Daily Comment (November 16, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Gold prices are rising as investors eagerly await the Federal Reserve’s next policy decision, while Gerrit Cole has been named the American League Cy Young Award winner. Today’s Comment delves into the reasons behind the surge in investor risk taking being fueled by optimism over a possible end to interest rate hikes, the potential easing of commodity inflation next year, and Xi Jinping’s softening stance towards certain adversaries. As always, our comprehensive report summarizes the latest domestic and international data releases.

Monetary Inflection Point? Risk appetite has started to pick up as investors are growing confident that monetary tightening is over.

- Recent economic data suggests that central banks are making progress towards their inflation targets. The Bureau of Labor Statistics (BLS) released data earlier this week showing that producer prices (PPI) rose 1.4% since October 2022, while consumer prices (CPI) increased 3.2% in the same period. This trend is also evident in other countries, with the eurozone and the U.K. both making headway toward achieving their respective 2% inflation targets. While policymakers have not ruled out further rate hikes, fed funds futures contracts indicate a 97.3% probability that the central bank will hold rates steady at its next meeting and an 81% likelihood of a rate cut by June 2024.

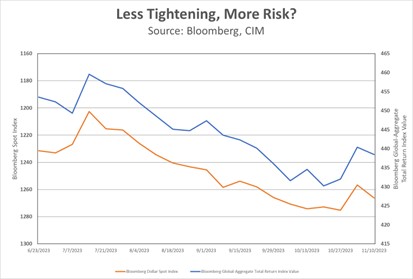

- Expectations of a Fed pivot have led investors to diversify away from safe assets. The Bloomberg indexes for global bond and dollar performances have also reflected the recent shift in risk sentiment. The investment-grade debt index from a multitude of countries has surged 3.1% in the past two weeks, recouping half of the losses it had incurred since mid-July. This impressive rally aligns with the Bloomberg Dollar Index, which indicates a similar resurgence of global currencies against the greenback within the same period. While this market response to economic data is encouraging, some investors remain cautious, recognizing that underlying uncertainties may reverse the present trend.

- In the near term, this shift might provide some respite for investors who have endured losses in riskier assets earlier this year. Notably, the weakening U.S. dollar should uplift emerging market equities. However, the sustainability of this trend remains uncertain. Much of the performance of the dollar and risk assets has been driven by expectations of central banks halting their tightening cycle, which may or may not materialize. Nevertheless, investors should also be mindful that as monetary policy concerns recede, attention may shift back to GDP growth, which could favor U.S.-denominated assets due to the country’s robust economic outlook.

Commodity Price Pressures: Increased supply and weakening demand are expected to put downward pressure on food and other commodity prices going into 2024.

- Global food prices are expected to fall next year, according to agribusiness lender Rabobank’s annual outlook. A key factor driving this downward trend is the surge in production resulting from firms seeking to capitalize on higher prices. Prices for sugar, coffee, corn, and soybeans are all expected to be impacted by the projected increase in supply. Conversely, China’s anticipated growth in copper output is likely to keep metal prices below 2022 levels in 2024. S&P Global Market Intelligence expects the London Metal Exchange’s three-month price per metric ton to hit $8602 in 2024, below its $8784 from two years prior and roughly in line with this year’s estimated price of $8596. However, copper prices are expected to spike in 2025 and onwards.

- On the demand side, there are also indications that commodity prices may face resistance. Rabobank forecasts that slower economic growth due to higher interest rates and elevated prices could dampen demand. Several major economies are already teetering on the brink of recession. The German economy is projected to contract by 0.3% in 2023. Meanwhile, China’s economic woes are expected to persist into the following year. The lack of growth across the globe could make it more challenging for commodities to sustain their current price levels.

- The moderation in commodity prices offers a glimmer of hope amidst the looming threat of a global economic downturn. The anticipated easing of food inflation should provide a much-needed boost for emerging markets, where high food prices have historically been linked to social unrest. Moreover, the relaxation of commodity pressures is likely to contribute to global efforts to curb inflation. If these supply and demand dynamics persist, the improvement in commodity prices could facilitate economic growth for non-commodity producers, even in the face of a potential recession.

Xi’s Delicate Dance: The Chinese president faces difficulties in fostering cordial relations with his Indo-Pacific rivals.

- President Biden’s seemingly impromptu remark calling Xi Jinping a “dictator” during a post-meeting Q&A session likely altered the tone of their discussions. Prior to this comment, the two leaders had reportedly engaged in productive talks, agreeing to collaborate on combating fentanyl trafficking and reestablishing military communication channels. Following his meeting with Biden, Xi is expected to meet with Japanese Prime Minister Fumio Kishida on Thursday. The two will likely discuss the recent detaining of well-known Japanese businessman Hiroshi Nishiyama on suspicion of espionage. His imprisonment has raised concerns about China’s recent crackdowns on foreign workers.

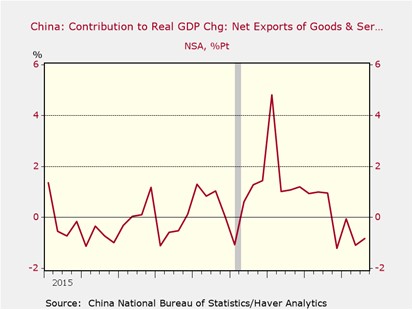

- Xi Jinping’s recent efforts to cultivate stronger ties with the international community underscore his determination to revitalize China’s economy, which has encountered hurdles following its stringent pandemic lockdowns. While investment spending has traditionally been a cornerstone of China’s growth, its aversion to accumulating debt necessitates a diversification of growth strategies. Trade emerges as an appealing option as it would allow the country to preserve its manufacturing base while alleviating deflationary concerns. In October, headline CPI dipped 0.1% year-over-year, while core CPI increased by 0.7%. A possible reset in relations with China and its rivals may help lead to an increase in its net exports which have been a drag on growth.

- Xi’s recent overture should not be misinterpreted as a change of heart. He has offered no indication that he is prepared to retract his willingness to decouple from the U.S. or remove his country’s backing of Russia. Therefore, the thaw in intentions is likely a tacit acknowledgment that he does not desire an abrupt end to relations with the world’s largest economy. However, this does imply that he may be more focused on addressing domestic challenges rather than settling historical scores such as the reunification of Taiwan, suggesting that the risk of conflict between the two largest economies may be diminishing.

Other News: West Virginia Senator Joe Manchin announced that he is contemplating a presidential bid. His inclusion adds another layer of complexity to an already crowded field, further clouding the outlook for the 2024 election. The GM-UAW contract is expected to be approved, thus reducing the chance of another strike. The Senate approved the stopgap spending bill to keep the government funded into 2024. This sets up another fight in two months but should calm nerves about disruption to governmental operations.