Daily Comment (November 17, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Oil prices fell into bear market territory on Friday due to a jump in U.S. inventories and demand pessimism. In other news, Shohei Ohtani, formerly of the Angels, and the Braves’ Ronald Acuna Jr. were named the most valuable players in their respective leagues. Today’s Comment begins with our thoughts about holiday spending this year. We then discuss why governments are struggling to find ways to fund initiatives, and then detail Argentina’s run-off election to be held Sunday. As always, our report includes a summary of the latest domestic and international data releases.

Holiday Cheers? Major retailers are concerned that Christmas spending may slow this year.

- This week several major retailers reported higher profit margins with tighter inventory but lower revenue. The decline in sales mirrors the impact of rising prices on consumer spending. Walmart’s (WMT, $156.04) report further underscored this trend, indicating a “softening” and “uneven sales” pattern since October. Shares of the company stock plummeted 8% on Wednesday due to the pessimistic outlook. At the same time, Target (TGT, $129.94) indicated that it believes consumers are delaying purchases until the last minute, while Macy’s (M, $13.33) results demonstrated that consumers may be receptive to purchases if prices are reduced.

- Recent economic data provides some clues about how holiday spending might unfold. October retail receipts indicate a significant slowdown in consumer spending compared to its peak in 2021. When adjusted for inflation, the data shows a year-over-year decline of 0.73%. This decline is likely attributed to a confluence of factors, including rising prices and high-interest rates dampening consumer spending. The trend is expected to persist as more households resort to increasingly expensive credit cards to finance purchases. The data indicates that real spending has not yet declined significantly enough to raise major concerns about the economy, but time will tell whether this will hold up over the next few months.

- The upcoming holiday season will serve as a critical test of consumer sentiment and spending patterns. Stronger-than-expected sales would provide reassurance that consumption remains resilient heading into 2024. Conversely, a weaker-than-expected performance would likely raise further concerns about the economy and could lead to more predictions of a downturn. In an effort to boost sales, firms may consider decreasing prices, which could offer a potential double benefit of stronger sales and lower inflation. However, it is important to acknowledge that price reductions may carry the risk of further cooling in the labor market. At this time, we remain optimistic that consumption will continue to be an engine of economic growth.

Fiscal Deficits: Governments are struggling to find a way to meet their spending plans without exacerbating their growing deficits.

- In the absence of a comprehensive spending bill, the Pentagon faces a potential $82 billion budget cut over the next two fiscal years. This mandate stems from a provision embedded in June’s debt limit legislation, which requires all federal departments and agencies to trim their budgets by 1% from 2023 levels for the subsequent two fiscal periods if no funding agreement is reached before the new year. The potential budget cut could hamper Washington’s efforts to bolster its presence and influence in the Indo-Pacific region, where it seeks to counter China’s growing dominance.

- Similarly, Germany’s top court has struck down a plan to fund climate change initiatives using off-budget funds, jeopardizing about 770 billion euros ($837 billion) in spending plans. The ruling, which comes as a blow to the country’s three-party coalition government, means that the government will have to find alternative ways to finance its ambitious climate goals. While the government has vowed to find a solution, there will likely be some bickering among members of the coalition. German Finance Minister Christian Lindner has said that it is possible to fund the budget without using additional debt or raising taxes; however, the climate fund has been frozen in the meantime.

- The pandemic’s burden on government finances, coupled with escalating geopolitical tensions, will necessitate further defense spending while potentially curtailing other initiatives. Climate change initiatives face heightened scrutiny as households hesitate to embrace costly transitions to a low-carbon economy. Governments are unlikely to completely abandon their commitment to climate change mitigation, but they may be forced to postpone some deadlines in the face of budgetary constraints. Defense spending is likely to remain strong as there appears to be a consensus that the world is becoming a more dangerous place. Hence, we do not view the budget tightening as a potential threat to portfolio positions within Aerospace and Defense.

Where Will Argentina Swing? Investors will be closely watching the Argentine elections on Sunday to gauge the political climate in South America.

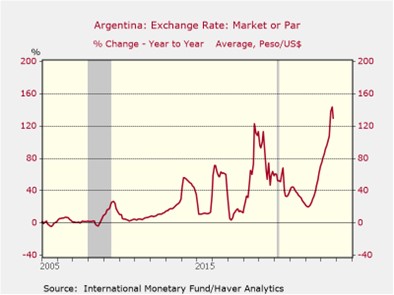

- The two candidates represent opposing ends of the political spectrum, with Javier Milei’s campaign drawing comparisons to former U.S. President Donald Trump and former Brazilian President Jair Bolsonaro due to his skepticism of central banks and his focus on law and order. Conversely, his opponent, Sergio Massa, despite being considered “the least Peronist of the Peronists,” has emphasized his party’s legacy of welfare spending and subsidies and is expected to seek support from radical leftists. The outcome is considered close, but Massa is favored to win given his strong performance in the general election.

- Geopolitical considerations also loom over this election, as China seeks to strengthen ties with Argentina to safeguard its access to the country’s resources. Last month, the People’s Bank of China extended a $6.5 billion currency swap line to Argentina, enabling Buenos Aires to intervene in currency markets and settle imports in yuan (CNY) rather than dollars, which will prevent it from falling into arears with the International Monetary Fund. This move was widely perceived as a political favor for Sergio Massa, the current finance minister, as he seeks to convince voters of his ability to steer the country away from the brink of collapse.

- The outcome of the election will shape the trajectory of a country grappling with persistently high inflation and an ever-growing debt burden. A Massa victory is likely to be favored by markets, as he is expected to pursue more conventional economic policies than his opponent. Conversely, a Milei win could potentially align with U.S. efforts to maintain regional influence, as he has shown that he is less willing to cooperate with China. Although the election may not have major impact on markets, it may provide further signs as to how the world is breaking into geopolitical blocs as the world moves away from globalization and towards regionalization.

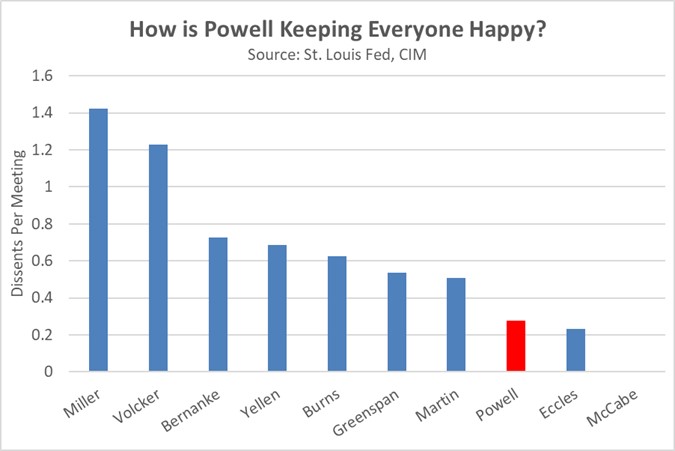

Other News: Iran maintains that it does not want the Israel and Hamas conflict to spread but has warned that it may take action if the assault on Gaza continues. The message is a positive sign that there is a communication between Washington and Tehran, which should reduce the chance of miscalculation. Spanish Prime Minister Pedro Sánchez won another term after securing an amnesty deal with the Catalan separatists. It is unclear how long he will be able to maintain his coalition as there has been public outcry following the appeasement of the separatists. Powell’s firm grip on the Fed is further evidenced by his exceptionally low dissent rate. Our analysis reveals that Powell has had the fewest dissents per meeting of any Fed chair since Thomas B. McCabe.