Daily Comment (November 3, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are surging due to the employment data, and Victor Wembanyama has proved that being tall and mobile makes it easier to score points in basketball. Today’s Comment begins with a discussion on how central bank policy impacts bond yields, examines a new rift over government funding, and concludes with a preview of the Xi-Biden meeting. As always, our report also includes a summary of the latest domestic and international data releases.

Will Rates Stay Down? Declining interest rate expectations have caused longer-duration U.S. Treasury yields to fall.

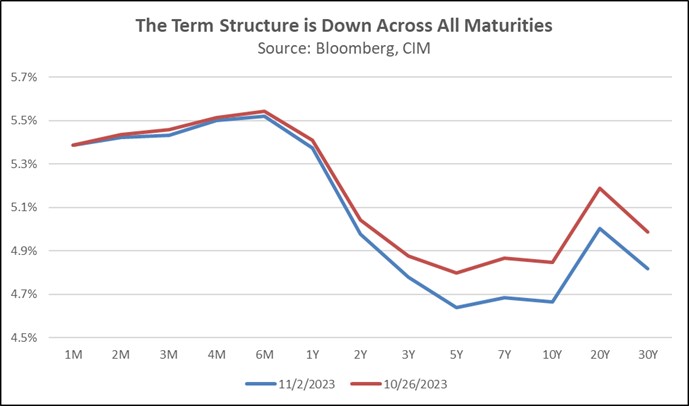

- Investors seem confident that central banks have finished raising interest rates, with four of the five G-7 rate-setting bodies holding rates unchanged in the past 10 days. The European Central Bank, Federal Reserve, Bank of Canada, and Bank of England have signaled that policy rates may already be sufficiently restrictive to bring down inflation and will take a wait-and-see approach before raising again. This comes after central banks hiked policy rates to multi-decade highs in an effort to restore price stability. The more accommodative stance is due to concerns about a recession as PMI manufacturing readings show that economic output in G-7 countries has slowed.

- This shift in sentiment has increased investors’ appetite for longer-duration assets, such as fixed income and growth stocks. The yield on the 10-year Treasury, a benchmark for global asset prices, has fallen by more than 30 basis points over the last two days, one of the biggest drops since the regional banking turmoil in March. Furthermore, the drop in interest rates also supported an equity rally, with the S&P 500 and Nasdaq Composite rising 3.0% and 3.5%, respectively, since the Fed’s rate decision. Investment-grade bonds also reflected this risk-on behavior, with the Markit CDX North American Investment Grade Index, a gauge of credit risk, falling the most in 10 weeks.

- While central banks have paused rate hikes, this does not signal a readiness to pivot. The Fed has cited tight financial conditions as a reason to keep rates steady, suggesting that policymakers may delay easing even if conditions improve. The recent rally in global bonds means that borrowing costs are starting to fall, thus paving the way for more lending. Moreover, core inflation remains above target in many countries, and progress could be reversed if demand starts to pick up. It is important to remember that bondholders were wrongfooted earlier this year; thus, investors shouldn’t rule out another head fake.

Bidenomics Pushback: New House Speaker Mike Johnson (R-LA) is preparing for a confrontation with the Biden administration over the president’s flagship legislation.

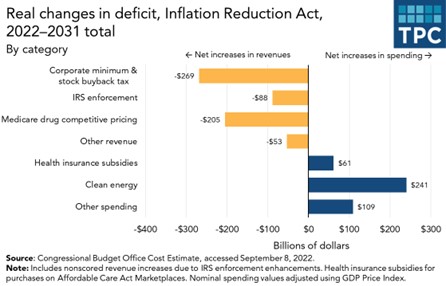

- The U.S. House of Representatives passed a bill on Thursday to provide $14.3 billion in aid to Israel and cut funding for the Internal Revenue Service. Despite its slim chances of passing the Senate or surviving a White House veto, the bill signals a shift in stance as the two parties prepare for another round of talks on the U.S. government budget. The move to tie military aid to spending cuts is an unusual gambit, given that providing assistance to allies has typically been bipartisan and without conditions. However, Johnson’s latest ploy will likely further divide Congress as the two sides look to prevent a government shutdown on November 17.

- Johnson’s insistence on spending cuts suggests that Republicans’ ultimate strategy in budget talks is to rein in the recent spending packages passed by Congress. The Inflation Reduction Act’s $80 billion increase in funding for the IRS was designed to give the agency more tools to pursue tax evaders. According to the Congress Budget Office, the investment should increase government revenue by approximately $200 billion and lead to a net deficit reduction of $114 billion over 10 years. Its inclusion in the IRA passed in 2022 was designed to offset much of the increased deficit spending included in the legislation. As a result, the lack of funding suggests that Democrats will have to find cuts elsewhere if they want to keep initiatives intact.

- Controlling the federal budget deficit is likely to play a key role in the upcoming presidential elections. Over the past five years, the country has seen an unusually sharp rise in spending due to the pandemic response, funding for clean energy, and tax cuts. The position by House Speaker Johnson suggests that he plans to push for more spending cuts to resolve the budget shortfall, while Democrats in the Senate are likely to push for tax increases to fill the gap. The upcoming elections could hinge on whether the country is willing to give up Trump’s tax cuts, which expire in 2025, or fund Biden’s energy transition, which will require significant spending in 2024.

U.S. and China Face Off: Leaders of the largest economies are set to meet in San Francisco on Monday in an effort to dial back tensions.

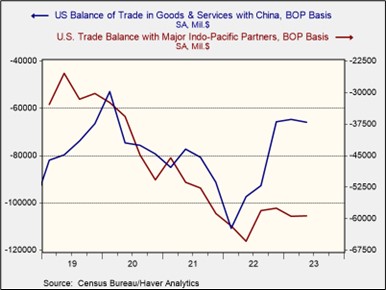

- The two leaders will focus on the deteriorating U.S.-China relationship, which is evident in China’s growing assertiveness in the Indo-Pacific, close ties to Russia, neutral stance on the Israeli-Palestinian conflict, and other issues. While the meeting is unlikely to produce any breakthroughs, the hope is that it will allow the leaders to put their differences on the table and prevent miscalculations that could lead to conflict. Last week, President Biden reaffirmed the U.S. government’s commitment to defending the Philippines in the event of an attack by China in the South China Sea. Beijing responded by warning the United States to stay out of other countries’ affairs.

- Despite factions in both countries that favor cooperation, the U.S. and China appear to be drifting apart. American companies still rely heavily on China for sales growth. For example, Apple (AAPL, $177.57) shares fell 3.0% after reporting weak sales in China, the world’s second-largest economy. At the same time, Chinese factories could lose market share to foreign competitors due to U.S. reshoring efforts. Nevertheless, the de-risking trend is accelerating as evidenced by the 14% decline in Chinese holdings of U.S. Treasury securities and the sharp drop in U.S. imports of Chinese goods and services to their lowest level since late 2020.

- The divorce between the world’s two largest economies is likely to unfold over the next few years, with the biggest impact on large companies with significant revenue exposure abroad. Small and medium-sized businesses, which are typically domestically focused, are somewhat insulated from the uncertainty surrounding the U.S.-China relationship. However, countries such as Mexico and Poland are well-positioned to take advantage of the shift as they have the manufacturing capacity and skilled labor needed to fill the output void from companies looking to reduce their reliance on China.