Daily Comment (November 14, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new data suggesting Russia is now almost completely getting around the West’s $60 price cap on its oil exports, potentially setting up new Western efforts to clamp down. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a slowdown in British wage growth that could help ease consumer price inflation in the U.K. and the latest on efforts in the U.S. Congress to avoid a partial shutdown of the federal government, which could begin this weekend.

Global Oil Supplies: New analysis shows virtually all of Russia’s seaborne oil exports are now selling for more than the $60-per-barrel cap that Western nations have tried to enforce as a way to limit Russian revenues for its invasion of Ukraine. The Group of Seven countries and Australia had some initial success when they tried to enforce the cap by banning insurance and other services for shipments priced above $60 per barrel, but now it appears the Russians have learned to circumvent the ban with tactics such as buying up and using old tankers without Western insurance and falsifying price certifications.

- It should be no surprise that the $60 cap has been circumvented. From time immemorial, government efforts to control trade have been undermined by smugglers and sanctions busters.

- Nevertheless, the West’s restrictions on trade have probably imposed additional costs on Russian oil exports. Even if the oil is sold at prices above $60, the profitability of that oil and the revenues it provides to the Kremlin have probably been reduced.

- In any case, the wide circumvention of the ban has prompted Western officials to start discussing ways to tighten the cap. If such tightening happens, it could potentially reduce global oil supplies and help buoy energy prices.

China-Taiwan: The Central Election Commission of Taiwan has certified the independent candidacy of Terry Gou, the founder of Foxconn (HNHPF, $5.93), for the presidential election coming up on January 13. Although Gou is currently trailing the three main candidates in opinion polls, Beijing is concerned that he will drain support from its preferred candidate, the Kuomintang Party’s Hou Yu-ih.

- The Chinese government has recently opened a large-scale investigation into Foxconn’s tax and land-use practices in China, in a move that has been widely interpreted as an effort to pressure Gou to drop out of the race. Company officials say they are bracing for additional such measures from China.

- Foxconn is best known as a supplier to Apple (AAPL, $184.80), and it is the key assembler of the company’s flagship iPhone. Additional Chinese pressure on Foxconn to force Gou out of the Taiwanese race could therefore potentially have an impact on Apple.

United States-Asia-China: After launching its Indo-Pacific Economic Forum last year to promote trade between the U.S. and the rest of the region and to loosen countries’ economic ties to China, the Biden administration has unexpectedly withdrawn its support for IPEF measures designed to ease cross-border data flows and coordinate labor standards. The retreat on free data flows apparently stemmed from administration efforts to tighten regulations over U.S. technology firms, while the retreat from labor standards came at the request of at least one U.S. lawmaker facing a tough election.

- Because of domestic political opposition, the U.S. is currently precluded from offering traditional tariff cuts and reduced import barriers to tease Indo-Pacific countries away from China’s economic pull. The administration, therefore, hoped that IPEF’s non-tariff measures would be attractive enough.

- Without the promise of free data flows and common labor standards, the IPEF deal will lean heavily on less attractive features, such as initiatives related to supply chains, clean energy, anti-corruption measures, and taxation.

- Perhaps most significant, the pullback from free data flows suggests the U.S. may soon adopt Chinese-style restrictions on data transfers. If so, it’s a sign that the fracturing of the world into relatively separate geopolitical and economic blocs, which we’ve been writing about so much, will disrupt not only trade, capital, and technology flows between the U.S. bloc and the China/Russia bloc, but it will also disrupt data flows.

United States-China Travel: New research by the Institute for International Education shows the number of U.S. citizens studying in China fell from more than 11,000 in the 2018-2019 academic year to just 211 in 2021-2022. The figures suggest many U.S. students have been put off by the Chinese government’s draconian pandemic shutdowns and aggressive law enforcement actions. Although the number of Chinese students in the U.S. remains about 290,000, the study illustrates how global fracturing is disrupting human travel and migration, just as it’s disrupting inter-bloc trade, capital, technology, and data flows.

United States-China Summit: When President Biden and General Secretary Xi meet tomorrow at the Asia-Pacific Economic Cooperation summit in San Francisco, they will reportedly announce a deal under which China will clamp down on companies exporting the precursor chemicals for fentanyl, the synthetic opioid that has spread addiction and death throughout the U.S. They are also expected to announce a deal to reopen military communication channels that Beijing shut after then-U.S. House Speaker Pelosi visited Taiwan in August 2022.

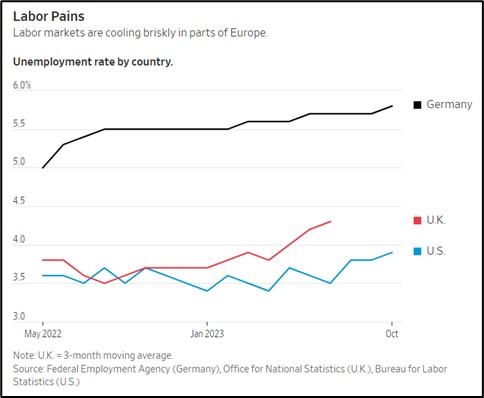

European Union: Recent data indicates the EU’s labor market is softening much more dramatically than the U.S.’s, especially in the industrial powerhouse of Germany and other northern countries. Much of the problem can be traced to weakening demand overseas and high energy costs. Higher unemployment will likely impose new fiscal burdens on EU governments but could also weaken inflation pressures, discourage further interest-rate hikes, and hold down the value of the euro.

United Kingdom: Average wages in July through September, excluding bonuses, were up 7.7% from the same period one year earlier, marking a modest deceleration from the year-over-year increase of 7.9% in May through July. Total pay was up 7.9% on the year, versus 8.5% in the prior period. The figures point to a modest cooling in wage pressures, which could help bring down consumer price inflation in the U.K. and allow the Bank of England to hold off on further interest-rate hikes.

U.S. Fiscal Policy: In the House of Representatives, at least half a dozen Republican lawmakers have come out against Speaker Johnson’s proposed two-part stopgap funding bill, which aims to avoid a partial government shutdown when the current stopgap expires on Friday. Since the Republicans only control 221 seats in the chamber, while the Democrats have 213, the defections from Johnson’s own party mean his measure would likely need the support of at least some Democrats to advance the bill to the Senate, where its prospects seem better. At this point, prospects for a partial government shutdown this weekend appear to be too close to call.

U.S. Labor Market: Industry groups say the demand for seasonal workers during the upcoming holidays will be much cooler than in recent years, with public advertisements for such workers at the lowest level in a decade and hiring intentions down about 40% from their recent high in 2021. Individual companies are also reporting relatively modest hiring plans. Weaker demand for seasonal workers suggests the overall labor market is softening, which is likely to contribute to slower wage growth and weaker economic growth.