Daily Comment (November 4, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with our thoughts on the impact higher interest rates will have on investor sentiment. Next, we discuss how the changing geopolitical landscape is forcing leaders to rethink their alliances. Lastly, we talk about both the positive and the negative developments internationally.

Pay Now, Not Later: Expectations of higher interest rates are adding to investor woes about duration risk.

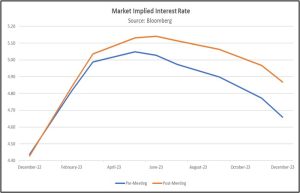

- Investors have reevaluated their estimates of rate hikes for 2023 in response to comments made by Fed Chair Jerome Powell. In a press conference, Powell stated that the central bank’s peak interest rates were likely higher than markets have currently priced in. As a result of this comment, investors have updated their peak interest rates to slightly above 5% by March 2023.

- The chart below shows the market-implied Fed funds rate through 2023. Post-meeting data shows that investors have priced in a higher peak and have extended expectations of a Fed reversal.

- Investors have begun offloading some of their duration sensitive assets thanks to new interest rate expectations. The nominal total return for the 30-year Treasury is down more than 30% year-to-date. Meanwhile, the NASDAQ composite index is down nearly 26% for 2022. The sell-off in duration sensitive assets is related to investors demanding higher premiums for investments that cannot provide short-term returns. Hence, investors are now prioritizing stocks that can give them a return now rather than later.

- The combination of higher interest rates and inflation will encourage investors to demand higher premiums to hold on to riskier assets. As a result, investors are starting to prefer stocks with low multiples and high-dividend-paying potential. This dynamic partially explains why iShares ETF for value (IVE, $140.42) has outperformed its growth (IVW, $56.23) counterpart this year (-8.62% vs. -30.53%). It appears that investors are becoming increasingly uncomfortable with holding onto securities for long periods when there is uncertainty concerning inflation and borrowing costs. This trend will likely continue as long as the Fed continues to tighten the screws on its monetary policy.

A New Identity: As Europe adjusts to the new world order, leaders begin to show their true colors.

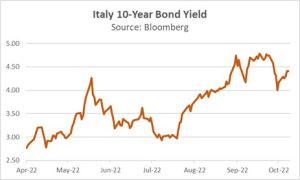

- The once Eurosceptic Giorgia Meloni has changed her tune since taking over as Prime Minister of Italy. On Thursday, Meloni met with Brussels to dispel notions that she was unwilling to work with officials to manage the country’s heavy debt burden. When Meloni was initially elected, there much skepticism about her readiness to make the reforms required for Italy to receive its total allocation of EU funds. So far, those concerns have been muted as Meloni has expressed an openness to working with Brussels.

- The improved outlook on Italy explains why Italian bond yields have declined in the weeks following Meloni’s election victory. The interest rate on bonds has fallen nearly 30 bps since the Italian elections. Although rates still remain elevated, the decline shows that investors are willing to give Meloni a chance.

- Meanwhile, German Chancellor Olaf Scholz reminded the world that Berlin will always prioritize its own self-interest. Scholz is set to meet with Chinese officials on Friday to ensure that the ties between Beijing and Berlin remain tight. China is Germany’s third biggest trading partner behind the European Union and the U.S. The decision by Scholz angered some of his Western allies who then accused Germany of making the same mistake it did when it built close ties with Russia. Scholz’s gesture toward Beijing suggests that the world may not be split into two blocs but possibly three, with the U.S., EU, and China each leading their own blocs.

- It is not clear how an independent Europe could coexist with the U.S. However, if we are correct, companies could be caught in the crosshairs as governments may pressure firms to choose sides. We are already seeing the S pressure firms such as Intel (INTC, $27.39) to stop selling semiconductors to China. Additionally, the situation will likely play out slowly over the next ten years as governments adapt to this new normal. In the meantime, companies with domestic supply chains may be relatively more attractive because they are less susceptible to policy-related disruptions.

Brighter Outlook: There is finally some good news coming out of China; however, rising uncertainty persists in other parts of the world.

- The investing environment in China is showing signs of improvement. For example, on Thursday, Bloomberg News reported that Chinese authorities were looking for ways to ease the impact of their Zero-COVID policy. Officials plan to lift restrictions on flight suspensions to make it easier for the country to receive more travelers. Additionally, U.S. regulators are ahead of schedule on their audit of Chinese companies. So far, the developments have provided a reprieve for Chinese stocks the day after Beijing stamped out speculation that it was preparing to end its COVID restrictions.

- Despite the positive news out of Asia, Europe and the Middle East still look like a mess. The EU is considering using the assets it seized from the Russian Central Bank to help Ukraine rebuild. Tensions between the West and Russia will surely escalate if Moscow is forced to bankroll the development of Ukraine. Thus, there is an increased likelihood that the two sides will completely sever ties. In the Middle East, former Pakistani Prime Minister Imran Khan was nearly assassinated on Thursday during a protest. The shooting of Khan reflects the rising tensions within Pakistan as the country deals with a heavy debt burden, slow economic growth, and high inflation. A political crisis in Pakistan could spill over to China and India.

- There is much uncertainty around the world which could weigh on investor sentiment. However, that doesn’t mean that there are not opportunities internationally. The development in China suggests that Beijing is somewhat sensitive to the market’s perception of its policies. Meanwhile, the stories from Europe and the Middle East will not have an immediate market impact. Nevertheless, it is essential to remember that a broad understanding of what is happening worldwide will help investors improve their valuation process, which is why we make certain to provide the good, the bad and the ugly in all of our reports.