Daily Comment (November 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start and the Texas Rangers are the new World Series champions. Today’s Comment starts with a discussion about the latest FOMC meeting, followed by our thoughts on the dollar, and an update on the bomb cyclone that is expected to make landfall in Europe. As always, our report includes an overview of the latest domestic and international data releases.

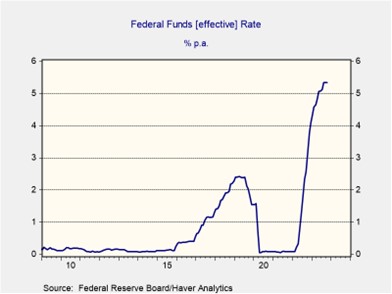

No More Hikes? Markets bet on peak policy rates after the Federal Open Market Committee (FOMC) voted to hold rates at a 22-year high.

- Fed policymakers held rates steady at 5.25% to 5.50% at their October 31-November 1 meeting, citing concerns about tighter financial conditions. The announcement comes just over a week after the 10-year Treasury yield exceeded 5% for the first time since 2007. At the press conference, Fed Chair Jerome Powell reiterated the central bank’s commitment to a 2% inflation target and said it remains prepared to raise rates if economic conditions warrant, adding that officials are not considering cutting rates anytime soon. However, he said the committee expects the economy to show signs of weakening as interest rates take hold.

- Markets cheered Powell’s remarks, with the S&P 500 closing up 1.0% on Wednesday and bonds rallying across the curve, with the yield on the 10-year Treasury falling 18 bps. Though some of the sentiment was driven by the Treasury’s decision to slow the pace of long-dated bond issuance, there was also hope that the Fed officials were finished with their hiking cycle. The CME FedWatch Tool now projects an 84.5% chance of steady rates in December and a nearly 70% chance of a rate cut by June 2024, up from 69.1% and 50.6%, respectively, last week.

- The Federal Reserve will keep its options open over the next few months, but all signs suggest it is done raising interest rates. Policymakers are likely to focus their efforts on making sure that rates do not remain too high for too long and begin impacting the real economy. So far, the Fed has been fortunate in keeping rates high for a sustained period without any negative consequences. However, it is unclear how long this good luck will last. Current default rates suggest that the default spread should be wider, indicating that investors are not adequately pricing in risk. This may change as more debt approaches maturity and needs to be refinanced at higher interest rates.

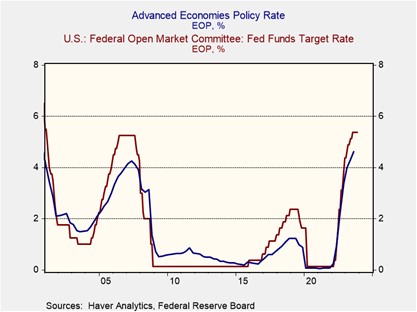

Greenback’s Resistance: After months of persistent growth, momentum in the U.S. dollar is showing signs of waning.

- Technical analysis shows that the U.S. Dollar Index has breached its 20-day moving average of 106.25, suggesting that the dollar trend may be close to reversing. The index has hovered in the 106-107 range over the past month, lacking upward pressure as market participants anticipate that central banks around the world are entering a new phase in their monetary policies. This lack of exchange rate movement comes as the market grows more confident that the policy rate differential between the Federal Reserve and its peers will not widen over the next few months.

- Over the past week, policymakers have signaled their reluctance to outdo the Fed in dovishness. The European Central Bank, the Bank of England, and the Bank of Canada all voted to hold rates steady for the second consecutive meeting, while the Bank of Japan took steps toward policy tightening. This cautious approach to a policy pivot reflects concerns that inflationary pressures may return if policymakers ease prematurely. Swap markets show that most central banks are expected to hold rates steady until the end of the year but may hike again in the first quarter of 2024.

- Historically, the Federal Reserve has hiked and eased more aggressively than its peers, suggesting that if the Fed is indeed done, then the downtrend in USD may start to take hold. This trend could benefit international equities as it should ease the debt burden and inflation pressures of countries that have exposure to the dollar. That said, investors should not become complacent as persistently strong economic data could lead the Fed to restart its hiking cycle, which would lead to renewed strength in the dollar. A weak jobs report on Friday should be enough to convince investors of a sustained trend, but another upward surprise may encourage investors to await more guidance from the Fed before abandoning their USD positions.

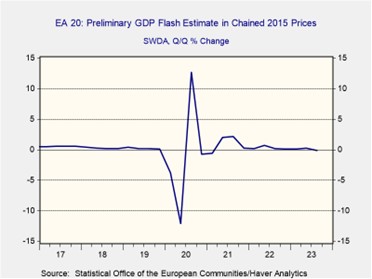

European Bomb Cyclone: A rapidly intensifying storm heads toward Europe this week, compounding its economic woes.

- Extreme Storm Ciarán is expected to make landfall in Britain first, becoming the first major country to be hit by the storm. The U.K. Met Office has warned of violent winds and possible flooding in several areas in the country. Afterward, the storm is expected to make its way to France carried by a “sting jet,” which is expected to lead to severe winds with speeds up to 130 km/h. Meanwhile, southern European countries such as Spain and Portugal are also expected to be impacted by strong winds. The storm has led to preemptive measures such as school closures as they prepare for the storm’s potential damage.

- These adverse weather conditions are coming at a bad time for Europe. Despite better-than-expected inflation data in October, with CPI falling below 3% for the first time since August 2021, economic activity in Europe has started to slow. GDP growth for the third quarter contracted at a seasonally adjusted annual rate of 0.1%, driven by a sharp decline in exports. The storm will likely lead to further economic disruptions, but any necessary rebuilding from the destruction could lead to a pickup in activity.

- Natural disasters are typically detrimental to local areas as opposed to the overall country, but the impact may vary depending on the event. There are several factors that influence the possible scale of the weather event, including the magnitude and duration of the event, the structure of the local economy, the population base, and the time of day the event occurs. That said, even in the case of major events, costs are typically overstated. In short, this storm may cause short-term disruptions, but it is unlikely to have a lasting impact on the growth prospects of Europe.

Other news: President Biden has asked the Israeli government to halt its forces to help with the hostage situation. The announcement highlights the potential risks of violence escalating throughout the Middle East.