Daily Comment (November 8, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning and happy Monday! It’s lighter in the morning but will be darker earlier. Risk markets are modestly higher this morning. Tesla (TSLA, USD, 1222.09) is making news (and might be lowering the major indices) after Elon Musk had a Twitter (TWTR, USD, 53.15) poll asking the “public” if he should sell 10% of his Tesla stock and pay capital gains taxes. The public overwhelmingly told him to do so, and shares are lower this morning. We also note oil prices have dipped on reports the White House will take steps to increase supplies. We expect the SPR to be aggressively tapped. We will have more to say on this in Thursday’s Weekly Energy Update. Our regular coverage begins with the international roundup. Up next is economics and policy; the infrastructure bill passed. China and crypto news follow, and we close with the pandemic update.

International roundup: Russia is getting active, and Iraq’s PM survives a drone attack.

- Recently, we commented on Russia’s increasing troop strength on the Ukraine frontier. It’s apparently serious enough that the CIA Director is going to Moscow to warn the Kremlin about its actions.

- Russia has also been active on its eastern end. It has been conducting naval exercises in the Sea of Japan and reportedly threatened the USS Chafee, a guided-missile destroyer. The Pentagon has denied that the Chafee was in Russian waters.

- Although Russia and China have been making highly public shows of their military cooperation, one potential point of conflict is in Central Asia. China has extended its influence into the region, in part to protect its western border from Islamic influence and in part to gain access to the region’s mineral wealth. Russia views this area as its sphere of influence and is acting to counter China’s actions. We note that nations in Central Asia are taking steps to control social media, following the lead of both China and Russia.

- Iraqi PM Mustafa al-Kadhimi avoided injury from a brazen drone attack on the “green zone,” an area set up by the U.S. for critical government operations. It is considered to be highly secure, so the attack is symbolic because it shows that one isn’t safe even in the green zone. Six security officers were wounded in the attack. Governments around the world are condemning the act. We note the U.S. described the incident as a “terrorist attack” while the EU avoided the term. So far, no group has taken responsibility for the incident. However, recent elections have elevated Moqtada al-Sadr’s political group, which is anti-Iranian. Thus, it’s highly possible the attack was backed by Tehran; this would account for the EU’s stance. The EU tends to avoid upsetting Tehran.

- Nicaragua held elections yesterday, but due to aggressive suppression of the opposition, Daniel Ortega is all but guaranteed victory.

- Sudan recently experienced a coup; protests against the junta continue.

- Argentina will go to the polls for midterm elections next weekend, and polls suggest the ruling Peronists are going to take a drubbing. There are growing concerns that the government will default on obligations because of the IMF.

Economics and policy: Infrastructure passes.

- The infrastructure package passed the House late Friday. Although six progressives voted against the measure, enough Republicans supported it to ensure passage. The package has all sorts of spending over the next decade and is a win for the White House. Overall, though, the net effect on the economy is expected to be modest. It remains to be seen if the budget will pass in the aftermath. The fact that six progressive Democrats voted against the measure could mean that moderates may not pass the current bill. We suspect the progressives knew passage of the infrastructure bill was settled, and thus, their opposition was mostly grandstanding. We will be watching in the coming weeks to see how the budget bill goes.

- President Biden reportedly met with Chair Powell as part of the latter’s renomination campaign. We think odds favor Powell’s reappointment, but there is still a chance Biden could try to put his own Fed Chair in place. Biden is facing pressure from left-wing populists to appoint Lael Brainard. In practical terms, there isn’t much policy difference between the two. They are both reliably dovish, although Brainard would likely support expanded regulations on financial firms. This vote is turning into a political morass for the president. Reappointing Powell can get through the Senate; Brainard might not make it through. Financial markets, already at high valuations, won’t take a rejection of Powell lightly.

- Inflation is becoming a hot-button issue in the U.S. It is already becoming a topic for next year’s midterms. It’s not just a U.S. issue. Asian beef buyers are facing sticker shock as disease and labor issues reduce supplies. Eurozone CPI is up to 4.1%, and ECB President Legarde is facing increasing pressure within the central bank to do something about it. Polls suggest consumers are not pleased with rising prices. Major European firms are warning that additional price increases are coming.

- Supply chain disruptions are a major cause of rising prices. A case study of the paint and coating industry highlights a delicate supply chain that was vulnerable to disruption. When something as mundane as paint has a complicated supply structure, it highlights that these current dislocations probably won’t be solved soon.

- One factor that has affected inflation is that industries have become concentrated over the past three decades. As industries become concentrated, they have greater market power to protect margins and pass along price increases. Sadly, supply chain issues further favor the larger firms and could lead to additional concentration.

- Over the years, the number of jobs requiring advanced education has grown. Anecdotal reports suggest that the advent of online job sites, which allow for easy application for positions, has led hiring managers to require a BA or higher as a screening tool. Hiring managers report that they have upscaled the positions as a way to reduce the crush of applications for positions. However, that situation happened when there were fewer jobs than candidates. In the current environment, firms are scrambling to find workers and thus are moving the other direction—ending the need for college for various positions to expand the pool of applicants. Background checks are being eased, and other restrictions are being lifted.

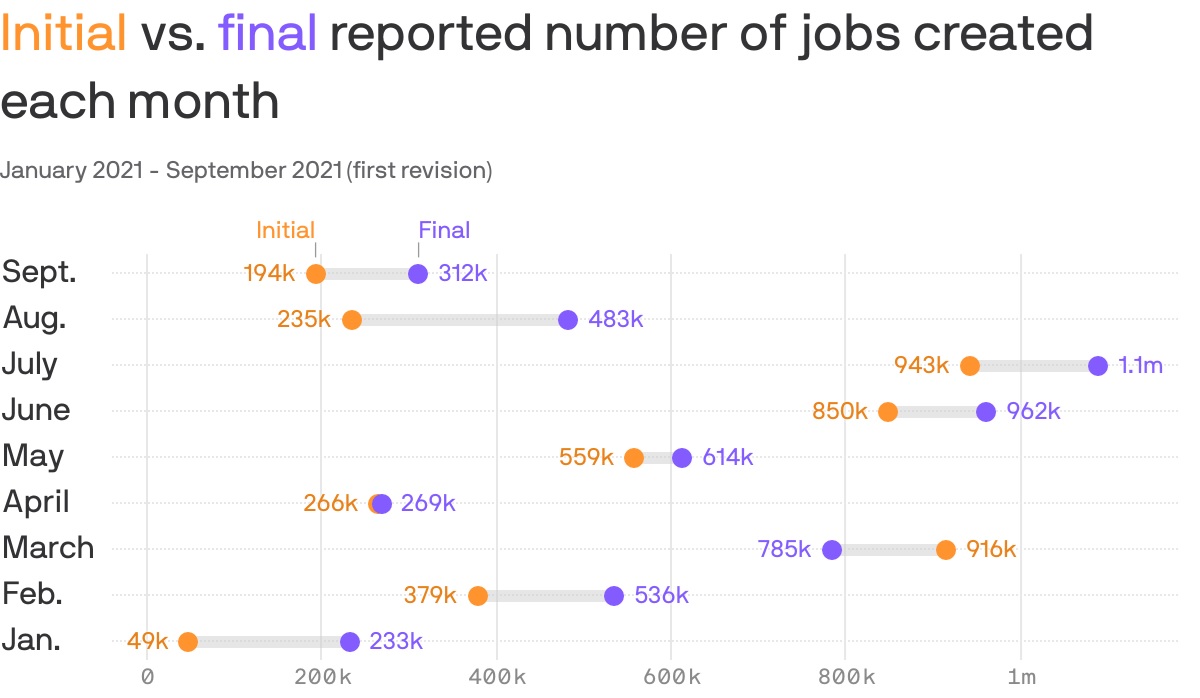

- We have noted recently that financial markets, especially the financial media, are seeing massive mood swings on the non-farm payroll data. This chart suggests participants should not get too excited about the first month’s report.

(Source: Axios)

As this shows, we have seen massive revisions this year. Much of this is due to the seasonal adjustment process. Seasonal adjustments are made to take account for the normal seasonal swings in hiring and are based on recent history. Recent history, unfortunately, has been anything but normal and leads to distortions that are addressed in the revisions. We also warn that every year, the BLS benchmarks have revisions, and even these numbers are subject to change. The best advice is to use a three-month smoothing process which reduces the front-month impact and takes the revisions into account.

- Airlines until recently were offering early retirement to pilots, because the pandemic was increasing the number of pilots ending their careers. Now, airlines are hiring aggressively. They are also boosting pay for attendants who are willing to work on holidays.

- One of the trickier areas of monetary policy and inflation is housing. That’s because a house is both an asset and a cost. In the U.S., we use a tool called “owner’s equivalent rent” to parse out the impact of housing operating costs for inflation purposes. For the most part, central banks are careful about including asset prices in policy aims because it appears as if they are targeting asset prices. Thus, there is great interest in the Reserve Bank of New Zealand’s decision to include home prices in the inflation policy. So far, most of their policy actions have been regulatory; it has discouraged low down payment mortgages and supported higher density housing projects. However, if the RBNZ begins raising rates because of high home prices, the increase in rates will likely lead to weaker home prices, triggering declines in wealth.

China news:

- China has maintained a zero-COVID-19 policy, meaning that instead of preparing for the endemic presence of the virus, Beijing continues to shut down areas where infections develop. Especially as anti-viral treatments emerge, this policy will become harder to maintain, given their economic costs. However, the Xi regime has staked its reputation on the policy, making it difficult to end.

- Regulations surrounding the insider sale of stock apparently are not consistent across nations. Chinese executives took advantage of this condition to dump New York-listed shares of their companies when crackdowns developed in China.

- A Chinese intelligence officer has been convicted of trying to steal secret information from General Electric (GE, USD, 108.74).

- Joseph Nye, a professor of foreign policy, has penned an op-ed on the Cold War notion with China, showing the concept to be improper, at least in comparing it to the one with the Soviets. The U.S. and China are closely linked economically, making isolating China much more complicated.

- As part of upcoming CPC meetings, General Secretary Xi will be creating a historical narrative that puts him on par with Mao and Deng. We expect this idea to be approved, which will further boost his power.

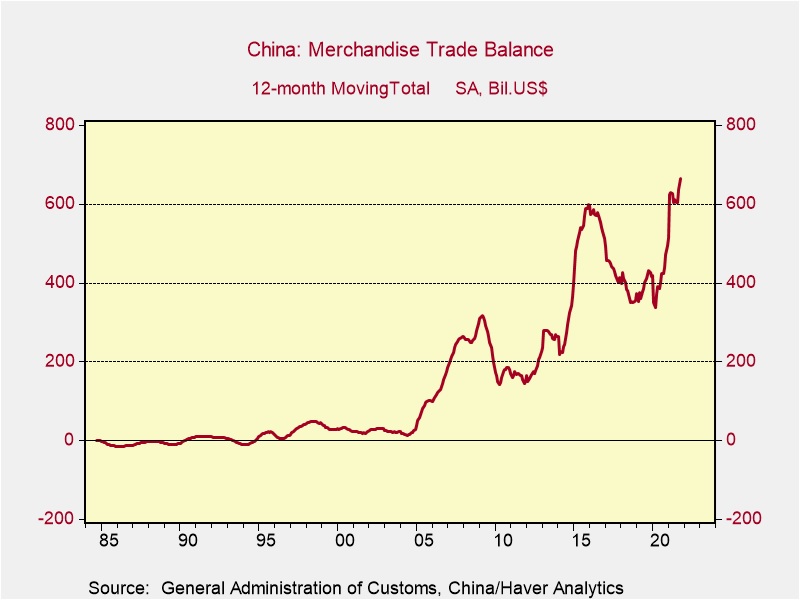

- China’s trade surplus expanded further in October. On a 12-month rolling basis, it hit a new high.

- Nations around the world know that the U.S. and others have satellites that allow intelligence agencies to monitor their activities. North Korea, in response, performs sensitive activities underground. China is apparently practicing missile strikes on mockups of U.S. aircraft carriers. Beijing is sending an unmistakable signal that these vessels are vulnerable.

- China’s digital CNY is seeing wider usage.

Crypto: Stablecoins and DarkSide are the major headlines today.

- U.S. regulators are expressing greater concern over the problems associated with stablecoins, calling for “urgent” regulation.

- The U.S. has put a $10 million bounty out on the DarkSide hackers.

COVID-19: The number of reported cases is 250,005,427, with 5,052,148 fatalities. In the U.S., there are 46,488,417 confirmed cases with 754,431 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 534,081,335 doses of the vaccine have been distributed, with 430,927,624 doses injected. The number receiving at least one dose is 223,629,671, while the number receiving second doses, which would grant the highest level of immunity, is 193,832,584. For the population older than 18, 70.1% of the population has been vaccinated. The FT has a page on global vaccine distribution.

- An appeals court has temporarily halted the vaccine mandate. Tensions over the mandate remain high.

- China has been distributing its vaccines to foreign militaries.

- The U.S. is ending most foreign travel restrictions to vaccinated foreign visitors.

- One of the more troubling side effects of the mRNA vaccines is myocarditis. Researchers are trying to determine why this side effect occurs. The side effect is rare and mostly affects young people. There have been 877 cases out of 86 million (0.001%) in those 30 years or younger, and the majority of cases are in men. Most cases self-resolve in a few days, and COVID-19 itself can lead to myocarditis (0.146%). There is some concern that if the injection directly hits a vein, it can expose the heart to the vaccine and raise the risk of the side effect.