Daily Comment (November 18, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest sign of disagreement among Federal Reserve policymakers on the direction of interest rates. In the latest statement, Fed board member Waller argues for cutting rates again in December. We next review several other international and US developments that could affect the financial markets today, including the first US government economic reports since the end of the shutdown and signs that the new US import tariffs are weighing on economic growth in Asia and Europe.

US Monetary Policy: Fed board member Christopher Waller yesterday said his reading of the available data suggests the central bank should cut its benchmark short-term interest rate at its next policy meeting in December “as a matter of risk management.” According to Waller, his stance was based on a sense that the US labor market is “still weak and near stall speed,” while the US’s new import tariffs have put little upward pressure on consumer prices.

- Despite Waller’s comments, which may be aimed at bolstering his chance of being appointed as the Fed’s next chair, other monetary policymakers continue to call for slower, more cautious rate cuts.

- The conflicting opinions from the Federal Open Market Committee members suggest it is now essentially a coin toss whether the Fed will cut rates again in December. If it doesn’t, the risk is that the recent sell-off in stocks could continue, pushing prices even lower.

- Separately, a lawyer for Fed board member Lisa Cook yesterday provided the first detailed defense of her mortgage applications, which administration officials have claimed are fraudulent and justify her removal. If the report sways the courts, government officials, and the public, it would deny the administration an opportunity to replace Cook with a more dovish policymaker.

US Stock Market: Even though the increased volatility in the US stock market this month has only resulted in a 3.0% decline in the S&P 500 price index, including a 0.9% drop yesterday, there is growing concern about excess investment in artificial intelligence and the Fed’s continued reluctance to cut interest rates quickly. This suggests that investors should consider what technical analysis is saying about the near-term prospects for the market. On that score:

- As of yesterday’s close, the S&P 500 stands at 6,672.41, its lowest level since late October. We would put the next significant support levels at about 6,555 and 6,350.

- Last year at this time, we had projected in our Outlook for 2025 that the S&P 500 would end 2025 between 6,500 and 6,800. We continue to believe that such a range is a reasonable expectation for the index’s level at the end of the year.

- As of yesterday’s close, the index sits just below its 50-day moving average. It remains far above its 200-day moving average of 6,151.63.

- Reflecting today’s narrow market, only 53.8% of the stocks in the S&P 500 are now trading above their 200-day moving average, far below the 70% or so that traders often consider indicative of a market with strong upward momentum.

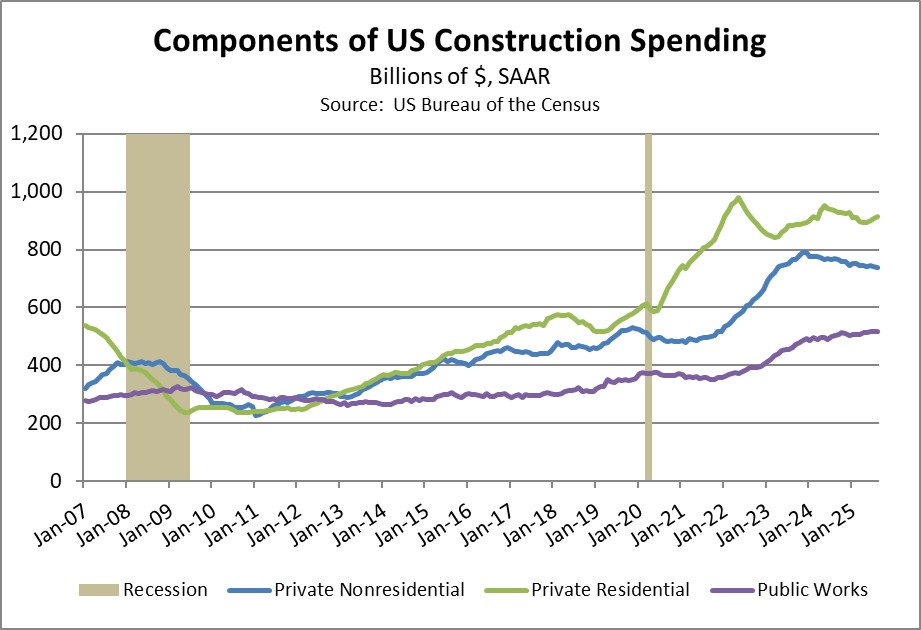

US Economy: The federal government finally began to release major economic data series yesterday, including a report on construction activity that came out after our Comment was published. The catch-up report showed construction spending rose by a seasonally adjusted 0.2% in both July and August, mostly driven by private housing construction. Still, construction spending in August was down 1.6% from the same month one year earlier, mostly on weakness in commercial construction. (Data so far today is in our Economics Releases section below.)

- August construction spending on public works was up 1.8% year-over-year, while spending on private residential construction was down 1.5%. August construction spending on private commercial construction was down a sharp 4.3% on the year.

- The weakness in private commercial construction may seem odd against the backdrop of massive spending on data centers and other artificial-intelligence infrastructure. We think the year-over-year decline in total commercial construction reflects significant weakness in corporate building outside the AI space.

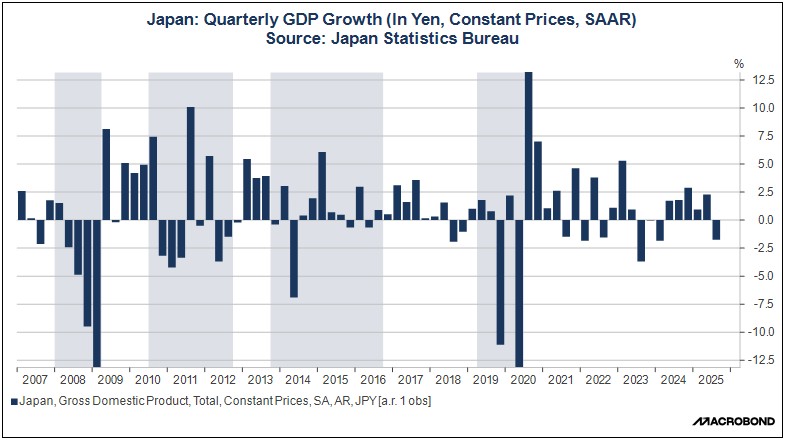

United States-Japan-Switzerland: Data yesterday showed Japanese gross domestic product declined at an annualized rate of 1.8% in the third quarter, reversing most of the growth in the first and second quarters of the year. Separately, Swiss GDP fell at a rate of 0.8% in the same period. In both cases, the main culprit for the declines was reduced exports to the US. The data illustrates how the US’s new, higher import tariffs are dragging on economic growth in key countries, which will likely be a headwind on their companies’ sales, profits, and stock prices.

US Agriculture Market: Soybean futures prices surged 3.2% yesterday on reports that China has finally started ramping up its purchases of US crops as promised in the recent US-China trade truce. According to broker AgResource Co., importers in China have bought seven to 10 cargoes from the US, some for shipping in January and others set for June or later. Beans are trading slightly higher today, with near futures currently trading at 1157.5, a 17-month high.

Japan-China: Bilateral tensions continue to spiral in response to Japanese Prime Minister Takaichi’s recent statement about Japan intervening militarily against a potential Chinese blockade of Taiwan. A meeting between mid-level diplomats yesterday seemingly made no progress, and Japan has been warning its citizens about their safety when traveling in China. We remain concerned that the tensions could lead to Chinese economic sanctions or other punishments against Japan, which could be a negative for Japanese stocks.

European Defense Sector: According to the Financial Times, several small defense contractors across Europe are considering initial public offerings to capitalize on today’s intense investor interest in the sector. The firms include British metal engineer Doncaster Group, Franco-German tank maker KNDS, and Czech defense firm Czechoslovak Group. The new listings would follow a plethora of European defense IPOs since 2024. Given the geopolitical threat from Russia, US policy changes, and the weaker dollar, we remain very optimistic about Europe’s defense stocks.

Ecuador: Official data from Sunday’s referendum show voters overwhelmingly rejected conservative President Noboa’s plan to allow a US military base, re-write the constitution, and cut state funding for political parties. The results may force Noboa to give up on some of his conservative, pro-business program, potentially crimping Ecuador’s economic prospects going forward.

Investment Strategy: CALPERS, the giant public pension fund for California, officially adopted a new strategic asset allocation policy yesterday. Starting July 1, the fund will use a “Total Portfolio Approach” that measures its performance against a single benchmark consisting of 75% global stocks and 25% US Treasurys, rather than individual benchmarks for each of its 11 asset classes. The change will immediately boost the fund’s exposure to stocks and allow greater flexibility in letting exposure to individual asset classes drift from target.