Daily Comment (November 19, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy World Philosophy Day! The winter surge in the pandemic is weighing on risk markets this morning. We update the progress of the Eurobond; delays have cropped up. We also update the EU’s stance on tech firms. There is a lot of news on China, including rising tensions with Australia. We update the pandemic news. Brexit is coming to its deadline, and a deal remains elusive. We are seeing South Korean interest in U.S. real estate. Mexico and the U.S. come to an agreement on the arrest of the former defense minister. We close with economic odds and ends. And, being Thursday, the Weekly Energy Update is available. The next report will be published on December 3. Here are the details:

EU: The proposed Eurobond has hit a snag; Poland and Hungary oppose the program’s requirement for following the “rule of law” to receive funds. The EU has been critical of both countries for their actions to undermine the independence of the judiciary, and both nations fear they will be shut out of funds from the EU budget. Thus, they are using their veto to stop the budget from passing. Our position is that the issuance of a Eurobond will be bullish for the EUR; if the budget fails, we will have to reconsider our position. We still believe that a deal will eventually be struck. But, the requirement of unanimity remains a stumbling block for Europe to act decisively. We do note that the actions Poland and Hungary have taken are unpopular within the EU, so making a deal could be difficult.

- The EU auditor has determined that the actions taken by Brussels have failed to restrain the large tech firms. The audit found that antitrust probes were too slow. By the time an enforcement action was taken, the larger firms were entrenched.

- Google (GOOGL, USD, 1740.64) has apologized to Thierry Breton, the EU internal market commissioner, for targeting Breton to undermine his plans for antitrust policy. An internal company document about the campaign was leaked and shows how the company planned to use various tactics to discredit the effort.

China: Here are the highlights on China.

- One key trend we highlighted with the election of Donald Trump was the tension between the establishment and the populists. That situation crossed party lines and national boundaries. Now, with the growing likelihood that Joe Biden will be president, the establishment is pressing for a return to the status quo before Trump.

- Singapore’s PM Lee Hsien Loong offered advice to Biden, suggesting that he should develop an “overall constructive relationship” with China. Leaders across Asia do not want to be forced to choose between the U.S. and China. They want the security guarantees from the U.S., but they also want to capture the economic activity of China.

- The U.S. Business Roundtable is urging Biden to ease tariffs on China and engage in trade talks. If a business is hit with a tariff and lacks the market power to pass along the price increase from the tax, the business bears the incidence of the tariff. Thus, reducing tariffs would be positive for a business’s bottom line.

- Overall, we doubt a return to globalization, and the previous U.S. role is likely. Biden may want to see that, but the arc of history appears to be bending toward a withdrawal of U.S. hegemony.

- Japan and Australia have agreed on a plan to increase military cooperation. This historic decision is important for two reasons. First, it increases cooperation among the nations surrounding China without the U.S. as part of the equation. Second, it is supporting Japan’s steady ending of its pacifist stance, which will become increasingly necessary as the U.S. withdraws from hegemony.

- Tensions between China and Australia have been elevated. In a recent press conference, Zhao Lijian, a Foreign Ministry Spokesman, laid all the blame on Canberra. A list of 14 disputes were sent to Canberra with threats to disrupt economic relations between the two countries.

- We continue to watch the travails of the Chinese corporate bond sector. Tsinghua Unigroup (600100.SS, CNY 6.83) is the latest firm to default, this time on a domestic CNY bond. As we noted earlier, these problems have led to delays in new issuance. Debt turmoil is a new concept for China. Until 2014, it was illegal. China is slowly moving to create a more modern financial system that will include defaults. The problem with allowing defaults is that it is nearly impossible to know if a default will lead to systemic problems. For example, we doubt the Bush administration thought that allowing Lehman Brothers to fail would cause the Great Financial Crisis. Chinese authorities (and frankly, no financial regulator) want to avoid the systemic event but also disabuse lenders and investors of the notion that firms, even SOEs, will always be bailed out.

- The default of Tsinghua Unigroup raises questions about China’s drive to develop its domestic semiconductor chip industry.

- Yongcheng Coal and Electric Company has until November 24 to make payments and avoid defaults on some of its other bonds.

- Government regulators are threatening to sanction Haitong Securities (600837, CNY, 13.13) for assisting the aforementioned coal company in issuing bonds illegally.

- Tunghsu Optoelectronic Technology (000413, CNY 2.52) has failed to make interest payments on $10 billion of outstanding bonds.

- In the wake of the Great Financial Crisis, China developed its own credit rating agencies. It rates a bit more than half of China’s onshore corporate debt as AAA. However, one of the key criteria for that rating is based on the perception of government support. The recent defaults of SOEs raises questions about the degree of support that government’s will provide to debt service.

- Henry Kissinger warns that U.S./China relations show strong similarities to British/German relations before WWI. We agree with that historical analogy.

- President Trump intends to represent the U.S. at tomorrow’s APEC summit, which will be held virtually. The president last attended this meeting in 2017. Under most circumstances, such meetings are generally not controversial, although given the recent rise in tensions between the U.S. and China, this one might be interesting.

- China has issued debt in EUR and was able to borrow at a negative yield. The offering, in total, was $4.7 billion. The offering was popular, with a bid/cover ratio of 4.5x.

- The Shanghai International Energy Exchange announced it will start trading copper futures denominated in CNY. China is the world’s largest consumer of copper, which should boost activity for this new contract.

- As hog herds rebuild, demand for foreign pork is declining. China has been reporting that COVID-19 has been found on imported frozen food, which may discourage imports.

- One of China’s historical patterns is that it can be unified but poor, or rich and divided. Specifically, during the rich periods, coastal regions tend to do very well while the interior lags. The coastal regions engage the world and prosper through trade. China did see its economic situation improve during the period of colonial incursion but was deeply divided. During periods of unity, China withdraws from the world; the country is unified, but the coasts are as poor as the interior. This was Mao’s policy. The last two governments in China are trying to lift the interior without losing growth. Although this is a reasonable goal, there is no historical precedent. Xi’s plan is to move entrepreneurs to the interior to spur economic growth.

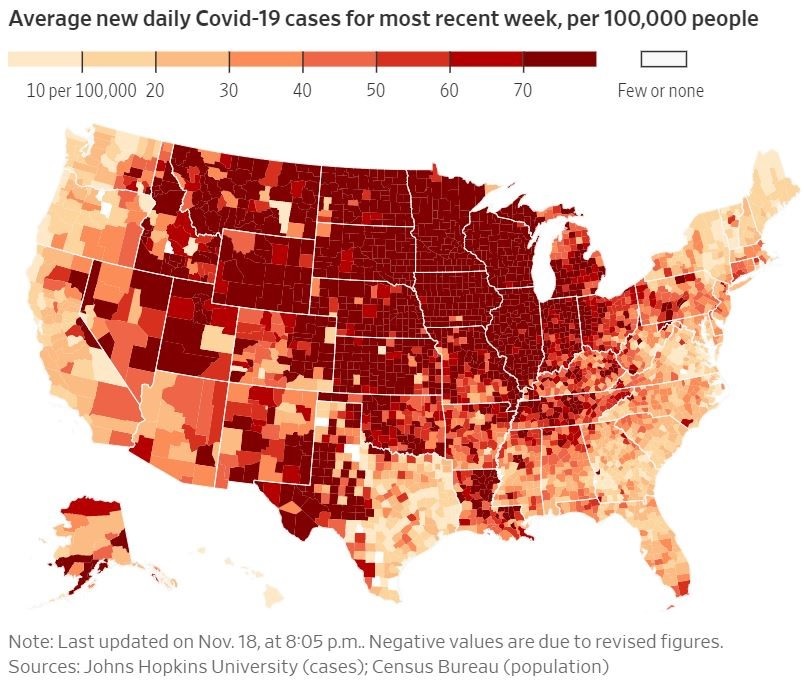

COVID-19: The number of reported cases is 56,394,215 with 1,352,188 fatalities. In the U.S., there are 11,531,451 confirmed cases with 250,548 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The map below shows infection rates by county. What is striking is that the coasts are seeing much lower infection rates, which may reflect growing natural immunity. The coasts suffered the brunt of the virus in the spring; now, the interior is facing rising infections.

Virology:

- China has traced the first COVID-19 case to November 17, 2019, meaning it’s been a year since the virus began to emerge.

- One of the problems to develop during periods of stress that triggers consumption surges is the issue of price gouging. Economic theory is pretty clear on this topic—the surge in price that is often considered “gouging” is the signal necessary to boost production. If prices don’t rise, shortages develop. Still, there is a sense of unfairness that emerges when plywood or battery prices jump in the midst of hurricane preparation. So, many states have enacted laws against price gouging. As the pandemic wears on, retailers are being hit with lawsuits and other actions over gouging violations.

- The pandemic is having a psychological impact. Reports from hospitals suggest that the surge in cases is wearing down medical workers. Meanwhile, in Germany, protests against pandemic restrictions turned violent.

- One of the concerns surrounding COVID-19 is the duration of immunity after infection. Antibodies, for example, seemed to dissipate in about six months, and there have been reports of re-infection. However, a recent study suggests that lasting immunity, perhaps the strongest immunity, called “sterilizing immunity” may follow an infection (and hopefully a vaccination). The key to long-term immunity is the development of T-cells against the virus.

- The vaccine being developed by Sinovac (SVA, USD, 6.47) is showing disappointing results, generating fewer antibodies than a person infected by COVID-19.

Brexit: As EU leaders meet today, there will be no briefing on Brexit because of the lack of progress. Although we still expect a deal to be made, there is evidence that the EU stance is hardening, which may restrict the ability of negotiators to reach an agreement. The GBP has weakened on these reports. Meanwhile, U.K. industry is warning that, even with an agreement, it will need six months to prepare border checks.

Real estate: South Korean investors have been flocking to U.S. commercial real estate this year. The combination of dollar-low interest rates and hedging costs has encouraged South Korean institutions to increase their exposure to the U.S. real estate market. These flows act to partially offset the loss of Chinese real estate investment.

Mexico: In mid-October, the U.S. arrested Salvador Cienfuegos, Mexico’s former defense minister, on charges he was working with drug cartels. At the time, the arrest was controversial; it’s not that the charges were not necessarily true, but the diplomatic damage it incurred was significant. After further consideration, the DOJ decided to drop the charges against Cienfuegos. It isn’t clear whether this decision will reverse the damage to relations with Mexico.

Economic odds and ends: Here are a couple of items worth noting.

- In the aftermath of the 2007-09 recession, state and local government revenues fell sharply. Since these governments lack monetary sovereignty and face balanced budget requirements, the drop in revenue leads to spending cuts. We are starting to see evidence of a repeat of the last recession. If the next fiscal package fails to offer support for these governments, we would expect the recovery to be less robust.

For the first time since 2013, S.W.I.F.T. reports that the EUR was the most used currency for global payments in October. However, the dollar remains the dominant reserve currency, used in 85% of all forex transactions and 61% of foreign reserves.