Daily Comment (November 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with some ideas we picked up on the world’s geopolitical trends from our reading over the holiday weekend. We next review a range of recent international and U.S. developments with the potential to affect the financial markets today, including a potential new financial crisis in China, a landslide victory for a far-right candidate in last week’s Dutch elections, and an early take on U.S. consumer spending on Black Friday.

United States-China: We often write about the intensifying U.S.-China geopolitical rivalry since it’s key to understanding the world’s future economic and financial market environment. Based on our reading over the Thanksgiving holiday, which included The Strategy of Denial, by Eldridge Colby, lead author of the U.S. government’s 2018 National Defense Strategy, we want to refine one assertion we’ve often made about how the U.S. established and maintained its position as global hegemon in the decades since World War II.

- As Colby notes, the great lesson of the 20th century was that the U.S. can’t rely on the Pacific and Atlantic oceans to protect its territorial integrity, political freedom, or prosperity. Concentrated economic wealth—and therefore potential military power—in Asia, Europe, and the Middle East means the U.S. can only be secure by blocking the emergence of regional hegemons in those territories.

- While we’ve often said that one step in establishing U.S. hegemony was to “freeze” past conflicts in those regions, it’s more precise to say the U.S. used its predominant military, economic, and diplomatic power after World War II to hold down the historic hegemonic aspirants in those regions: Japan in Asia, Germany in Europe, and potentially Russia in the Middle East. This is consistent with Colby’s analysis of U.S. strategy.

- But importantly, Colby notes that the U.S. can’t just exercise its own power to hold down those want-to-be hegemons. To safely contain aspiring regional hegemons, the U.S. actively developed regional anti-hegemonic coalitions to help keep the peace, such as the North Atlantic Treaty Organization in Europe and various bilateral alliances in Asia and the Middle East.

- President Trump’s error was casting these alliances as relationships in which the U.S. benevolently provides security for Asia, Europe, and the Middle East.

- Actually, the U.S. enlists countries in these regions to help protect U.S. national security. While “free rider” problems exist in all such alliances, they’re the price the U.S. pays for these regions to cooperate in protecting U.S. security.

- By allowing us to maintain military bases on their soil, our allies enable the U.S. to practice an extraordinarily deep “forward defense.”

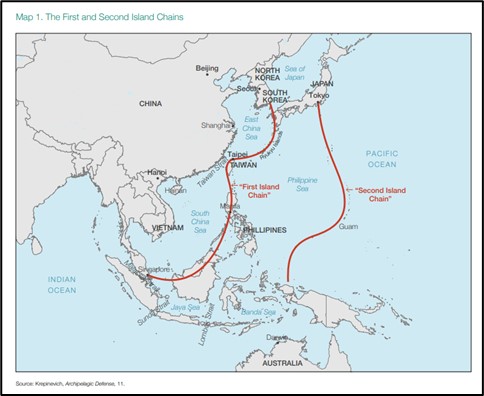

- Rather than having a western defense perimeter along our own Pacific coast, we’ve pushed it more than 5,000 miles away to the “First Island Chain” running from Japan and Taiwan through the Philippines, Guam, and Malaysia, as shown in the map below.

- Rather than an eastern defense line along our own Atlantic coast, we’ve pushed it more than 4,000 miles away to the eastern frontiers Finland, the Baltics, Poland, Romania, Turkey, Jordan, Israel, and Saudi Arabia.

- Just as important, the U.S.’s preponderant military spending and power give us the leadership role in coordinating and agglomerating our allies’ power in ways that serve U.S. interests as well as their own, especially in managing the coalition to deny China’s bid for regional hegemony.

- By allowing us to maintain military bases on their soil, our allies enable the U.S. to practice an extraordinarily deep “forward defense.”

- Colby’s book is pretty theoretical, almost like a primer on game theory, but it’s a useful guide to the geopolitical dynamics we’re likely to see between the U.S. and China in the coming years. For investors, the key is that the U.S.’s efforts to build and maintain anti-hegemonic coalitions in Asia and Europe will surely exacerbate the global fracturing that we’ve been writing about, with results ranging from higher inflation and interest rates to potential investment opportunities in short-duration, dividend-paying industrial stocks and commodities.

(Source: Hudson Institute, 2023)

(Source: Hudson Institute, 2023)

China: The government in recent days has been scrambling to avert a meltdown of shadow-banking giant Zhongzhi Enterprise, which last week announced it was insolvent and had at least $31 billion more liabilities than assets. If the company collapses, it would be one of China’s biggest corporate failures in many years and would likely further sour investors on the country. In addition, investors in products offered by the company have begun to stage demonstrations demanding their money back, which could lead to broader political unrest.

- Separately, the Financial Times today has a fascinating article on the Chinese government’s ongoing campaign to repress Muslim influence, not just in Xinjiang but throughout the country.

- Using satellite photos, the article shows how the government has torn down or refurbished mosques and other buildings to eliminate their Arabic features, and in some cases replaced them with traditional Chinese elements.

Taiwan: The opposition Kuomintang and Taiwan People’s Party have scuttled their effort to present a unified ticket in the January 13 presidential election, while Terry Gou, the founder of giant contract electronics manufacturer Foxconn (HNHPF, $6.29), withdrew from the race.

- The moves will probably further boost the prospects of the ruling Democratic Progressive Party under Vice President Lai Ching-te.

- Since the poll-leading DPP favors greater independence from China, the opposition’s collapse will raise the risk of China launching provocative military, economic, or diplomatic moves against Taiwan in the coming weeks.

Malaysia: The government of Prime Minister Ibrahim has unexpectedly extended the license for Australian mining firm Lynas (LYSDY, $4.38) to run its rare earths processing facility in Pahang state, despite opposition from residents wary of environmental pollution. Renewing the license to operate the plant, which is the world’s largest such facility outside China, is a signal that Ibrahim will push forward with his plan to make Malaysia a key player in the mining and processing of rare earths, which are critical to the highly electrified economy of the future.

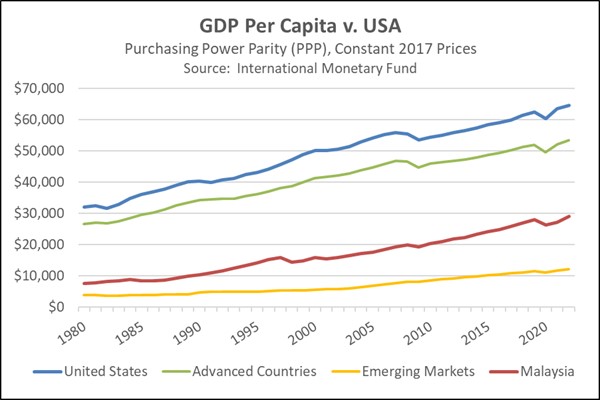

- Ibrahim’s government believes Malaysia holds some $173 billion of rare earth reserves, which it believes should be exploited to boost foreign investment, economic growth, and Malaysian wealth (the chart below shows how Malaysian per-capita gross domestic product has grown in recent decades).

- As the U.S. and its evolving geopolitical bloc work to cut their dependence on Chinese rare earths, they would likely be a ready market for anything Malaysia can produce. In turn, that would likely help draw Malaysia closer to the U.S. bloc. Our analysis currently places Malaysia in the “Leaning U.S.” camp.

Netherlands: In parliamentary elections on Wednesday, the far-right populist Freedom Party led by anti-Islam and Euroskeptic firebrand Geert Wilders came in first with 23.7% of the vote, well ahead of the Labour-Green Alliance of Frans Timmermans and its 15.6%. That gives the Freedom Party 37 of the 150 seats in parliament, versus 25 for the Labour-Green Alliance, 24 for the ruling center-right Freedom and Democracy Party (VVD), and 20 for the centrist New Social Contract Party (NSC). Because of the fractured results and the reluctance of other parties to associate with Wilders, it is not yet clear if he will be able to form a coalition that would have a majority in parliament, despite his unexpected landslide victory.

Turkey: As the government continues to normalize economic policy after President Erdoğan’s recent re-election, the central bank on Thursday hiked its benchmark short-term interest rate to 40%, boosting the rate from 35% previously and marking its sixth straight rate hike. Still, the benchmark rate remains far below Turkey’s consumer price inflation, currently over 61%. The lira (TRY) has therefore continued to weaken, trading on Friday at 28.8656 per dollar ($0.0346), down 35.2% for the year-to-date.

Russia-Ukraine War: With Russian and Ukrainian forces largely at a stalemate along the front lines in eastern and southern Ukraine, Russia launched big new waves of kamikaze drones against Kyiv and other Ukrainian cities over the weekend. After rebuilding its missile and drone stocks over the summer, Russia now appears to be repeating last winter’s tactic of attacking Ukraine’s civilian power and heating infrastructure to undermine the country’s will to fight and force it to divert its air defense systems away from the front lines. To warn off the Kremlin, the Ukrainian military retaliated by striking a power plant in Russian-occupied eastern Ukraine, cutting electricity to several cities and towns.

Israel-Hamas Conflict: Over the holiday weekend, Israel and Hamas continued to honor a ceasefire and release of Hamas hostages and Israeli-held prisoners. The released hostages include several Thais, a dual Israeli-Russian citizen, and at least one U.S. citizen. Nevertheless, Palestinian-Israeli violence continues in the West Bank, and Iran-backed militants elsewhere in the region keep attacking U.S. military forces, keeping alive the possibility that the conflict will expand into a regional conflagration.

U.S. Income Tax System: The Internal Revenue Service said it will delay several new tax rules mandated by Congress. The rules, which will be delayed for two years, touch on reporting requirements for e-commerce sales and cryptocurrency transactions, and on catch-up contributions to retirement accounts.

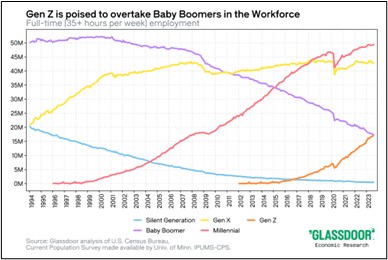

U.S. Labor Market: New analysis from Glassdoor shows that Generation Z workers (those born from 1997 to 2012) are about to overtake baby boomers in terms of their share in the U.S. labor force. The baby boomers’ share in the labor force has long been falling as more and more of the cohort retired, faced health problems, or died, and as younger generations started working. The coronavirus pandemic greatly accelerated the process, just as the Great Financial Crisis did a decade and a half ago. The mass withdrawal of baby boomers during the pandemic not only helped create today’s labor shortages and rising wage rates, but it also made it that much easier for Gen Z workers to overtake the baby boomers’ share in the labor force.

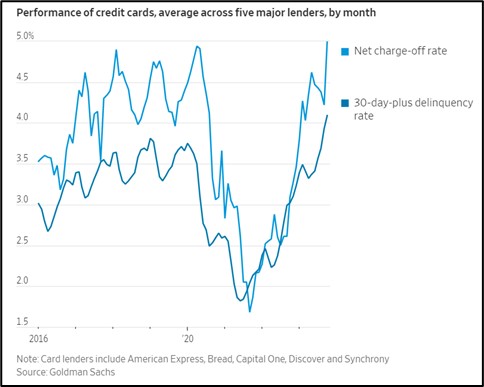

U.S. Consumer Finances: Among the nation’s top five credit card issuers, new analysis shows the share of their lending portfolios delinquent by 30 days or more is continuing to surge. The rise in delinquencies and associated charge-offs likely reflects factors such as the consumer price inflation of recent years, the Federal Reserve’s aggressive interest-rate hikes, and the fact that some households have now spent all their excess savings from the pandemic years. Rising delinquencies and charge-offs serve as a reminder that the economy remains at risk of recession going into 2024.

U.S. Consumer Spending: As the holiday spending season swung into high gear over the Thanksgiving weekend, the data so far suggests retailers saw a modest increase in store traffic and sales compared with last year. Data from Mastercard SpendingPulse™ showed Black Friday sales in stores and on-line were up 2.5% year-over-year. Data from RetailNext showed foot traffic in stores was up 2.1%. Nevertheless, it is still too early to gauge just how successful the holiday selling season will be when all is said and done.