Daily Comment (May 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are trading lower following a weaker-than-expected bond auction on Wednesday. However, in a thrilling turn of events, Real Madrid secured a comeback victory against Bayern Munich, booking their spot in the Championship Final against Borussia Dortmund. Today’s Comment explores how the earnings outlook from Intel reflects the US-China rivalry’s impact on tech companies. We’ll also examine why the Federal Reserve might hold off on further interest rate hikes and how Germany is working to lessen its dependence on China. As usual, the report concludes with a wrap-up of international and domestic data releases.

Rubber Meets Road: Intel’s earnings outlook offers a real-world example of how the shifting geopolitical landscape can harm corporate profits.

- Semiconductor giant Intel exceeded first-quarter earnings expectations but cautioned about a revenue dip due to a new US ban on chip exports to China. While Intel is maintaining its revenue forecast within its $12.5 billion to $13.5 billion range, it anticipates falling short of the midpoint. This revised outlook follows the US Commerce Department’s decision to revoke the licensing rights of Huawei Technologies to purchase semiconductors from both Intel and Qualcomm. The announcement triggered stock price declines for both companies. However, Qualcomm later clarified that its business with Huawei was already limited and will likely cease entirely.

- The weak outlook comes as the US tightens the screws on China’s chip access. In 2022, the Biden administration, along with allies like Japan and Europe, limited chip sales to certain Chinese companies to prevent their use in military weapons. These efforts proved inadequate, though, as Chinese firms continued to improve the quality of their semiconductors. Last month, US lawmakers were angered that Huawei’s new AI laptops were powered by American-made Intel chips, leading to calls for more chip restrictions. This episode highlights the tightrope that tech companies must walk as they are caught between escalating geopolitical tensions and government policy shifts.

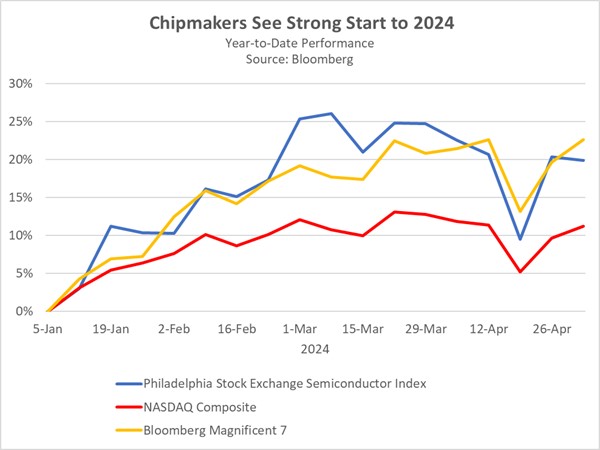

- Despite their strong start this year, semiconductor companies face potential headwinds from rising US-China tensions. This is because tech companies, as measured by the Invesco QQQ ETF, have a greater exposure to China than the broader S&P 500 index. However, there are safer alternatives to large cap tech companies. Midcap companies, with their focus on the US domestic market and strong financials, might offer a hedge against those risks due to their lower exposure to trade disputes.

Restrictive Enough: As the Consumer Price Index continues to disappoint, central bankers are increasingly concerned about whether monetary policy is sufficiently tight.

- Minneapolis Fed President Neel Kashkari weighed in on the current state of monetary policy in a Wednesday note. While acknowledging current policy is stricter than it was prior to the pandemic, Kashkari pointed to a robust housing market as evidence that more action might be necessary to get inflation back to its 2% target. This aligns with recent comments from Fed Governor Michelle Bowman. Over the weekend, she expressed concern that rising immigration might be putting upward pressure on shelter price inflation, as supply struggles to keep pace with demand.

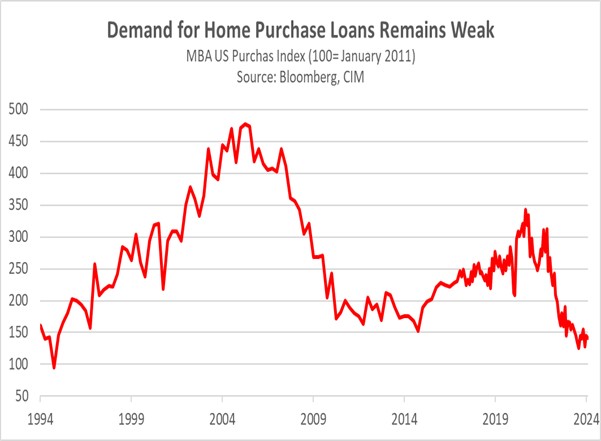

- Anxiety about tightening credit conditions is emerging despite a seemingly easier residential mortgage market. The latest Senior Loan Officer Opinion Survey (SLOOS) shows banks are indeed tightening lending standards for commercial real estate and consumer loans. However, for residential mortgages (excluding subprime), the survey indicates a slight easing in the previous quarter. This divergence suggests the Fed’s policy may not be having a consistent impact across all loan sectors. It’s important to note, though, that despite this easing of financial conditions, demand for home purchase loans remains well below pre-pandemic levels.

- The Federal Open Market Committee (FOMC) minutes, due to be released in two weeks, could provide key insights into the ongoing debate regarding the Fed’s monetary policy stance. During the press conference following the recent decision to hold rates steady, Fed Chair Powell remained tight-lipped when questioned about the possibility of another hike. The minutes from this past meeting may reveal whether any committee members advocated for a rate increase. This, if confirmed, could significantly alter interest rate expectations, especially if the upcoming April CPI data continues the trend of high inflation as seen in the past three months.

Berlin’s Shift: Germany aims to build a closer relationship with the US as it increasingly views China as a threat to its interests.

- Germany’s trade winds have shifted dramatically. The US has surpassed China as Germany’s top import partner for goods and services in the first quarter of 2024, ending China’s eight-year reign at the top. This change reflects China’s sluggish economic growth, but also likely stems from Germany’s growing reservations about its reliance on Chinese imports. German businesses are facing a mounting challenge in China. Soaring compliance costs, coupled with Beijing’s policies that favor domestic companies, are creating a difficult operating environment. While German Chancellor Olaf Scholz has tried to assuage these concerns, there have been few signs of success or improvement.

- In 2023, Germany formally designated China as a “partner, competitor, and systemic rival,” reflecting a strategic shift meant to reduce its dependence on the Asian nation. This attitude change comes as Germany has expressed concern that Beijing may look to resolve its overcapacity problem by dumping its excess goods into Europe. Furthermore, Germans have become sharply critical of China’s backing of Russia. Last week, a cyberattack, which breached emails of the Social Democratic Party, was linked to Russia. Additionally, allegations surfaced that China and Russia may have offered financial incentives to a German lawmaker in order to influence policy in their favor.

- Germany’s economic slowdown has been heavily influenced by its exposure to China, and this fact could play a major role in its shift towards the US. A change could offer long-term advantages for German companies. A potential turn inward by China might prioritize domestic firms at foreigners’ expense. At the same time, the US, with its strong dollar and commitment to open markets, could favor allies like Germany. However, the transition will likely be slow. German firms, especially carmakers with deep ties to China, will likely lobby their government to manage the deteriorating relationship and mitigate potential disruptions.

In Other News: The Bank of England signaled a potential rate cut in June following its policy meeting. This could be a sign that it believes inflation is under control and will likely lead to further weakness in the pound (GBP). Separately, President Joe Biden warned Israel that the US would halt arms sales if it invades Rafah, in a sign of growing friction between his administration and Israel. Political tensions are also on the rise in Germany, with a recent attack on a former German mayor.