Daily Comment (November 11, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Happy Veterans Day! Today’s Comment begins with our view on the market’s reaction to the positive CPI report. Next, we discuss how a moderation in Fed policy could impact the dollar. The report ends with a review of recent developments that may impact commodity markets.

CPI Day: A deceleration in inflation has bolstered investor confidence that the Fed will end its tightening cycle.

- Markets rejoiced Thursday after the latest consumer price index report showed that inflation slowed more than expected in October. Last month, headline CPI rose 7.7% from the previous year, well below the September rise of 8.2%. Meanwhile, core CPI, which excludes food and energy prices, rose 6.3% from October 2021, down from 6.6% in the previous month’s report. The sharp decline in inflation was driven by a deceleration in energy and used car prices. The reaction from investors is likely the result of speculation that the Fed may pivot soon.

- The upbeat report helped boost equities and bond prices but weighed heavily on the dollar. On Thursday, the S&P 500 had its best performance in over two years as the index rose 5.5% from the previous day. Meanwhile, the yield on the 10-year Treasury, which is inversely correlated to bond prices, fell 28 bps to 3.86%. Hence, the robust market response from the inflation data suggests that there is still much optimism that the Fed will not raise rates much higher than their current levels. The latest CME Fedwatch tool shows that the market has priced in an 85.4% chance the Fed will raise rates by 25 bps in its next meeting.

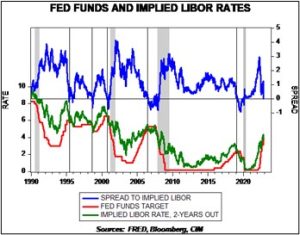

- We have our doubts about a possible Fed pivot. The chart below shows the implied three-month LIBOR rate using two-year Eurodollar futures and compares it to the Fed Funds target rate. The blue line shows the spread between the two rates, and the black line shows where the Federal Reserve ended its tightening cycle. Assuming this trend holds, the latest spread numbers suggest that the Fed may stop hiking in early 2023. That said, this time may be different. The Fed has habitually disciplined markets whenever investors doubted the central bank’s commitment to fighting inflation.

Dollar’s Descent: As the Fed starts to ease off the accelerator, other central banks are looking to press on.

- Fed officials welcomed the positive inflation news but insisted that the central bank is not finished tightening. Philadelphia Fed President Patrick Harker signaled that in light of the CPI data, the Fed could raise rates by 50 bps. His colleagues Dallas Fed President Lorie Logan and San Francisco Fed President Mary Daly, mirrored his sentiment. The insistence by Fed officials that they will continue to raise rates is another example of the Fed’s relentless effort to reinforce its inflation fighting credential. As a result, the rally in equities may be short-lived as investors realize that financial conditions will likely get tighter going into 2023.

- Moderation in the Fed tightening cycle could allow other central banks to catch up. On Thursday, several European Central Bank officials stressed that interest rates must rise much further to control inflation. Meanwhile, the Bank of England announced that it was prepared to offload some of the bonds it purchased during its emergency action. Even the Bank of Japan has discussed the possibility of normalization! The move to tighten monetary policy in other parts of the world will put downward pressure on the dollar but also threatens global growth. As a result, the U.S. may be an attractive target for investment going into 2023.

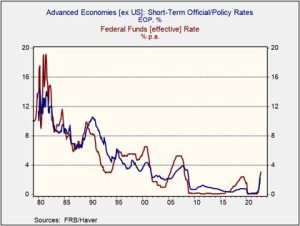

- The strong CPI report may not be enough to sway the Fed to stop tightening, but it could threaten the greenback. There are two reasons that support a possible peak in the U.S dollar. 1) Inflation in Europe and the U.K. has yet to hit its peak, suggesting more tightening is needed. 2) Advanced economies have typically maintained a relatively tight place when the Fed has started cutting. That said, a global recession or a geopolitical conflict, such as a nuclear attack on Ukraine or an invasion of Taiwan by China, could trigger a flight-to-safety response from investors, pushing the dollar up even further. As a result, the currency’s continued decline is far from certain.

- Several European economies are showing signs of an impending recession. On Friday, economic reports showed that Spain, Germany, and the U.K. are in dangerous territory.

Commodity Challenges: Despite the warmer-than-expected winter so far, there is still a risk that commodity prices could begin to surge.

- The reopening of the Chinese economy could bolster demand for commodities. On Friday, Beijing eased some pandemic restrictions. Temporary bans on routes from countries with COVID outbreaks have been lifted, while regulators narrowed quarantine and mass testing requirements. Although China has not formally ended its controversial Zero-COVID policy, the recent measures suggest it is heading in that direction. As a result, crude oil prices jumped 3.3% so far today, as there are now expectations that demand will rise. We estimate that the price of Brent Crude could easily surpass $100 a barrel once China fully opens its economy.

- Meanwhile, Germans are reluctant to supply non-allied countries with their natural gas. On Friday, Germany sent diplomats to India to resolve a dispute over a cut in supplies. Their decision to reduce exports to India may be related to New Delhi’s continuing trade ties with Russia. Although India has not formally taken a side in the Russia-Ukraine war, its indifference on the matter could lead it to be shunned by western countries. That said, Germany’s hesitancy to sell its LNG to India will likely reduce its chance of facing an energy crunch later in the winter.

- Despite the Russian retreat in Kherson, the war in Ukraine is far from over. On Friday, the Kremlin announced that its soldiers had left the city. Although this may sound like good news, residents have stated that Russians remain in the country dressed in civilian clothing. The ongoing war in Ukraine remains the biggest threat to commodities. There is hope that Russia and Ukraine will come to terms on a new peace agreement; however, it does not appear that either side is ready to make steep concessions to get a deal done. The U.S. is rumored to be working on a way to get the two sides together, and if they are successful, we could see a drop in commodity prices.