Daily Comment (October 7, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. U.S. equity futures are up this morning. A potential deal on the debt ceiling and relief on oil and gas prices have improved sentiment. Our coverage begins with an examination of these two factors. Up next is crypto news and an update on China, followed by the international roundup. We close with economics and policy and the pandemic update.

What’s behind the rally? Two developments seem to be lifting equity sentiment this morning.

- The potential resolution of the debt ceiling. We will admit to being a little jaded about this issue, mostly because we have seen all this before. Was there a chance of default? Yes, but the odds were very small. The debt ceiling is really a convenience for Congress. Prior to 1917, Congress would assign a revenue source for each bill. If a bill required funding, it was either assigned a tax revenue stream or borrowing was authorized. When war spending ramped up during WWI, this arrangement became unwieldy, so Congress mandated a debt level and allowed the Treasury to manage the spending, using either tax revenue or borrowing. The debt ceiling, then, is simply the accommodation for spending that has already occurred. Although Congress likely never intended this convenience measure to turn into a political football, it has become one.

- So, what about default? There are a couple of schools of thought about the debt ceiling issue. The first is that the Constitution (14th Amendment) says U.S. Treasury debt will not be questioned. One school of thought that suggests the president facing the debt ceiling issue should simply ignore it and order the Treasury to continue issuing debt. It would be a risky strategy, although some legal scholars suggest that the argument for ignoring the ceiling is pretty strong. Essentially, the point is that the Constitution overrules Congressional rules. The worry is that the fate of the world’s reserve asset could be in the hands of a judge.

- The other popular idea is that instead of risking a Constitutional crisis, the Treasury, through its power to mint currency, should simply strike a large denomination coin, let’s say, $1.0 trillion, take the coin, walk it to the Eccles Building, and present it to the Fed for deposit in the Treasury’s account. How can they do this? The Treasury has the power to mint money, and this act is within that power. Is this a gimmick? But if used, it reveals that Modern Monetary Theory is the correct way of looking at money; the government effectively creates money out of thin air and funds anything it so desires. The fear of saying this out loud is that the temptation to oversupply fiat currency will be really hard to contain. After all, why stop at a trillion?

- Instead of testing a Constitutional theory or revealing that money is a pure construct, we engage in political Kabuki theater. Both political parties use it to score points but really don’t want to “die on this hill.” There is some evidence that the Democratic leadership was going to use the debt ceiling issue to further erode the filibuster, something the minority doesn’t want to see occur. So, Sen. McConnell (R-KY) made an offer that we expect the Democratic leadership to accept.

- In conclusion, there was never going to be a default. The Democrats didn’t want the GOP to use the debt ceiling against them in the 2022 midterms. They wanted the GOP to join them in lifting the ceiling. The GOP correctly noted they could use budget reconciliation to raise the ceiling without GOP votes; that wasn’t acceptable to the Democrats. In the end, it appears the ceiling agreement will pass because the GOP has agreed not to filibuster the ceiling increase. However, it will probably be raised with Democratic votes alone. The GOP gets its talking points (which, BTW, we expect that GOP won’t need the help next November; it should retake control of Congress with little effort), and the Democrats don’t have to use reconciliation.

- Aid on energy. So as not to bury the lede, Russian President Putin seemed to signal that Russia would lift oil and gas supplies to ease the current crisis. Now, on to the backstory. Globally, energy prices across the board—oil, natural gas, coal—have been on a tear. Governments are facing a real crisis on energy costs, even before winter sets in. Any politician knows that higher energy costs are a major negative factor. No one likes paying high prices for gasoline or having to decide how much cold one can stand in the winter. How did we get here? Like any major trend, a combination of factors is in play. Here are the biggest ones:

- ESG has played a major role. Investing in hydrocarbon production has become, well, something that righteous people don’t do. Energy firms have seen their ability to source capital constrained. Perhaps even more important, energy producers are being sent clear signals that the balance of policy will be designed to reduce demand for their products. Faced with a bleak future, they have reacted as any declining business would; they have reduced investment.

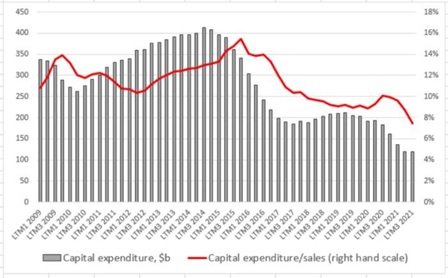

(Source: FT, S&P)

This chart shows the capital expenditures of public energy firms. Since 2014, there has been a clear reduction in investment. For energy firms, the fear is stranded assets. If a future investment could decline to zero value in a few years, there is little sense in making that investment. And, since hydrocarbons are a depleting energy source, slowing investment means less supply. Higher prices should not be a shock to anyone. If the goal is to reduce hydrocarbon consumption, the increase in price aids in that goal. In fact, it could be argued that ESG has effectively created a carbon tax, but the revenue from the tax is going to energy companies instead of governments. The problem for politicians is that higher prices are unpopular. Even with changes in governments, we suspect this trend is in place.

- The logical behavior of energy firms facing these constraints is to maximize revenue in the short run. Thus, OPEC’s recent decision to not increase production is part of that process.

- So why is Putin suddenly coming to the rescue? Yesterday, the Russian president offered to address the jump in prices. It looks to us that this is a rather transparent ploy to open Nord Stream 2, which will isolate Eastern Europe and further increase EU dependence on Russian gas. However, there may be other concerns. The U.S. government should be making the same calculations on the future of oil regarding the Strategic Petroleum Reserve (SPR). If the value of oil is going to zero at some point in the future, it should sell off this asset while it has value. Putin realizes that his OPEC+ could be competing with the Department of Energy at some point and would likely prefer to stabilize oil prices to prevent aggressive selling of SPR oil to lower prices.

Crypto: The SEC wrangles with Congress and the DOJ sets up a task force.

- SEC head Gary Gensler is an aggressive regulator. Given the slow progress in filling positions in the Biden administration, he has moved to expand the purview of this department into areas that perhaps are better regulated by the CFTC or other bodies. Congress is starting to push back. We don’t think this will reduce the drive to regulate crypto (stablecoins are a real risk), but arguably, the SEC isn’t the best venue for all that is being done.

- Criminals love crypto; ransomware and other activities are often done in bitcoin, taking advantage of the products’ pseudo-anonymity and ease of transfer. The DOJ is creating a team to push back against the use of the product in illicit activity.

- Bonds are being issued denominated in cryptocurrencies. So far, the market reaction has been rather poor.

China news: Xi and Biden to talk, and trade relations remain tense.

- Presidents Biden and Xi will hold a virtual summit this year. The U.S. has been pressing for talks, but China has been reluctant to accept a meeting. Although talking is usually a positive sign, there is little evidence that U.S./China policy is going to improve markedly.

- This week, USTR Tai gave a speech on China trade relations. The clear takeaway is that the foreign policy establishment has concluded that China will never accept a U.S.-led global system. Thus, trade relations will remain transactional and difficult. This trend to isolate and contain China is becoming ever clear and will have profound effects on markets in the coming years.

- China’s dollar property bonds are getting hammered, sending yields to around 18%. For comparison, CCC bonds are currently yielding 7.48%.

International roundup: The German Greens/FDP have picked the SDP, and Putin faces a new internal threat.

- Although the news wasn’t a complete surprise, the “kingmaker” coalition of the Greens and the FDP have selected the SDP to try to form a government. It is still possible that these efforts fail, but we do expect they will form a government, ending CDU/CSU rule for now.

- Russia has been plagued with slow growth and high levels of corruption during the Putin era. Despite general unrest, Putin has managed to hold power without serious threat. Interestingly, there is a rising movement among the communists, of all places, to Putin’s hold on power.

- In related news, NATO has expelled eight members of the Russian mission for spying. Look for a similar retaliation in the near future.

- While the U.K. is facing a winter that some are comparing to the bleak period of the 1970s (high inflation, widespread shortages), PM Johnson described a future Britain that will be much better.

- Authorities in Austria raided the office of the chancellor on suspicion of illegal activity.

- Taiwan is pushing back against U.S. demands for supply chain information.

Economics and policy: Powell looks safe, and there is new hope regarding malaria.

- The GOP members of the Senate banking committee are warning President Biden against replacing Jerome Powell at the Fed. This committee has been a brake on populism. Unorthodox candidates in the last administration generally failed to get out of this committee, and it seems the trend continues.

- Even though the focus remains on COVID-19, for much of the world the real scourge is malaria, an old malady that has mostly defied a vaccine. It appears that, at long last, one is on the horizon, which could be a huge plus for frontier markets.

- As the Fed begins to prepare to taper, financial dealers warn there is a risk of market malfunction. This is something we will be monitoring closely.

COVID-19: The number of reported cases is 236,612,988, with 4,830,359 fatalities. In the U.S., there are 44,060,356 confirmed cases with 707,797 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 480,427,985 doses of the vaccine have been distributed with 398,675,414 doses injected. The number receiving at least one dose is 216,012,495, while the number receiving second doses, which would grant the highest level of immunity, is 186,385,751. For the population older than 18, 67.5% have been vaccinated. The FT has a page on global vaccine distribution. The Axios map shows definitive improvement in the spread of the disease.

- A recent study examines the issue of myocarditis (heart inflammation) in patients who received the mRNA vaccines. The highest occurrence is in men aged 16 to 29 years, who had about 0.01% incidence. Most cases were mild to moderate; those infected with COVID-19 tended to have a higher frequency.