Daily Comment (November 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures are signaling a lower open. Today’s report begins with U.S. economic and policy news, followed by our roundup of China-related stories. International news is next, and we conclude with our pandemic coverage.

Economics and policy:

- Senator Joe Manchin (D-WV) stated that he is looking favorably at supporting Federal Reserve Chair Jerome Powell for renomination.

- Automakers have decided to get into the semiconductor business. Frustrated with the chip shortages, Ford (F, $19.56) and General Motors (GM, $62.33) have both expressed an interest in forming strategic partnerships with U.S.-based semiconductor manufacturer GlobalFoundries Inc. (GFS, $64.27) in order to develop chips internally.

- Mexican President Andres Manuel Lopez Obrador (AMLO) and Canadian Prime Minister Justin Trudeau met with President Biden on Thursday. The meeting focused on a provision within the social spending bill that is being discussed amongst U.S. lawmakers. The provision would allow citizens to receive a tax write-off of $12,500 for electric vehicles assembled by U.S. union workers using American-made batteries. Both Lopez and Trudeau contend that the provision would be a violation of the USMCA trade agreement signed in 2018.

- During the meeting, AMLO brought up the possibility of the U.S. loosening immigration restrictions in order to address the labor shortage.

- An American diplomat stated that the U.S. could attempt to persuade China and Russia to help pressure Iran to return to the negotiating table if it is unable to secure a nuclear agreement with Tehran.

- The Congressional Budget Office estimates that the social spending bill will add $160 billion to the budget deficit. The estimate contradicts the White House’s claim that the social spending bill is deficit neutral. This discrepancy has been attributed to differing projections in the amount of revenue the IRS will generate with increased enforcement. The White House estimates that the IRS will generate $400 million, while the CBO estimates the agency enforcement would increase revenue by $207 million.

- The CBO also reported that the four-week paid family and medical leave would cost $205.5 billion.

- Additionally, the CBO estimates that the lower prescription drug pricing in the spending bill will lead to a $160 million decrease in the budget deficit.

- That being said, moderate Democrats appear to be ready to back the spending bill.

- The Texas electric grid is not prepared to deal with another severe winter storm as it did in February, according to the North American Electric Reliability Corp (NERC). If the state is hit with another severe winter storm, it could lead to disruptions in natural gas pipelines and power stations.

- Atlanta Federal Reserve President Raphael Bostic, a noted dove, stated he would like the Federal Reserve to start raising rates next summer. He believes that by that time jobs should have returned to their pre-pandemic levels.

China:

- President Biden is considering a partial boycott of the Winter Olympics in Beijing. It would mean the U.S. would not send government diplomats to the event.

- Chinese stocks dipped on Thursday after e-commerce company Alibaba (BABA, $143.60) warned of a drop in sales due to a projected slowdown in consumer spending in China.

- China has agreed to sell some of its reserves to help offset the rise in natural gas and oil prices. The U.S. is expected to follow suit.

- Prior to the meeting between Xi and Biden, China and the U.S. exchanged good faith offerings. China allowed an American to leave the country, and the U.S. freed seven Chinese nationals. The gestures from both sides provide further evidence of de-escalation. However, countries in the Indo-Pacific are still wary of a thaw in tensions between the U.S. and China.

- Former Secretary of State and Democratic Presidential candidate Hilary Clinton stated the U.S. should cooperate with China on some issues and avoid an aggressive buildup of military forces. Her comments reflect the growing trepidation among the political establishment regarding the ongoing tension between the U.S. and China. We suspect that her views could be a sign that there is a growing rift within the White House as to how to deal with an increasingly assertive China.

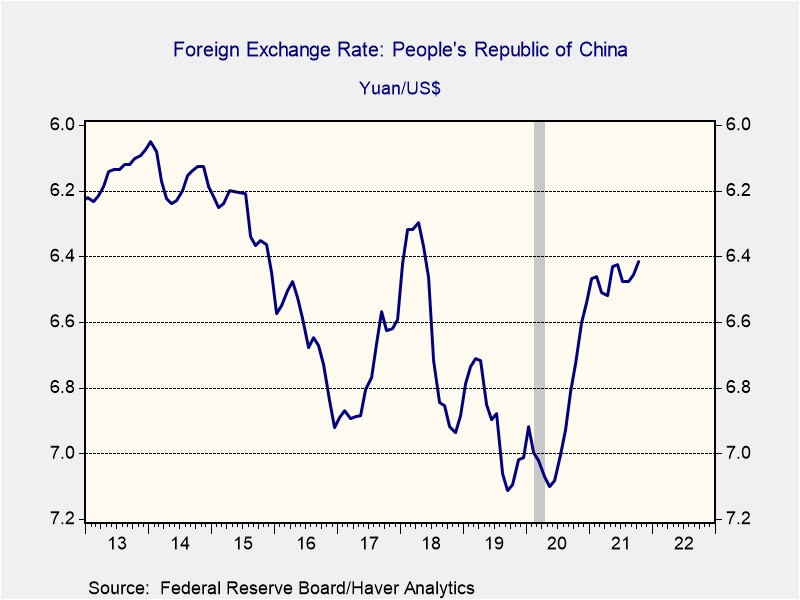

- The People’s Bank of China has warned financial institutions about taking one-sided bets against the yuan. The currency has strengthened significantly versus the dollar since the start of the pandemic and is now approaching a three-year high. If this persists, the currency could make Chinese goods less competitive, and therefore, hurt the country’s exports. In the past, China has directly intervened in currency markets when the yuan has gotten too strong. However, this time around, such intervention could risk the possibility of reigniting trade tensions with the U.S.

International news:

- The Belarusian government has removed immigrants along its border with Poland to the relief of Brussels. Although the crisis is far from over, the move suggests Belarus has backed down in its standoff with the EU.

- Turkey’s central bank has cut rates in the face of rising inflation. The bank said the rise in price levels is due to issues outside of the government’s control. The decision to cut rates led to a sell-off in the Turkish lira, as investors have expressed wariness of the currency’s legitimacy.

- Russia has decided to send some of its diesel to the U.S. Although this is welcome news to President Biden, it may be a slight toward neighboring Europe, which is also struggling to meet its diesel needs.

- The Japanese government approved a $490 billion stimulus package as the country looks to address economic inequality and domestic supply chain issues. The stimulus package accounts for 10% of the country’s GDP and is expected to boost domestic output by 5.6%.

- The U.S. learned that China was developing a military facility at a port in the United Arab Emirates and warned the Emirates government that China’s presence could hinder ties.

COVID-19: The number of reported cases is 256,232,609, with 5,135,360 fatalities. In the U.S., there are 47,532,795 confirmed cases with 768,703 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 561,149,025 doses of the vaccine have been distributed, with 446,250,342 doses injected. The number receiving at least one dose is 228,570,531, the number of second doses is 195,713,107, and the number of the third dose, the highest level of immunity, is 32,469,881. The FT has a page on global vaccine distribution.

- A new study suggests that the first known case of the COVID-19 may have come from a vendor in a Wuhan market.

- India has imposed an export ban on syringes as the country tries to implement its vaccine program to combat the spread of COVID-19.

- The U.S. will look to purchase $5.3 billion worth of COVID-19 pills from Pfizer (PFE, 51.41).

- Austria will enter a national lockdown on Monday, while Germany’s health minister stated he would not rule out a lockdown.