Daily Comment (November 21, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

The Daily Comment will go on hiatus beginning Wednesday, November 23, and will return on Monday, November 28.

Our Comment today opens with an update on the Russia-Ukraine war, where it appears that the Russian forces recently pushed out of the southern city of Kherson are now being redeployed to other parts of the front line and are digging in for a stronger defense. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a welcome upward revision to economists’ expectations for the Eurozone’s economy this winter.

Russia-Ukraine: Now that the Ukrainian military has pushed the Russian occupiers out of the southern city of Kherson and its environs, various reports indicate that the Russians are redeploying their withdrawn forces to other fronts, with an emphasis on the northeastern Donbas region. The latest news suggests that they are also prioritizing the building of new defensive lines to limit Ukraine’s ability to make further gains. Meanwhile, the Russians continue to pummel Ukraine’s civilian infrastructure with air, missile, and kamikaze drone attacks. As winter takes hold in Ukraine, we suspect that the Ukrainians will prioritize keeping the pressure on the Russian forces in order to complicate their efforts to reconstitute and regain their combat strength.

- Despite the Kremlin’s on-going propaganda efforts regarding its invasion, new polling suggests that Russian citizens are becoming increasingly anxious about the war. This indicates that President Putin’s political position is becoming increasingly at risk even among the broader public.

- Meanwhile, demonstrations against Western support for Ukraine are continuing and even spreading into Europe. The demonstrations, organized by both the far left and the far right, raise the risk that Western governments could eventually be forced to reduce their support for Kyiv which would give Russia a freer hand in the war.

Eurozone: Despite the continuing war in Ukraine, economists have recently boosted their forecasts for the Eurozone’s near-term economic growth and now believe its downturn this winter will be much milder than earlier thought. Greater fiscal support from governments, lower gas prices, and a mild autumn have all helped to improve the bloc’s outlook, with many economists now expecting the Eurozone’s economic output to decline just 0.5% in the fourth quarter and 0.1% in the first quarter of 2023.

- Importantly, a mild autumn and success in building up huge stocks of natural gas have left the Eurozone in a relatively good position to avoid the massive energy crunch previously expected to result from Russia’s cut-off of energy exports to the bloc.

- If the Eurozone’s economic performance comes in as now expected, it would likely give a boost to the bloc’s stock markets and help U.S. firms that conduct business there.

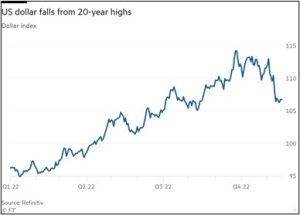

- Of course, U.S. investors might also see some benefit from the weakening dollar, which tends to boost their returns from foreign stocks and increases the value of U.S. firms’ foreign revenues.

- The U.S. dollar index is now down approximately 5.5% from its most recent peak in late September, and it has fallen some 4% in November alone.

Turkey: Over the weekend, in response to last week’s terrorist bombing in Istanbul, the Turkish military launched air strikes against Kurdish militant’s bases and other sites in Syria and Iraq. The ministry also said it had destroyed 89 targets, including shelters and ammunition depots, and that senior members of the PKK “were among those neutralized.” Such a large series of strikes raises the risk of new instability in the region.

China: The broad new wave of COVID-19 infections continued unabated over the weekend, with daily new infections remaining above 24,000. In addition, the country reported its first fatalities from the disease since late May. Separately, Hong Kong’s chief executive has tested positive for COVID-19 just days after interacting with his boss, President Xi Jinping, at the Asia Pacific Economic Cooperation forum in Bangkok. Xi is therefore at risk of coming down with the disease, increasing the likelihood that he will be in quarantine for some time after returning from his trip.

- Even though Beijing has ordered that the country’s previous Zero-COVID policy be watered down to reduce the negative impact on the economy and people’s social lives, the new infection wave means that there is some risk that the government will backtrack and impose new lockdowns in the future. Besides, with so many Chinese residents still unvaccinated, millions of people could begin to self-quarantine to keep from being infected.

- In either case, the new wave threatens to become another headwind for the Chinese economy in the coming weeks and months. And of course, that would imply new headwinds for the global economy and financial markets. For example, China’s torturous exit from Zero-COVID lockdowns has helped push global crude oil prices down below $80 per barrel last week.

Indonesia: An earthquake struck the island of Java early today, leaving at least 56 people dead, around 700 injured, and hundreds of buildings damaged. The quake registered 5.6 on the Richter scale, making it a rather moderate temblor despite the damage and loss of life.

Democratic Republic of Congo: Ethnic tensions have erupted into the most intense clashes in a decade, with the M23 rebel group advancing to within 12 miles of the city of Goma and pushing United Nations-backed Congolese government forces from several surrounding towns. The advance raises the prospect that M23 and its foreign allies could dominate a region that produces important minerals, including tin, gold, tantalum, and coltan.

Colombia: Even though recently inaugurated leftist President Gustavo Petro had pledged to stop new oil and gas exploration projects in Colombia, his finance minister signaled in a recent interview that the government will first review existing contracts to see if any modifications are necessary. Stepping back from Petro’s plan to end Colombian fossil fuel exports could help buoy the economy and reverse a steep fall in the peso.

COP27 Climate Summit: As the global summit conference to address climate change ended over the weekend, negotiators reached a deal in which large, rich, developed countries would set up a special fund to help the poorest less-developed countries manage the cost and damage of global warming. In return, the developing countries agreed to support the current targeted cuts in global greenhouse gas emissions. However, the size, structure, and mechanics of the fund were left to be hashed out sometime in the future.

U.S. Consumer Demand: As the holiday shopping season kicks off in earnest this week, new data and polling suggest that headwinds such as high inflation and rising interest rates will push down spending on gifts this year. The polling indicates that people will buy less presents and spend marginally less than they did on presents last year.

U.S. Energy Sector: Although it now looks like Europe could skirt the big energy crisis it was previously expected to face this winter, the massive energy exports to Europe and other issues are pushing heating costs dramatically higher in the U.S. Northeast this winter. The New England regional grid operator has said that it will be able to cope under normal weather conditions this winter but warned that a prolonged period of particularly cold temperatures could force it to ration electricity supply, potentially through rolling blackouts that could negatively affect the region’s economy.

U.S. Cryptocurrency Market: As part of its bankruptcy process, crypto exchange FTX and its linked companies filed a list of their 50 largest creditors on Sunday, and the filing showed that all of those creditors were customers which are owed more than $20 million. Two of those are due over $200 million.