Daily Comment (November 13, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with the latest on the West’s slowing demand for electric vehicles. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an easing of data regulations in China and a proposal by House Speaker Johnson for a two-step stopgap funding bill to keep the federal government functioning after the current stopgap expires on Friday.

Global Electric Vehicle Industry: As incoming data continues to point to a slowdown in the West’s demand for electric vehicles, new research by HSBC (HSBC, $37.03) indicates dealers in key markets now have to offer discounts from the vehicles’ suggested retail price. For example, the average discount in October was 11% in the U.K., 10% in the U.S., and 7% in Germany.

- The slowdown in demand reflects a range of factors, from the high price for EVs, rising interest rates, concerns about recharging and safety, and political attacks.

- If it continues, the slowdown threatens to undermine what has been seen by some as a promising new investment sector and a source of new economic growth.

- Nevertheless, at least some companies are continuing to invest in the sector. In news this morning, oil giant Exxon (XOM, $103.75) announced it is starting to drill for lithium in Arkansas and aims to become a major U.S. supplier for makers of EV batteries by 2030.

United States-China: When President Biden and General Secretary Xi meet on Wednesday at the Asia-Pacific Economic Cooperation summit in San Francisco, they will reportedly announce an agreement not to incorporate artificial intelligence into autonomous weapons, such as drones, or into the command and control of nuclear weapons. We haven’t seen any details on the deal, but if it is substantive, it would suggest that U.S. and Chinese diplomats have been able to make more progress on cooling bilateral tensions than earlier expected.

- On the other hand, any ban on military AI announced at the meeting could be much less than meets the eye. One big hurdle to such a ban is that verification might be difficult. If neither side can verify with confidence that the other side isn’t deploying military AI, the deal could have little practical effect.

- Moreover, it is questionable whether Beijing would countenance or abide by such restrictions. Chinese military doctrine and official statements make clear that the People’s Liberation Army not only intends to bulk up to the point where it can compete with the U.S., but also intends to fully leverage AI and other technologies to bolster its warfighting capabilities.

China: Information provider Qichacha announced that the Cyberspace Administration of China has approved its data export security plan, which will allow the company to offer databases of Chinese corporate information in other countries. The approval of Qichacha’s plan is a sign that Beijing may be easing its recent draconian limits on providing Chinese information to foreigners.

- Coupled with a range of other government intrusions into business operations, the data export limits have helped sour foreign businesses on China, likely contributing to the recent sharp drop in foreign direct investment into China.

- Easing up on the data export rules and other regulations may be an effort by Beijing to reattract foreign capital and reverse China’s ongoing slowdown in economic growth.

Spain: Over the weekend, tens of thousands of protestors marched in cities across the country to register their anger at Prime Minister Sánchez’s gambit to win parliamentary support for his Socialist Party government by offering amnesty to Catalan separatists. The move has sparked especially strong condemnation by right-wing populists, who accuse the prime minister of allowing the Catalan separatists, who held an illegal referendum on independence in 2017, to achieve a “coup.” The political crisis could potentially weigh on Spanish assets despite the country’s relatively good economic performance recently.

United Kingdom: Prime Minister Sunak today replaced Home Secretary Suella Braverman, a controversial right-wing firebrand, with Foreign Secretary James Cleverly. He also named former Prime Minister David Cameron, a moderate who campaigned against Brexit and resigned when the measure passed in 2016, to take over the foreign ministry.

- The moves apparently aim to drag the Conservative Party back toward the political center and close its massive polling gap with the Labor Party ahead of the next election.

- Nevertheless, they could spark increased chaos in the Conservative Party, as Braverman now seems likely to launch a bid to replace Sunak as prime minister.

Israel-Hamas Conflict: Illustrating many of issues involved in the fighting, the Israel Defense Forces are focusing much of their invasion force on Gaza’s Al-Shifa hospital to destroy what they say is a Hamas command post located in the facility and in tunnels underneath it. The IDF has demanded that Hamas abandon the hospital, but the militants have refused. Meanwhile, the hospital has virtually run out of fuel, electricity, food, and medical supplies.

- The IDF claims it delivered supplies to a location about 1,000 feet from the hospital, but they were not retrieved. Hospital officials say the fighting has been too intense to collect the supplies, but it isn’t clear whether Hamas actually prevented them from doing so.

- Separately, a key foreign policy advisor to the president of the United Arab Emirates warned that Israel’s “unparalleled” and “disproportionate” attacks on civilians threaten to spark increased radicalization in the region.

- Indeed, Iran-backed Hezbollah fighters and other Islamist groups continue to attack Israel from the north, keeping alive the risk that the conflict will spread regionally.

U.S. Military: The Air Force’s future heavy bomber, the B-21 “Raider,” made its first test flight on Friday, about two years later than initially planned. The sixth-generation bomber, with its flying-wing design and advanced capability to network with other platforms, is designed to replace the aging B-1 and B-2 starting later this decade. Its mission will be to deliver either strategic-nuclear or conventional weapons around the world to deter U.S. adversaries such as China, Russia, Iran, and the rest of Beijing’s geopolitical bloc.

- The Air Force currently plans to buy at least 100 units of the B-21, at a projected cost of about $750 million each.

- The Defense Department continues struggling to ramp up the output of weapons, ammunition, and supplies as geopolitical tensions rise, but the launch of the B-21 is a reminder that it is making some progress. Other ongoing programs to modernize the U.S. strategic deterrent force include replacing the Air Force’s Minuteman III intercontinental ballistic missile with a new “Sentinel” missile and replacing the Navy’s Ohio-class ballistic missile submarines with new “Columbia-class” subs.

U.S. Fiscal Policy: As Congress continues to bicker over fiscal policy ahead of this Friday’s expiration of the current stopgap spending authorization, Moody’s (MCO, $344.57) at the end of last week cut its outlook on U.S. Treasury debt from “stable” to “negative.” Moody’s remains the last of the major credit-scoring firms to give the Treasury its top debt rating, but it warned that the outlook is worsening because of political polarization, expanding federal budget deficits, and worsening debt sustainability.

- With federal spending rising rapidly while tax revenues wither, the widening budget shortfall was probably a contributing factor to the run-up in longer-maturity bond yields over the last couple of months.

- With the current stopgap funding bill set to expire on Friday, newly installed Speaker of the House Mike Johnson has proposed a “laddered” new stopgap measure that would keep the government funded at current levels until early 2024. Under the proposal, some departments would be funded at their current levels until late January, while others would be funded at their current levels until early February.

- The new continuing resolutions would give lawmakers more time to come up with a deal on funding for the rest of the fiscal year, which runs to September 30.

- A vote on Johnson’s proposal could come as early as Tuesday.

U.S. Labor Market: New analysis by the Federal Reserve Bank of Atlanta shows lower-skilled workers are now seeing much more moderate wage growth than in the first two years of the post-pandemic period. For example, average hourly earnings for workers in the bottom quartile of the wage distribution were up just 5.9% in the year to October, versus a 7.2% rise in the year to January.

- The end of out-sized wage gains for lower-skilled workers suggests the economy is continuing to normalize from the pandemic era’s disruptions.

- Nevertheless, their exceptionally large previous wage gains mean that those workers are now capturing a larger share of total wage income, potentially reducing wage inequality and allowing them to consume more in the coming years.

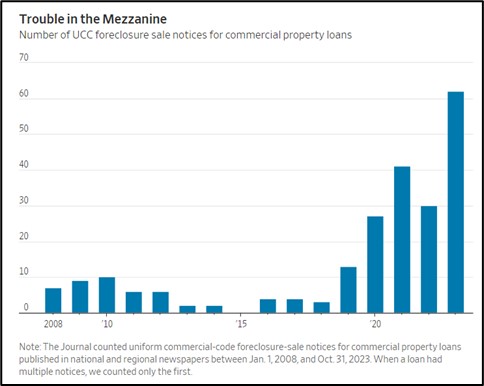

U.S. Commercial Real Estate Market: New analysis by the Wall Street Journal shows that lenders this year have issued a record number of foreclosure notices on mezzanine loans and similarly risky loans connected with commercial properties. Mezzanine loans, similar to second mortgages, can be foreclosed much more quickly than first mortgages, so the rapidly rising number of foreclosures provides a more real-time view into the financial stresses caused by rising vacancies and higher interest rates. As the Federal Reserve raises interest rates or keeps them higher for longer, the commercial real estate and/or private debt sectors are probably the most likely domestic source of financial crisis or a recession.