hamas threatened to kill one of its estimated 100 or so civilian hostages for every unannounced Israeli airstrike on the territory.

- Naturally, a key concern is whether the conflict will spread. So far, reports indicate there have only been sporadic sympathy attacks by the Iranian-backed Hezbollah militants in southern Lebanon, but that could change as the Israelis commit more forces to a ground incursion in Gaza.

- Meanwhile, the U.S. is reportedly sending a surge of ammunition and other military equipment and supplies to the Israelis. The U.S. has also deployed its aircraft carrier USS Gerald R. Ford and its battle group to the eastern Mediterranean Sea and has sent additional military aircraft to land bases in the region. This morning, Chair of the Joint Chiefs of Staff CQ Brown explicitly said the deployments aim to deter Iran from getting involved in the conflict and warned Tehran to keep its distance. The U.S. and European leaders also continue to voice their support for Israel, but China still has not condemned the Hamas attack.

- Separately, Saudi Arabia’s Crown Prince Mohammed bin Salman said his kingdom stands by the Palestinians in the crisis.

- That suggests Iran has had some success in achieving what was likely one of its goals in helping Hamas with its attack, i.e., scuttling the budding U.S.-brokered deal in which the Saudis would have recognized Israel.

- Yesterday, U.S. and other financial markets initially responded as would be expected in such a crisis: Investors sold off equities and piled into safe havens like bonds, oil, and gold. By day’s end, however, investors had reversed much of those moves, and equities ended with impressive gains.

- Such a turnaround is common in these types of crises. The initial selling clears out the weak longs, and once they’re out of the market, the selling stops. That allows for a rebound in stocks, but we wouldn’t count on it to last.

-

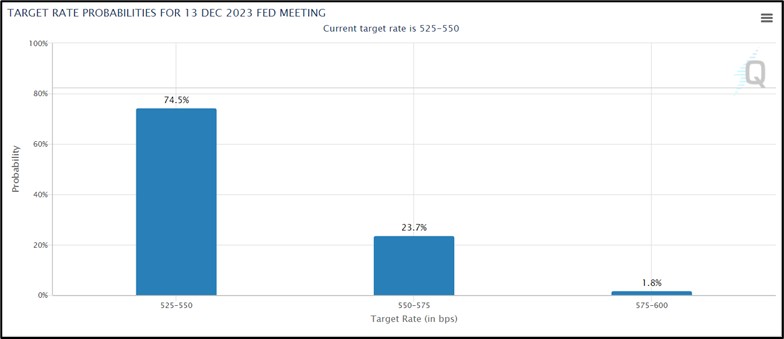

- Some of the late-day buying yesterday probably also stemmed from hopes that the crisis would convince the Federal Reserve to stop hiking interest rates and start easing policy. For example, the CME’s fed funds target-rate probability gauge now shows that investors see only about a 25% chance that the Fed will hike rates further by the end of the year. That may prove prescient if the policymakers only focus on the ongoing slowdown in economic growth and cooling current inflation. Keep in mind, though, that they could just as easily keep hiking if they focus more on continuing threats, like the big federal budget deficit.

Russia-Ukraine-North Korea: In the world’s other major war, new satellite imagery suggests Russia has begun taking delivery of additional military supplies via railroad from North Korea. The imagery shows a huge increase in freight-car traffic at the Tumangang Rail Facility on the Russian-North Korean border. The cars are also carefully covered, further suggesting they are carrying sensitive equipment. The evidence of new shipments comes after Russian President Putin met with North Korean leader Kim Jong Un last month to request help with replenishing the ammunition and supplies that Russia has depleted in its continued invasion of Ukraine.

China: New data shows consumer spending and home sales were weaker than expected during the Golden Week holiday that ended on Friday. Golden Week is typically one of the country’s top periods for spending and home transactions, but the data shows tourism outlays were only 1.5% higher than in the pre-pandemic year of 2019, representing a decline after stripping out price inflation. The amount of residential floor space sold was also lower than in 2019. The figures are further evidence that China’s economic growth is being held back by issues such as weak consumer demand, high debt levels, poor demographics, and de-coupling from the West.

- As further evidence of China’s economic problems, the major real estate developer Country Garden (CTRYY, $2.71) failed to make one of its international loan payments for the first time. It also warned that it doesn’t expect to make upcoming payments to its foreign bond holders.

- Country Garden’s troubles began after its apartment sales plunged in recent months, as the government’s crackdown on highly indebted developers sparked a liquidity crisis and weighed on sales.

European Union-China: The EU is expected to launch an anti-subsidy investigation against Chinese steel producers later this month. The probe would be part of a new, U.S.-led “Global Arrangement on Sustainable Steel and Aluminum” aimed at China’s dumping of cheap, subsidized metal products to the detriment of developed-country producers. Countries including Japan and the U.K. would also be invited into the group if they agree to impose punitive tariffs on China’s dumped metal products.

- The EU’s move comes just weeks after it announced an anti-subsidy probe into Chinese electric vehicles, and shortly before it is expected to announce a separate probe into Chinese wind turbines.

- The initiatives by Brussels are sure to worsen EU-China relations and contribute further to the fracturing of the world into relatively separate geopolitical and economic blocs, as we have frequently described.

Argentina: The peso (ARS) dropped 7.4% against the U.S. dollar on the black market yesterday as right-wing firebrand Javier Milei, who is leading the opinion polls ahead of the October 22 presidential election, warned again that he plans to dollarize the economy if he wins. In a radio interview, Milei warned that Argentines shouldn’t keep any investments denominated in ARS.

Canada: The Unifor auto workers’ union today has launched a strike against U.S. automaker General Motors (GM, $30.99) after the workers and the company failed to agree on a new labor contract. The strike illustrates how tight labor markets have emboldened workers in Canada just as they have in the U.S. The work stoppage also piles pressure on GM, which is already dealing with the United Auto Workers strike in the U.S.

U.S. Labor Market: The 75,000 healthcare workers who launched a three-day strike against Kaiser Permanente last week have now gone back to work, and negotiations on a new labor contract with the firm are set to begin again on Thursday. The union has warned that the workers will go out on strike again in November if they can’t strike a deal for higher pay and increased staffing at Kaiser’s facilities.

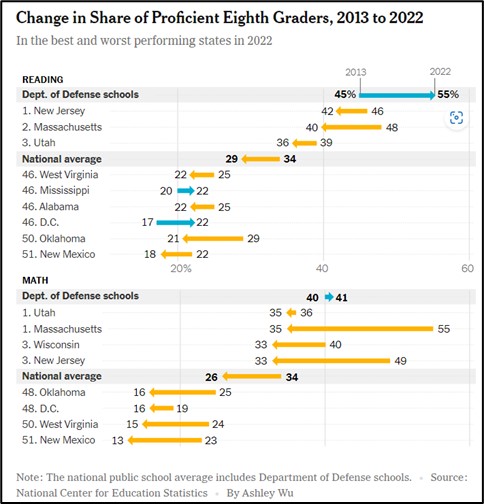

U.S. Education System: An intriguing story in the New York Times notes that schools run by the Defense Department on U.S. military bases have begun to substantially out-perform typical public schools. The article ascribes their outperformance to a range of factors, including higher teacher pay, higher standards, stronger discipline, and quicker reopening after the coronavirus pandemic.