Daily Comment (November 3, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning. Today’s Comment begins with our thoughts on the Federal Reserve’s rate decision. Next, we discuss how the Fed indirectly pressures other central banks to tighten their own policy. Finally, we explain how an international push away from globalization will likely impact U.S. firms.

The Fed Is Not Done: Bullish investors got whacked on Wednesday after Federal Reserve Chair Jerome Powell squashed pivot expectations.

- The Federal Reserve raised rates by 75 bps and signaled the possibility of a more moderate rate hike in its next meeting. Although the hike was widely expected, the Fed gave somewhat conflicting remarks about future increases. In the Fed statement, officials mentioned increasing interest rates until inflation returns to its 2% target while acknowledging that it will be monitoring the policy’s impact on the economy. The two statements led to confusion within markets as investors interpreted it as a signal that the Fed was nearing the end of its tightening cycle. However, Powell later clarified that the central bank is not ready to pause or pivot and has instead increased the ceiling of its interest rate target.

- Although the market initially responded favorably to the possibility of policy moderation, the mood changed after Powell spoke. The S&P 500 tanked 2.5% following the news as Powell’s comment dashed hopes of an imminent Fed reversal. Meanwhile, the dollar rose, and bond prices dropped as tighter financial conditions made cash more attractive. The market’s reaction suggests that many investors still hold risky assets in their portfolios, with hope that the Fed will change course. Hence, the market has not likely hit bottom yet.

- Clearly, the Fed would like investors to believe it is prepared to combat inflation at all costs; however, we have our doubts. The Federal Open Market Committee is unlikely to have unanimous support in favor of raising rates into a recession. In fact, the committee’s reference to a decrease in the size of the rate hikes and an increase in the peak of interest rates suggests that it will try to push up rates as high as it can while the economy remains relatively strong. Hence, the Fed may raise rates by 50 bps until either inflation falls or the economy contracts.

- The increase in borrowing costs has pushed auto and mortgage rates to their highest levels in more than a decade. Thus, the rise in interest rates is already hurting growth as it suppresses durable goods consumption and investment spending.

The More, The Scarier: Monetary policymakers in other countries feel compelled to follow the Fed’s lead, whether they like it or not.

- The Bank of England hiked its benchmark interest rates by 75 bps on Thursday, marking its biggest hike in 33 years. The central bank was forced to raise rates aggressively after unfunded tax cuts from the Truss administration called into question the country’s ability to contain inflation. In its statement, the BOE specified that its interest rate peak would be lower than the market expects. The comment indicates that the bank is reluctant to continue to hike rates as the economy starts to slow. The two dissenters who voted for smaller hikes reflected this cautiousness. The lack of action suggests inflation in the U.K. could be higher for longer, and the pound may begin to weaken again.

- European Central Bank officials have also signaled that they are now more hawkish. ECB president Christine Lagarde stated that a recession would not be enough to bring down inflation. Meanwhile, Governing Council member Martins Kazaks went further and noted that the banks should raise rates “significantly” even with a recession on the horizon. The signaling from ECB officials indicates that the bank will raise rates by 75 bps in its next meeting and could continue to tighten for the foreseeable future.

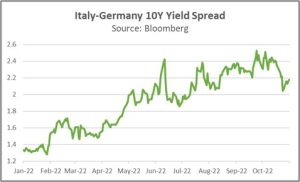

- The spread between the 10-year bonds for Italy and Germany, a gauge for financial distress in Europe, is well below its 2022 high. So far, European fragmentation is less of an issue than earlier in the year; however, this could change if the Eurozone falls into recession.

- It is unlikely that either the BOE or ECB feels comfortable becoming more hawkish. This fact explains why these banks have yet to close the door on their respective bond-purchasing programs completely. Their decision to follow the Fed’s lead reflects their need to save face in order to persuade investors not to sell off their respective currencies. Thus, it is unlikely that either central bank will continue with jumbo hikes when the Fed eventually decides to halt its tightening cycle. In the meantime, ubiquitous monetary tightening of financial conditions raises the likelihood of a severe global downturn.

A Darker World: Globalization may run out of steam as the governments become more hostile and demagogues gain influence.

- Benjamin Netanyahu’s right-wing coalition will face resistance from other countries. The Biden administration has hinted that it is reluctant to work with Jewish supremacist politician Itamar Ben-Gvir. His history of making threats toward the Palestinians makes a relationship untenable. The controversial figure has risen in prominence due to the rise in popularity of ultra-right-wing candidates. His party, Religious Zionism, will be essential for Netanyahu to be able to form a government. The election in Israel reflects how nationalistic countries are becoming and provides further evidence that the world is moving away from multilateralism.

- U.S. rivals North Korea and Russia are becoming increasingly belligerent. Pyongyang tested its most powerful intercontinental ballistic missile (ICBM) on Thursday. Although the launch failed, it is clear that North Korea’s weapon capabilities are still improving. Meanwhile, Russian officials discussed when or how to use nuclear weapons in Ukraine. Although the U.S. will be unlikely to seek violent means to contain these threats, military action is not completely out of the question. That said, the risk of a continental war in Asia and Europe is elevated.

- A recent report showed that North Korea sent artillery to Russia for war in Ukraine. The cooperation between the two countries suggests that they share policy interests.

- Globalization cannot survive in a hostile world. Companies’ reliance on supply chains depends solely on the belief that countries will remain stable. Thus, as governments become more nationalistic and assertive, firms will be forced to move their manufacturing production to safer countries or bring them back home. This outcome will lead firms to increase their capital expenditures and potentially increase prices as they adjust to a costlier world.

- In addition to rising conflict, the lack of cooperation is also a headwind to the global economy. Today’s sell-off in China is a good example. Beijing’s unwillingness to seek help from the West has prolonged its COVID recovery. On Wednesday, Beijing reiterated its plans to adhere to Zero-Covid policy. The outcome could make a global recession more likely and weigh on commodity prices.