Daily Comment (November 13, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] Happy Monday! Here are the news items we are watching this morning:

The president’s trip to Asia comes to a close: The president stayed mostly on script for the early part of his trip but began to stray toward the end. We suspect historians will look at his APEC speech as one of the clearest signals that the U.S. is ending its superpower role. Although there is much being made over the 11 remaining TPP nations putting together the treaty, in reality, there isn’t much to make the group work without the U.S. and China. Among the remaining nations there isn’t an obvious importer of last resort, a key element of multilateral trade deals. Essentially, multilateral trade deals are geopolitical entities, not trade agreements. If the U.S. would have passed TPP and TTIP, the U.S. would have been the effective “center of the trading world,” straddling both the Asia-Pacific and the Atlantic. Instead, the U.S. is promising a series of bilateral agreements. It is interesting to note that Chairman Xi’s speech promoted globalization and got a standing ovation from the delegates. Trump’s speech didn’t. Perhaps the quote of the weekend came during the president’s visit to Vietnam.

“Xi Jinping’s ambitions are dangerous for the whole world,” General Cuong said. “China uses its money to buy off many leaders, but none of the countries that are its close allies, like North Korea, Pakistan or Cambodia, have done well. Countries that are close to America have done much better. We must ask: Why is this?”[1]

-Maj. Gen. Le Van Cuong

Another, perhaps more unsettling, quote:

“Everybody thinks that the U.S.-Japan alliance will last forever,” said former defense minister Shigeru Ishiba, a member of Abe’s Liberal Democratic Party and supporter of rewriting the constitution, said in an interview last month. “I don’t think so.”[2]

Was the trip a success? If the goal of the trip was to clearly state Trump’s Jacksonian foreign policy, then yes it was. Is that outcome good for financial markets? As with every major event, it’s mixed and will take a long time to sort out. But, in the end, we are in the steady process of seeing the U.S. abdicate its hegemonic role which will most likely lead to rising global insecurity.

Taxes: The House tax bill may get a vote before Thanksgiving and we expect it to narrowly pass. However, the Senate is facing much tougher sledding. Perhaps the biggest problem will be reconciliation. The two bills are not close in construction. At best, we will likely see a modest package of tax cuts without significant restructuring. At worst, this effort will fail. The odds of failure are rather elevated.

May’s troubles: Forty Tory MPs are apparently prepared to sign a letter of no-confidence on PM May. The important number is 48, which would trigger a no-confidence vote within the Conservative Party and bring a leadership contest. The strong Brexit supporters, mainly Michael Gove and Boris Johnson, are pressing for a “hard Brexit” which will limit May’s negotiating position and put the London financial industry at risk. In addition, a hard Brexit would almost certainly lead to a hard border in Northern Ireland and put the Good Friday Agreement at risk. The GBP slipped on the news.

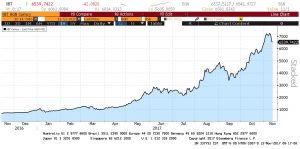

Bitcoin slips: As the popularity of bitcoin has increased, the ability of the “plumbing” to handle transactions has been adversely affected. The founders have tried to come up with a compromise that would maintain the cryptocurrency’s structure but allow for larger transactions to occur. That compromise has failed and there is concern that traders will gravitate to other competing instruments.

Note the recent decline in bitcoin. Although the correlation between bitcoin and gold isn’t all that close, both instruments play a similar role—a safe, anonymous store of value. We note that gold is doing better today as bitcoin prices fall.

The Alabama Senate race: Although the polls are tightening, we note the betting sites are still putting their money on Roy Moore.

In general, we have more confidence in betting sites than polls. The latter face problems of sampling and participant lying. On the other hand, one can hold an opinion in a betting pool but stand to lose money if they are wrong. Perhaps the most interesting part of this election is that the GOP establishment would probably prefer Jones, the Democrat; although he would be a member of the opposition, a Democrat in Alabama is probably conservative and may be a more reliable voter than Moore. We will likely see more of this in the coming years as the party coalitions reform. In other words, membership of class (establishment v. populist) will matter more than party affiliation.

[1] https://www.nytimes.com/2017/11/11/world/asia/vietnam-china-us.html

[2] Washington Post, Worldview.