Daily Comment (November 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning; it’s Veterans Day. A sincere thanks to all who served. It’s also Single’s Day, but the Chinese celebration is lower key this year under conditions of shared prosperity. Risk markets are higher this morning, with gold continuing to rally. Our comments begin with a brief discussion on inflation. Concerns about rising prices are escalating and may force the Fed’s hand to raise rates sooner than it projected. In China news, there is some evidence of cooperation between the U.S. and China and growing optimism that regulators will ease back on property restrictions. The international roundup is next, with the situation on the Poland/Belarus frontier in the news. Economics and policy follow, and we close with the pandemic overview.

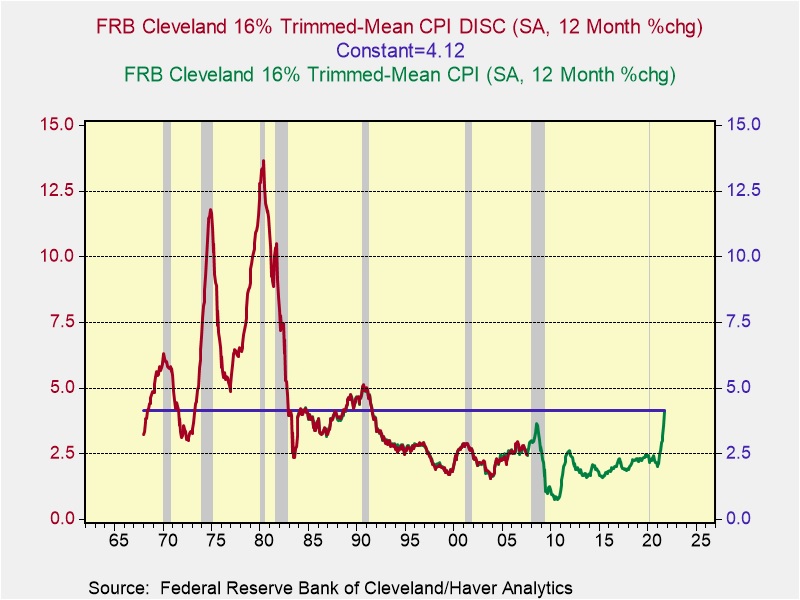

On inflation: We have waited for the regional FRB to update their various calculations attempting to determine the underlying trend in inflation before commenting on this issue. Here is a chart worth mentioning. The Cleveland FRB’s trimmed mean[1] yearly CPI is up to levels last seen in 1991. This measure is up 214 bps since January.

It’s hard to argue that the inflation readings are being distorted by one-off price increases in a small subset of goods.

The key concern is what policymakers will do about it. Although there are concerns that the current fiscal programs will simply add to inflation pressures, that’s probably not true. Most of the spending won’t occur for a couple of years. The fiscal problem was the last pandemic package, and that one can only be reversed with tax increases. The Fed can raise rates to try to slow down demand, but it would need to raise rates aggressively to have an impact. Given leverage in the economy, such actions will more likely destabilize the financial markets and may not have much impact on spending. At the same time, if policymakers show a lack of concern about inflation, that in itself could become destabilizing. The problem we face is excess demand relative to supply. The latter is constrained and won’t get better by policy actions, only with time.

Although it doesn’t seem like it now, one concern for next year is that there will be a strong fiscal drag as fiscal spending slows. It’s important to remember that GDP is a flow measure. Even with the current spending proposals, we won’t repeat this year’s fiscal largess, so government spending will lower growth next year. If policymakers aren’t careful, they could overcorrect and run the risk of inadvertently triggering a recession. The fact that firms and households are trying to restock could exacerbate this issue but lead to an event we really haven’t seen since the 1950s—an excess inventory recession. We suspect the current budget proposals are in serious trouble. The political ramifications will be worth watching.

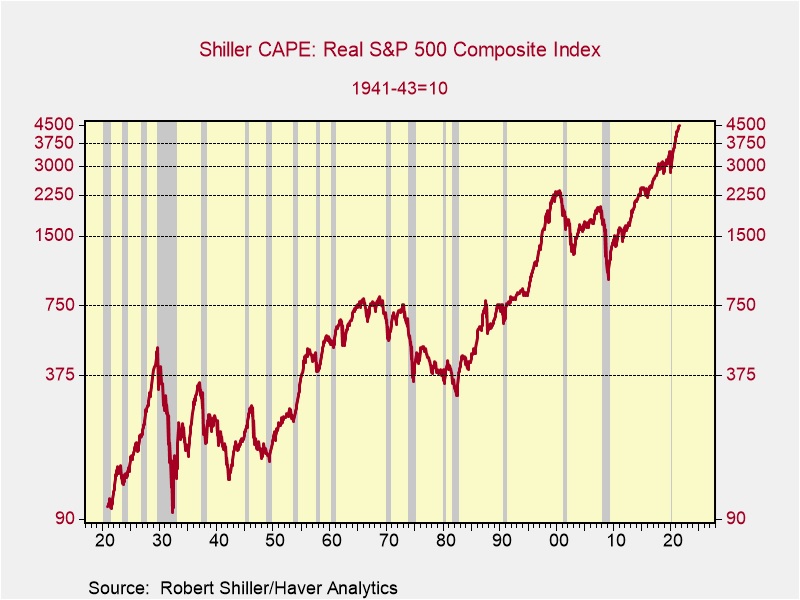

At the same time, it’s important to note that equity gains are outpacing inflation.

Even with rapidly rising inflation, the S&P is rising faster. As long as equities do better than inflation, flows into stocks will probably continue.

China news: The Sixth Plenum has wrapped up. It will be several weeks before we know for sure what happened, but we suspect it’s another term in office for Xi and an elevation to the level of Deng and Mao.

- In the runup to a virtual summit between Presidents Xi and Biden, the Chinese leader is indicating he is ready to “properly manage differences.”

- In this vein, we are seeing unexpected cooperation on climate issues. The U.S. and China issued a joint declaration on climate change action. Earlier this year, Chinese officials refused to separate climate issues and other foreign policy aims, so this announcement is a surprise. Of course, promises are one thing but doing is another.

- Yet, differences remain. China opposes U.S. moves to build encircling relationships with other Asian nations. It comes as the EU is increasing ties to Taiwan, further isolating Beijing. A long interview with SoS Blinken sheds some light on how the U.S. is trying to manage the relationship with China.

- Four senators and two representatives, all from the GOP, made a trip to Taiwan this week. China was not happy with the visit. In response, China held combat readiness patrols.

- One key unknown with China is whether policymakers will maintain their crackdown on excessive lending, especially in the real estate sector, or if they will relent and ease restrictions. There is some evidence that an easing is underway. For example, Chinese real estate firms are being allowed to issue interbank debt. Residential real estate represents between 25% to 35% of China’s economic activity, so staying the course will almost certainly lead to slower growth. There is a long history of Chinese regulators easing restrictions when growth declines. At this point, we don’t know if what is happening now is a regime change or simply another cycle. If it is a cycle, we may be close to the bottom of it, and lending will resume. But, at some point, China will have to deal with its debt issues, and they won’t get better over time.

- There is some dispute as to whether or not Evergrande (EGRNF, USD, 0.30) has defaulted. The company claims it made a last-minute payment, staving off official default. However, a German firm claims it is preparing bankruptcy proceedings against the company. There is a growing consensus that Chinese authorities are planning a slow dissolution of the company. Such dissolutions are common with bank-centric financial systems. Commercial banks in the U.S. used to have standing “work out” groups that would be assigned a non-performing loan; these groups would slowly resolve the non-payment. In a bond-centric system, such slow workouts are usually not tolerated, or they are done (at least in the U.S.) in a Chapter 11 setting.

- Evergrande isn’t the only real estate firm in trouble. Fantasia (1777, HKD, 0.35) is also in default.

- One of the more curious developments is the expansion of Chinese citizens buying “real estate” in the metaverse. At least there aren’t supply constraints.

- China is borrowing in EUR to take advantage of negative rates. By doing so, it will need to acquire EUR to service these loans (at least pay back principal), which means it will need to run a trade surplus with the union.

- One of the monumental failures of U.S. intelligence was the 2017 capture and purge of intelligence assets in China. The disruption means the U.S. lacks insight into what is happening in China’s inner circles.

- A promotional film from the PLA hints at a new stealth aircraft.[2]

- The U.S. has extended Trump-era restrictions on U.S. investments in Chinese military-linked firms.

International roundup: The Poland/Belarus border is a hot zone.

- Using refugees as a weapon has become something of a tool for regimes trying to affect EU policy. The EU struggles with refugees; an influx of foreigners is a political nightmare for policymakers, so they are phobic about uncontrolled border crossings. Turkey has used this tool to gain funds from the EU. Now, Belarus is using it in an attempt to gain sanctions relief. So far, Belarus’s actions are bringing more sanctions, not less, but it remains to be seen if that trend will continue. The EU is backing Poland’s defense of the border, which puts refugees in a difficult position. They are being caught between the two states and have nowhere to go. The problem has now escalated to the attention of the U.S. and Russia. There are increasing worries that the situation could destabilize into a military conflict.

- The U. K. is clearly worried that the EU will retaliate over the trade dispute in Northern Ireland. Ireland is preparing for border issues.

- Sweden is likely to have its first female PM.

Economics and policy: The EU hits tech.

- The EU has won an appeal over a €2.4 billion anti-competitive shopping case against Google (GOOG, USD, 2932.52). More actions are likely.

- Perhaps the biggest monetary policy question at present is when will the first rate hike occur. The deferred Eurodollar futures market is putting the two rate hikes over the next two years. Chair Powell indicated that he wants an “inclusive” recovery, which would imply high levels of employment for minorities, women, and lower-income groups. If this position remains in place, it will likely mean that rate hikes will be slower than the market expects.

- The CBO will not be providing a cost estimate for the budget in short order. That means a vote on the current spending plan won’t be happening anytime soon. Business groups, who tended to support the infrastructure package, are much less interested in the budget proposals.

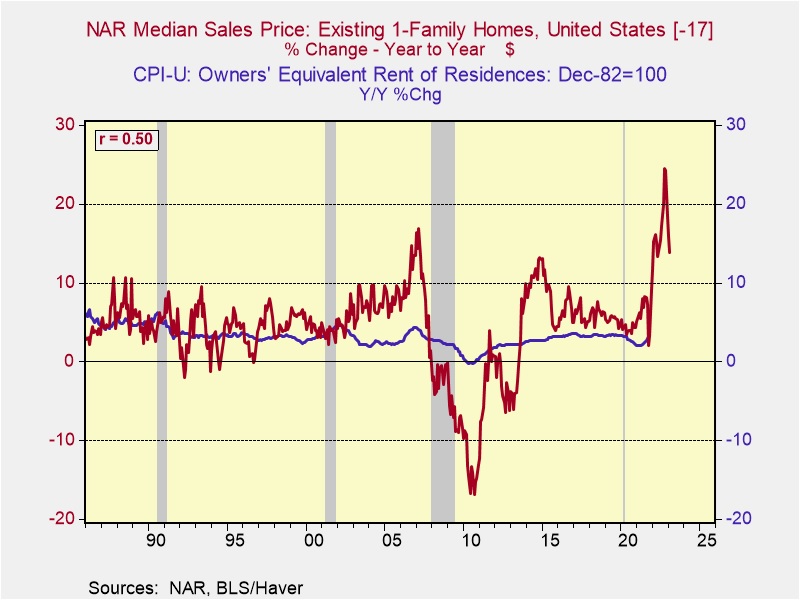

- Home prices are continuing to rise. Although home prices are not directly part of the CPI, they do, over time, affect owners’ equivalent rent.

In general, owners’ equivalent rents tend to lag home prices by about 18 months, meaning that the current increases will be affecting CPI for the foreseeable future. Owners’ equivalent rent has a large weighting in the CPI, at 23.5%.

- One unpleasant side effect is that buyers are being forced to waive inspection or mortgage protections to make a purchase.

- Even Santa is demanding higher wages these days.

COVID-19: The number of reported cases is 251,605,914, with 5,076,073 fatalities. In the U.S., there are 46,792,138 confirmed cases with 759,062 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 541,361,525 doses of the vaccine have been distributed, with 434,486,889 doses injected. The number receiving at least one dose is 224,660,6453, while the number receiving second doses, which would grant the highest level of immunity, is 194,382,921[3]. For the population older than 18, 70.3% of the population has been vaccinated. The FT has a page on global vaccine distribution. The Axios map shows rising cases in the west and the upper tier of states, and falling cases in the South. It is likely due to the change in seasons.

- The Chinese city of Shenyang requires foreign visitors to spend their first 28 days in hotel quarantine and then have their movements restricted for an additional 28 days. This is an extreme example of China’s zero COVID-19 policy.

- Although not directly related to COVID-19, avian influenza has been confirmed in northeastern Japan, leading to a culling of 143,000 birds. So far, there is no evidence that this particular strain of the virus infects humans.

[1] A trimmed mean removes a certain percentage of extreme measures on both the right and left sides of the distribution, reducing the potential distortion of these extreme measures. The process is designed to create a better view of the underlying trend.

[2] See 0:30.

[3] The data likely looks similar to yesterday’s reporting. The CDC didn’t update due to Veterans Day.