Daily Comment (November 29, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! Risk markets are higher after a rough day on Friday. It’s a big week for Fed speakers, with Chair Powell speaking to Congress tomorrow on pandemic policy. We expect Powell will get lots of questions on inflation today as well. Vice-Chair Clarida and Gov. Bowman also speak tomorrow. Atlanta FRB President Bostic talks on Thursday, along with Gov. Quarles, San Francisco FRB President Daly, and Richmond FRB President Barkin. Financial markets are trying to project the path of monetary policy, so this week will offer us some clues.

Our coverage begins with comments on Friday’s market action, along with some preliminary discussion of the Omicron variant. Our pandemic coverage comes next, followed by economics and policy. We then discuss China news and close with an international news recap.

More like red Friday: On Friday, news of a new COVID-19 variant sent risk assets tumbling. Oil prices fell over 12%, and the major equity indices fell over 2%. The news of this variant, dubbed Omicron, is bad, but for now, we don’t really know how bad. South African researchers were able to identify the new strain early; the thing about early warnings is that the earlier you get them, the less you know. The number of mutations to the spike protein of the B1.1.529 variant raises the risk that it will be able to evade current immune defenses. But we don’t know if this new variant is more lethal than the current versions. It appears that it spreads more easily but early indications hint that this variant may not be as potent, although we warn this is anecdotal evidence. One complicating factor is that South Africa has a young population, so the lethality may be skewed by this factor. Simply put, we don’t know what exactly we are dealing with quite yet.

South Africa’s reward for providing an early warning was to be hit with travel restrictions. Although that response makes sense, it may discourage nations in the future from disclosing the information. There are concerns that if this new variant leads to breakthrough infections and is more lethal, it may be hard to reimplement social restrictions.

At the same time, Friday’s market reaction looks a bit severe, most likely due to a combination of bad news colliding with thin, holiday market conditions. Once trading stops are high in a falling market, it will tend to build on itself. Risk markets are recovering this morning, but we are still well off from Wednesday’s level. We would expect markets to trend higher in the aftermath of the selloff.

COVID-19: The number of reported cases is 261,629,689 with 5,202,472 fatalities. In the U.S., there are 48,234,746 confirmed cases with 776,647 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The CDC reports that 572,190,175 doses of the vaccine have been distributed with 454,447,737 doses injected. The number receiving at least one dose is 231,367,686, while the number receiving second doses, which would grant the highest level of immunity, is 196,188,756. For the population older than 18, 70.9% of the population has been fully vaccinated, with 59.1% of the entire population fully vaccinated. The FT has a page on global vaccine distribution.

- After South Africa announced the Omicron variant, it appears to be spreading rapidly, with Canada, Australia, and EU nations reporting cases of the variant.

- Vaccine makers are rushing to see if the current vaccines are effective, and, if not, moving to create new boosters.

- Those with knowledge of the Greek alphabet would note that the WHO skipped a couple of letters. When news broke on the variant, wags were already doing a “who’s on first” with Nu, which was the next letter in line. The WHO also skipped the next letter, Xi, likely worried about offending the leader of the CPC.

- One of the public policy debates is whether vaccines or infections offer a better immune response. Early studies suggested that vaccines were better; however, with other infectious diseases, the immune response from the infection tends to grow over time. New studies suggest that may be happening with COVID-19 as well. If so, it may mean we are closer to herd immunity than previously thought.

- Merck’s (MRK, USD, 79.16) antiviral treatment, molnupiravir, isn’t as effective as early test results suggested.

- Hospitals are preparing to lose staff over the vaccine mandates.

Economics and policy: The economy is roaring, and port conditions are improving.

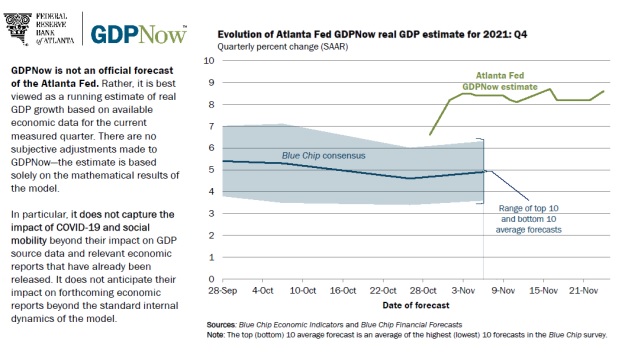

- Although we have been getting questions about “stagflation,” the current state of the economy might be better described as “growthflation.” Inflation is clearly rising. Although Q3 GDP was soft, the Q4 data are suggesting a stunning rebound.

The Atlanta FRB’s GDPNow forecast, which plots the path of GDP for the current quarter based on the flow of economic data, is projecting a growth rate of 8.6%. Although we think the FOMC will move slowly to raise rates (and the Omicron variant will likely support that point), if the Fed wanted to raise rates, there is enough economic growth to support tighter policy…at least for now.

- There is better news on the port snarls. Wait times for containers are declining, suggesting that there is some improvement at the ports. Empty containers are being removed by “sweeper ships,” which are freeing up space on the docks to move full containers into port. Although the ports are still backed up, progress is being made.

- December will be a busy month for legislators. The debt ceiling, the defense bill, and the budget are all on the docket. We suspect that the Build Back Better program gets delayed into next year.

- As we mentioned earlier, the West Coast dockworkers’ contract expires next summer. Talks will be starting soon. We suspect that the only way a strike can be avoided is with significant pay increases.

- Although the expansion of online shopping has changed “Black Friday” for good, stores did report increased traffic this year.

- The old idea of rent caps is making a comeback. While capping rents helps keep costs down for renters, it doesn’t do anything to boost units. Zoning restrictions have tended to reduce apartment construction which is leading to higher rents. Rent caps are not a good solution, but in the absence of aggressive apartment construction, it isn’t surprising that rent caps are returning.

China news: The U.S. is hinting at nuclear talks with Beijing, and the Commerce Department expands the Entity List.

- The recent silo building activity and the hypersonic missile test have led Washington to consider nuclear talks with Beijing. The U.S. and China don’t have the same level of nuclear protocols that the U.S. and Russia have, a holdover from the Cold War. There is no “hot line” and China hasn’t been part of nuclear weapons talks. Now that China is clearly embarking on building a more sophisticated nuclear arsenal, it would make sense to create some of the basic ground rules to avoid an accidental nuclear exchange.

- At the same time, the U.S. is expanding its Entity List to Chinese companies working on quantum computing. Twelve new companies were added to the list which restricts technology exports.

- There is an underlying skepticism about China’s economic data. In general, we find it useful to assume that any number with a hard target will likely be manipulated. Thus, data that isn’t on Beijing’s radar can sometimes offer insights into China’s economy. China’s CO2 emissions unexpectedly fell in Q3, which probably reflects the downturn in the property sector.

- There are reports that local governments are issuing “coal coupons,” which are ration cards that give the holder a certain amount of coal. As coal prices rise, it may become difficult for households to purchase heating fuel on the open market. The ration cards provide fuel at a set cost. Coal coupons were common during the Mao era and reflect the degree of scarcity of heating fuels. Basic economics suggests that such measures usually lead to shortages as companies dislike providing the product at below-market prices.

- China has asked Didi (DIDI, USD, 7.88) to delist from U.S. markets so as to avoid disclosing sensitive data.

- In a speech, a former government official suggested that tech companies should pay a tax when they trade their users’ personal data. Huang Qifan, the former mayor of Chongqing, made the argument. This disclosure may be a trial balloon to judge the firms’ reactions, but a data tax would be another tool in controlling Chinese tech firms.

International roundup: There were contested elections in Honduras over the weekend, and Ukraine warns of a coup.

- Honduras held elections yesterday. Early indications suggest the leftist candidate, Xiomara Castro, is ahead of Nasry Asfura. Castro is the wife of former President Manuel Zelaya, who was ousted in a 2009 coup. Asfura is the mayor of Tegucigalpa. Castro and Asfura are trying to replace Juan Orlando Hernández, considered to be a drug trafficker by the U.S. Pre-election polls suggest a tight race and it isn’t clear if either candidate will accept a loss. With tensions running high, there are fears that unrest will follow the vote regardless of the outcome. At the U.S. border, Hondurans are the second-most common nationality, so a surge in unrest would likely increase those trying to enter the U.S.

- The president of Ukraine is accusing Moscow of fomenting a coup against his government. President Zelensky claims to have uncovered a coup plot.

- Last week, a new government was formed in Germany. The FDP was awarded the finance ministry. All eyes now are on who the government picks to run the Bundesbank. This person will represent Germany on the ECB.

- Germany is boosting its minimum wage by 25%. The wage covers about 5% of the workforce.

- Germany has asked the U.S. Congress not to sanction the companies involved in the Nord Stream 2 pipeline. We would be surprised of Congress complies.

- Turkey has been facing significant financial stress as President Erdogan has interfered with the central bank to require easy monetary policy. The central bank says that the financial system is still “strong.” However, there are growing reports of “dollarization,” where Turks are scrambling to acquire and use USD in transactions and saving.

- Iran and the U.S. are preparing to talk about restoring the 2015 nuclear deal. We will be covering the progress in detail in our Weekly Energy Update report but suffice it to say that we have very little hope of full restoration of conditions. Meanwhile, Israel and Iran are engaging in a cyberwar that is increasingly targeting non-military sectors.

- Japan announced additional military spending to its already record defense budget for this year.