Daily Comment (October 10, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we begin with an update on the war in Ukraine, with a special look at the bridge attack. China news comes next, where we discuss the U.S.’s further tightening of semiconductor export controls. The international news roundup follows where we note that the BOE is preparing markets for what follows after its Gilt intervention activities end. We close with economics and finance news.

Ukraine War: We cover the attack on the Kerch Strait Bridge and other news items from the conflict.

- Over the weekend, social media showed dramatic footage[1] of an explosion and fire from what is being described as a truck bombing of the Kerch Strait Bridge. According to reports, a truck bomb exploded and caused seven fuel cars on the adjacent railroad tracks to catch fire as well. The bridge is a key link between Crimea and Russia and is an important symbol of Russia’s annexation of the peninsula. It is also a key logistical link to supporting Russia’s war effort. So far, Ukraine has not taken official responsibility for the attack, which Putin has dubbed a “terrorist act,” but it is highly likely that Kyiv is behind that action.

(Source: Russia Briefing)

Although the bridge was heavily damaged, it is still partially operable. The footage of the railroad bridge in flames was notable, but according to reports, some rail traffic has resumed. However, reports suggest that trains are moving slowly, perhaps worried about the structural integrity of the line. In addition, as one would expect, security checks have intensified, which has slowed traffic. Finally, some lanes remain open for auto traffic, but trucks have been banned. To make up for the break in the bridge, a ferry service has restarted.

In response to the attack, Russia launched missile strikes (during rush hour no less) against Kyiv and several other cities in what looks to be a direct attack on civilian targets. Moscow is threatening additional strikes in retaliation.

Overall, this attack is a massive blow to the Kremlin. For those living in Crimea, the severing of the bridge will raise questions about their security. For the Russian military, the logistical disruptions are coming at a bad time in the war. There are rumors of yet another shakeup in the command structure. There are also reports of growing dissention within the Putin regime. The fact that this attack occurred around Putin’s birthday has to be problematic for the Russian president.

- Meanwhile, in other war news, Ukrainian forces continue to press into Russian occupied areas.

- Ukrainian forces have been using the Starlink system, a satellite internet system built by Elon Musk. There are reports of outages, which has undermined Ukrainian military communications. It is unclear why these are occurring, but the company suggests that the system has been brought down occasionally to prevent Russian interference.

- Russian shelling has forced the Zaporizhzhia nuclear power plant to go offline, although there are reports that power has been restored. The plant does have backup diesel generators to cool the core, but there is only about a week’s worth of fuel. There are worries that the reactor may melt down if the disruptions continue.

- In our most recent BWGR, we noted that Russia has been so consumed by the war in Ukraine that it is losing its ability to project its influence in the southern periphery. The New York Times confirms this observation. Kyrgyzstan has abruptly cancelled joint military exercises with Russia, and no official explanation has been offered, although we believe that Moscow’s inability to intervene in recent tensions between Kyrgyzstan and Tajikistan is likely to blame. We also note that China has been deepening ties to Georgia, another nation that Russia believes is in its sphere of influence.

- As we noted in recent reports surrounding the Nord Stream 1 and 2 pipeline attacks, there is growing concern that Russia may be attacking European infrastructure. There has been a recent sabotage of Germany’s rail system. German security officials are investigating.

China News: As General Secretary Xi prepares for a third term (unprecedented in the post-Mao era), the Biden administration is continuing to restrict semiconductor chip sales to Beijing.

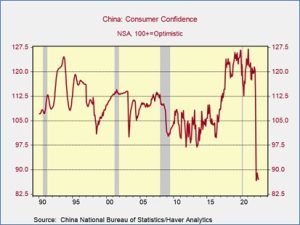

- Although there is little doubt that President Xi will get his third term, the picture he paints of the near future is one of “great struggles.” We would agree. The economy is rapidly decelerating, and consumer confidence is in near collapse due to a combination of slower growth and China’s Zero COVID policy. Much of this weakness is tied to Xi’s economic and security policies.

- The U.S.’s policy on restricting tech exports to China continues to undermine Beijing’s efforts to achieve self-sufficiency in semiconductors. If enforced effectively, it would prevent China from accessing the most advanced semiconductors. China’s foreign ministry spokesperson Mao Ning reacted angrily to the news and pointed out that this policy will not just hurt China but also U.S. tech firms. She is correct. Beijing has been consistently trying to use American businesses to lobby against restrictions. Chinese semiconductor shares plunged on the news.

- The U.S. is warning of secondary sanctions on Chinese companies that aid Russia’s war effort. If this restriction was to expand to energy (which we don’t expect) the impact on Russia would be devastating.

International Roundup: The BOE prepares the Gilt market for the Friday deadline of its emergency measures, and the U.S. details data protection measures for the EU.

- Late last month, the Truss government unveiled numerous measures to boost and reshape the U.K. economy. As we noted, the financial markets whirled into a panic, with Gilt yields soaring after pension funds were forced to sell the paper to meet margin calls on derivative schemes. To quell the panic, the BOE began aggressively buying Gilts to bring down yields. At the time, the bank said the measures were temporary and will end on Friday, but fearing a resumption of selling, the Bank indicated it was willing to continue to buy Gilts if necessary. We note that although the Bank had plans to buy £40 billion Gilts, it has actually only purchased £5 billion. This outcome is similar to the Fed’s experience with backstops during the pandemic. The mere implementation of the backstop was enough to address the panic and allow for normal market functions to return. The BOE will continue to offer a Gilt repo facility to ensure pensions will have an orderly market to generate liquidity and avoid panic selling.

- In related news, the Truss government will bring the date forward for its economic and fiscal forecast to October 31 from the original early November target.

- President Biden has signed an executive order which will place limits on what personal information U.S. security agencies can gather on Europeans. EU data restrictions are stronger than U.S. regulations, and the EO is the first step in aligning the regulatory environment. Interestingly enough, the direction of travel seems to be that the U.S. will get an effective veto on EU regulations. We expect talks to continue.

- In response to recent North Korean missile launches, the U.S. has added further economic sanctions designed to make it harder for Pyongyang to acquire petroleum. North Korea responded by launching more missiles.

- Germany’s SPD won local elections in Lower Saxony, a key swing state.

- Relations between Greek universities and the government have been tense for years. Campuses have often fostered opposition to various Greek governments. Recently, the government has attempted to put a permanent security presence on Greek campuses, which has led to unrest.

- An interesting and unexpected feature of left-wing governments in the Americas has been fiscal austerity. In general, leftist governments have historically run large fiscal deficits. Mexico’s government, however, has been running modest deficits, and Chile, with a new left-wing government, announced a budget surplus.

- In Japan, Prime Minister Kishida’s popularity has fallen to new lows.

- The Malaysian government has dissolved parliament in preparations for early elections.

- As we have noted in various Geopolitical Reports, Brexit was likely to foster Irish unification. We are starting to see evidence of political movement on this issue.

Markets, economics and Policy: We touch on the dollar, labor markets, and note the Economics Nobel prize winners.

- This year, the dollar’s rise has been relentless. An aggressive turn in monetary policy has been behind the bullish turn. Although by parity measures the dollar is overvalued, rarely does valuation alone turn a market. Historically, strong trends in currencies become self-filling and require political action to turn. Often, bull markets in the dollar face political pressure from the manufacturing sector. We are starting to see signs of this pressure building. We would note that since 1970, manufacturing production (as measured by the subindex of industrial production) rises by 2.2% per year; however, when the JPM dollar index rises by more than 7.5% per year, manufacturing declines by 0.4% per year.

- As bank earnings are released this week, we note that banks are raising loan-loss provisions.

- How tight are labor markets? So tight that criminal records are no longer a barrier to employment.

- Ben Bernanke, along with Doug Diamond and Phillip Dybvig (of Washington University here in River City) have been awarded the Nobel Prize for Economics.[2]

[1] Along with some rather funny twitter memes.