Daily Comment (November 30, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! The day is off to a lively start, with equities surging and Arkansas pulling off an upset victory over Duke. In today’s Comment, we delve into the reasons behind investor rate expectations that may be amiss, explore the waning influence of the Magnificent Seven, and provide our insights into how the world might respond to a reduced U.S. presence. As always, our comprehensive report encompasses the latest domestic and international data releases.

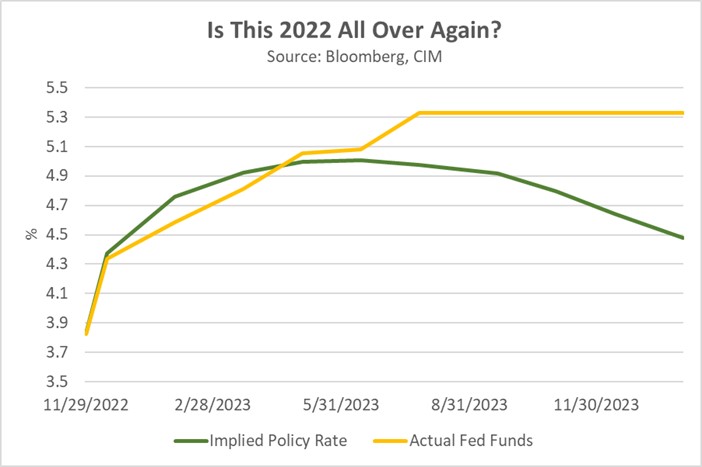

Investor Deja Vu? Ignoring the lessons of the previous year, investors have eagerly embraced riskier and longer-duration assets in anticipation of a Fed pivot.

- The fed futures market has signaled investor anticipation for a rate cut in early 2024, with estimates indicating an almost 80% likelihood by May. This optimism stems from recent progress in inflation and Fed commentary, which have bolstered expectations that the current rate-hike cycle is nearing its end. On Wednesday, 2024 voting member and Atlanta Fed President Raphael Bostic stated that price pressures could subside as the economy slows. However, some Fed officials, including Richmond Fed President Thomas Barkin, Fed Governor Michelle Bowman, and Minneapolis Fed President Neel Kashakari, have all advocated the possibility of another rate hike if inflation resurges.

- As 2023 draws to a close, the stock market is displaying a pattern reminiscent of the year’s beginning. In 2022, inflation exhibited persistent signs of easing after reaching a peak of 9.1% in June, followed by a 140-basis-point decline four months later. Similarly, investors had been anticipating a potential recession in the first half of 2023. While inflation has continued its downward trend this year, investor optimism proved to be premature. A resilient labor market and improved household balance sheets supported economic growth, giving the Federal Reserve more leeway to raise interest rates further.

- Without a substantial economic downturn, it is prudent to trust the Federal Reserve’s commitment to maintaining elevated interest rates for an extended period. The latest Atlanta GDPNow estimate suggests the economy likely expanded at an annualized seasonally adjusted pace of 2.1% in the fourth quarter, indicating that economic momentum remains. Additionally, central bankers have shown a growing interest in incorporating anecdotal evidence into future policy decisions. Although the latest Beige Book indicated signs of economic moderation, policymakers remain vigilant about future price developments, seeking early signs of a potential resurgence in inflation. As a result, government data may have less of an impact on Fed rate decisions going forward.

Down With the Kings? The Magnificent Seven have been the market’s top performers in 2023, but their continued dominance into the new year is uncertain.

- These titans of the S&P 500, including Apple (AAPL, $189.37), Amazon (AMZN, $146.32), Alphabet (GOOGL, $134.99), Meta (META, $332.20), Microsoft (MSFT, $378.85), Nvidia (NVDA, $481.40), and Tesla (TSLA, $244.14), stand as the dominant forces within the index. Collectively, these behemoths account for nearly 30% of the S&P 500’s value, eclipsing their 493 counterparts. While the broader market has gained 19% this year, the Magnificent Seven have surged by an astounding 80%. However, this remarkable growth has been accompanied by a concerning rise in their P/E ratios from 29 to 45, prompting questions about potential overvaluation.

- Maintaining the remarkable performance of the Magnificent Seven in 2023 could be challenging. Their exponential growth was fueled by investor optimism in their ability to capitalize on artificial intelligence advancements that would translate into exceptional future returns, which is offsetting the risk of sacrificing higher-yielding safe-haven assets today. Their ascent has drawn parallels to the Nifty 50s of the 1970s and the dot-com boom of the 1990s, leading to speculation that these companies could face a correction if expectations are not met. The latest earnings reports show that Amazon and Microsoft may still have some momentum, while the remaining companies are seeing less favorable attention.

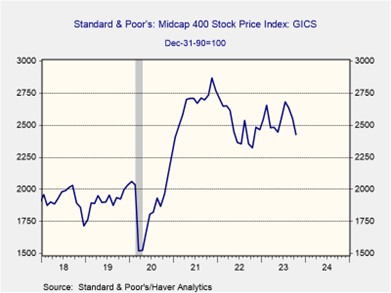

- As the prospect of higher interest rates diminishes, investors may redirect their focus to stocks that were largely neglected throughout 2023. This sentiment shift is evidenced by the recent performance of the S&P 400, an index that tracks mid-cap companies. Despite starting November down nearly 2% for the year, the index surged by an impressive 7.7% during the month, indicating a renewed interest in these often-overlooked companies. This improved performance can be attributed to a resurgence of bargain hunting among investors seeking opportunities to reenter the market. If favorable conditions persist, this trend could extend into the coming year.

A More Hostile World: With the United States gradually relinquishing its mantle as the world’s preeminent superpower, the global community faces the daunting task of navigating a world without a global hegemon.

- The United Nations and NATO have urged Western nations to address the growing influence of fringe powers in Eurasia and the Middle East. The director general of the International Atomic Energy Agency emphasized the need for renewed engagement with Iran to avert its nuclear ambitions. Meanwhile, NATO’s secretary-general has cautioned that Russia has amassed a significant stockpile of missiles specifically aimed at disrupting Ukraine’s power grid and energy infrastructure during the harsh winter months. India’s brazen assassination attempts in foreign nations (see below) also underscore the potential for escalating geopolitical tensions in the absence of a robust global authority.

- The intensifying global conflicts have prompted non-U.S. nations to reevaluate their approaches to addressing these challenges. The European Council president has advocated for the issuance of defense bonds within the economic bloc. This proposed legislation would facilitate the expansion of Europe’s defense capabilities. Meanwhile, to counter Iran’s nuclear ambitions, UN officials have urged the West to abandon the current Iran nuclear deal and negotiate a new one, considering the situation has deteriorated significantly since the initial agreement in 2015.

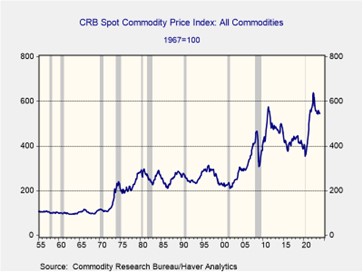

- The world’s fracturing into regional blocs is likely to unfold over the next few years. While the U.S. shows no immediate signs of relinquishing its superpower status, political currents are clearly nudging Washington in a different direction. This shift is evident in the growing congressional gridlock over aid packages for Israel and Ukraine. The geopolitical transformation is likely to trigger an upsurge in global military spending, which should bode well for the aerospace and defense industry for the foreseeable future. Furthermore, the burgeoning political uncertainty is poised to render commodities as an attractive haven, since intensifying competition will compel nations to drive up resource prices.

Other news: The U.S. charged an Indian official with plotting to assassinate a Sikh separatist. The incident underscores the challenges the U.S. faces in aligning India with its interests, as India has repeatedly asserted its autonomy as a rising power. Meanwhile, the U.S. and China are poised for a clash of influence in Micronesia, a reflection of their intensifying competition for global influence. On a somber note, political mastermind Henry Kissinger passed away at the age of 100. Renowned as the architect of U.S. foreign policy for decades, his legacy will continue to shape how people view international relations even after his death.