Daily Comment (November 6, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an update on the Israel-Hamas conflict, where we continue to see a risk that the fighting could expand regionally and potentially even draw in the U.S. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a new ban on short selling in South Korea and additional signs of softer labor demand in the U.S.

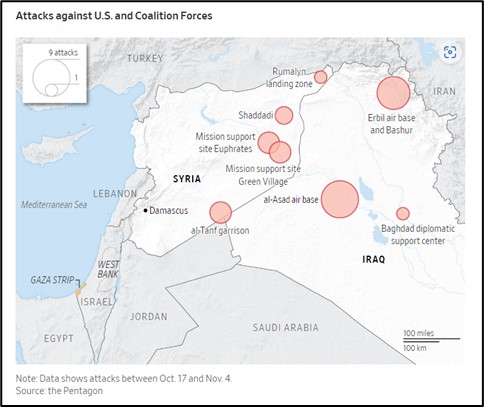

Israel-Hamas Conflict: The Israel Defense Forces continue to attack Hamas forces in the Gaza Strip, with a focus on stand-off attacks against the entry and exit points of the extensive tunnel network the terrorist government has built throughout the enclave. The strikes have reportedly trapped many Hamas fighters in the tunnels with no electricity, light, or air conditioning. Meanwhile, Iranian-backed groups in the region continue to launch drone, missile, and air attacks against Israel and U.S. forces in the region (see map below). In an effort to reassure allies that the U.S. will carefully calibrate its response to those attacks, Secretary of State Blinken made a surprise trip to several regional capitols over the weekend.

- The IDF reportedly plans to continue its strikes on the tunnel network until at least 65% of its entry and exit points have been destroyed. Outside analysts currently estimate about 50% have been destroyed.

- The continuing rise in reported civilian casualties suggests that Hamas has built many of those entry and exit points under residential and commercial buildings. The IDF insists that it gives fair warning for civilians to evacuate before each strike, but many civilians with no place to go still die in the airstrikes or artillery and tank fire.

- The mounting civilian casualties and growing anger at Israel around the world will probably raise the risk of retaliation, against both Israel and the U.S., by Iranian-backed Islamist groups such as Hezbollah in southern Lebanon. If they continue, they could potentially even prompt attacks on Israel by regional states, including Iran. In other words, there is still a risk that the conflict will expand into a dangerous regional war that could crimp global oil supplies and drive-up energy prices.

Israel: As we have warned, the fight against Hamas is now starting to have palpable negative effects for Israeli businesses, with firms struggling to deal with plummeting demand, the loss of workers called up for reserve duty, and consumers in border areas fearful to go out on shopping trips. Prime Minister Netanyahu has promised vast, pandemic-style cash transfers to affected firms and workers, but the aid package is already being criticized as too small.

Japan: Now that the Bank of Japan has softened its yield curve control policy and signaled it will let longer-term yields rise, several major Japanese banks have raised the (still miniscule) interest rates they offer on time deposits. For example, Sumitomo Mitsui Trust Bank, a unit of Sumitomo Group (SSUMY, $21.11) said it will hike the annual interest paid on five-year noncancelable deposits to 0.10% from 0.01% previously. (So far, we have seen no reports of Japanese depositors dancing for joy in the streets.)

South Korea: The Financial Services Commission today issued a blanket ban on short selling listed stocks until June 2024. In a statement, the Commission claimed the ban was necessary to ensure “fair price formation in the domestic market” following “repeated illegal naked short selling by global institutional investors.” Nevertheless, the move is being seen as a sop to retail investors ahead of next year’s parliamentary elections. In response, Korean stock-price indexes today have surged as much as 6%.

China-Russia: On Friday, the Commercial Aircraft Corp. of China, otherwise known as Comac, gave an update on the development progress of its long-delayed widebody jet, the C929, without mentioning its Russian joint-venture partner, United Aircraft Corp. (UAC). That marks the second time in two months that Comac has given an update without mentioning the Russian firm, which suggests UAC has dropped out of the project.

- If the Russian firm has indeed dropped out of the C929 project, it could signal that the firm is a casualty of the Western sanctions on Russia for its invasion of Ukraine.

- After similarly long delays, Comac’s single-aisle C919 aircraft, designed to compete with the 737 from Boeing (BA, $195.05), began flying commercially only in May.

- Despite China’s successful industrial policies to develop products such as electric vehicles and mid-range semiconductors, it continues to struggle with large civilian airliners. For now, that suggests the global market for such aircraft will remain a duopoly between Boeing and Europe’s Airbus (EADSY, $34.59).

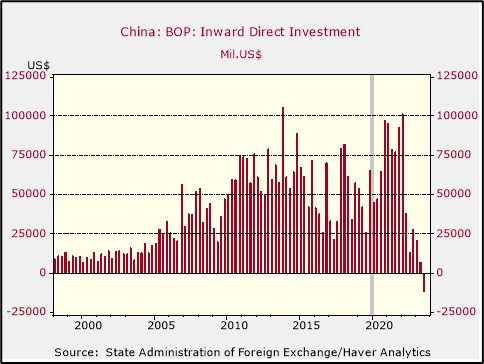

China: New analysis of Chinese data suggests foreign companies pulled more than $160 billion of earnings out of the country over the six successive quarters ended in September. Reflecting that, net foreign direct investment in China in the third quarter of 2023 turned negative for the first time in a quarter-century, and the value of the yuan (CNY) fell to its lowest level in a decade.

- The withdrawal of foreigners’ earnings reflects a range of factors, such as rising interest rates in the West, slowing growth as the Chinese economy matures, and headwinds from poor consumer demand, high debt levels, bad demographics, and disincentives arising from the government’s increasingly intrusive control over business.

- In addition, the economy is slowing from foreign decoupling, i.e., new barriers to trade, capital, and technology flows with China. In other words, the pull-out of earnings is also another example of how the world is fracturing into relatively separate geopolitical and economic blocs, as we’ve written about in depth.

European Union: In an interview with the Financial Times, EU Transportation Commissioner Adina Vălean said Brussels has launched an investigation into the big fare increases of 30% or more that European airlines imposed during the summer. The European Commission has no authority to regulate airfares, but the probe is a useful reminder that governments around the world may not rely solely on tight monetary policy to fight inflation. Executive and legislative branches of government can also put regulatory pressure on firms, perhaps including price caps.

Germany: Tesla (TSLA, $219.96) last week reportedly announced big pay increases for the workers at its “Gigafactory” near Berlin. Chief executive Elon Musk also promised the workers that they will build the firm’s next-generation electric vehicle. The moves come as Tesla is trying to fend off an organization effort at the plant by Germany’s powerful IG Metall union. If the plant is successfully unionized, it would likely encourage efforts to organize other Tesla facilities around the world.

Sweden: Separate from the German situation, the IF Metall trade union that launched a strike against Tesla in late October claims the company will open talks with it today. Although Tesla doesn’t manufacture autos in heavily unionized Sweden, it does employ about 120 mechanics at its service centers there, and those workers have been agitating for a union. If the company ultimately acquiesces to the mechanics’ demands, it could also potentially encourage further unionization efforts elsewhere.

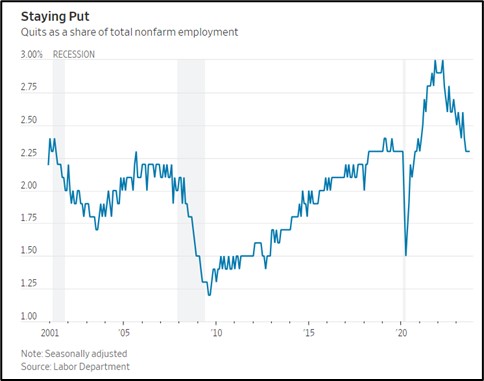

U.S. Labor Market: In contrast with the post-pandemic “Great Resignation,” when employers reported big jumps in voluntary quits, the softening white-collar labor market has now pushed turnover down steeply. The latest JOLTS report from the Labor Department shows the quits rate is now back down to where it was just before the pandemic. As a result, some businesses are over-staffed, which will heighten the risk of bigger layoffs as the economy slows.

- In a further sign of softer demand for white-collar workers, major consulting firms such as McKinsey and Bain & Co. say they are freezing starting pay for new graduates they will hire in 2024.

- Nevertheless, the firms continue to pay rich salaries to new employees. McKinsey, for example, offers a base pay of $192,000 per year for fresh MBA graduates.