Daily Comment (May 9, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Trade concerns remain, while tensions with Iran increase. Here is what we are watching:

China trade: Although Chinese negotiators are meeting with U.S. officials today, it appears we are heading toward tariffs at midnight EDT tonight. China has vowed to retaliate.[1] In a speech (granted, at a rally), President Trump accused China of “breaking the deal.”[2] We have been seeing more color around the decision-making process in both countries. When the written agreement went to Chinese officials, they realized it would require changes to the law; China apparently had assumed it could make adjustments through regulation, which would be easier to enact but also less difficult to reverse.[3] It’s likely that, from the Chinese perspective, this adjustment met the spirit of the deal without the difficult process of new legislation. From the American perspective, this was a deal breaker. In reality, this is rather classic diplomatic behavior, called “strategic ambiguity,” where two parties say the same thing but each interprets it as something different. USTR Lighthizer would be sensitive to such tactics and would likely see it as an attempt to circumvent monitoring and penalty (and he is probably correct in that assessment).

Another element that may have led to China’s behavior is the perception that the U.S. economy may be faltering, undermining the U.S. bargaining position. President Trump’s persistent attacks on the Fed may have created this impression.[4]

So far, the financial markets have reacted with caution but not panic. This may be due to what the NYT calls the “Trump put,” which means that every time equities run into trouble the president takes steps to lift confidence.[5] We don’t disagree with this observation. What one has to be careful with is the reason a Trump put might exist. If the president believes a bear market would weaken his chances at re-election, then relying on it makes sense. But, if the president concludes that playing tough with China is even better for his re-election, then the put might not be as reliable as the market seems to believe.

We note the president has suggested that China (and we believe the EU as well) may very well be playing a stall game,[6] where they try to push negotiations into 2020 with the idea that the White House will want to avoid the disruption of a trade conflict in an election year, or in hopes that a change in power might lead to a less confrontational trading partner. We think Trump has a point here, but not the one he is making. An establishment candidate would likely want to return to the pre-Trump multilateral trading system and would almost certainly not engage in the sort of tariff tactics deployed by the current administration. However, a populist Democrat might very well conduct policy in a fashion similar to Trump and may be even more aggressive. After all, we doubt a Sanders or Warren White House would have anyone resembling Steve Mnuchin in the cabinet. The key point here is that if it becomes a campaign strategy to make statements suggesting China and the EU want to negotiate with a “weak Democrat,”[7] then the Trump put may not be as certain as financial markets seem to believe.

To some extent, the tradeoff between the Trump put and the trade warrior stance may come down to the degree and distribution of pain that occurs from a trade war. The first element of risk is Chinese retaliation. China is nearly out of U.S. imports to apply tariffs, so its next step would be to deny investment and simply not buy certain (politically sensitive) goods. This is really bad news for the agriculture markets and probably a loser for companies with extended supply chains into China.[8] The second element of risk comes from the U.S. tariffs themselves. Up to now, most of the incidence of the tariffs has mostly affected primary and secondary goods, with less direct impact on consumer goods. But, as the tariffs widen, the impact on consumers will become more direct.[9] Winners could be foreign companies that directly compete with the U.S. for the Chinese market and foreign commodity suppliers, e.g., Brazil and Argentina.[10] At the same time, a trade war between the world’s two largest economies creates a good bit of collateral damage. World trade appears to have suffered.[11]

The bottom line in all of this is that the financial markets’ rather sanguine approach to the trade spat is probably based on the notion of a Trump put. Clearly, the president’s pattern of behavior fosters this idea. But, our fear is that the put is based on the president’s perception of political benefit, so things could get rocky if he concludes that a trade war brings him more benefit than an ebullient stock market. In addition, as we have stated before, wars occur due to miscalculation. We think China has misunderstood Trump. Although we doubt Beijing will hear us, they should really read about the archetypes of American foreign policy. Embarrassing a Jacksonian is a really bad idea.[12]

The Iran issue: Although the EU is trying to hold the nuclear deal together, we doubt it will work.[13] The EU is caught between Iran and the U.S. and has more to lose by not toeing the American line.[14] The U.S. has broadened sanctions on Iran,[15] further isolating the Iranian economy.[16] Meanwhile, Iran has indicated it will begin to enrich uranium again if the Europeans don’t support the Iranian economy, which would essentially scotch the deal. One other item of note—there are reports, so far not confirmed from mainstream sources, that an Islamic Revolutionary Guard Corps (IRGC) commander has defected.[17] Brigadier General Ali Nasiri ran the IRGC protection bureau, which performs some of the Secret Service protective functions for the Iranian regime. There are rumors that he carried “sensitive” documents to a Gulf state embassy when he defected. We will be watching to see if the report emerges in the Western media in the coming days.

Brexit: PM May survived another leadership challenge, indicating that there really isn’t an obvious alternative to her in the Tory Party. She indicated that another Brexit vote will likely be held in a couple of weeks.[18]

Odds and ends: Cyril Ramaphosa won yesterday’s poll but the margin of victory was the lowest since the end of apartheid.[19] North Korea launched more “projectiles.”[20] Although Venezuela has defaulted on most of its bonds, it continues to pay on a portion of its debt, the bonds of Citgo and those held by Russia. The former is being paid to avoid creditors seizing its refining assets in the U.S., while the latter is to keep Russia as an ally.[21]

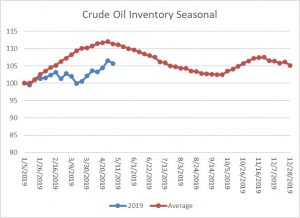

Energy update: Crude oil inventories fell 4.0 mb last week compared to the forecast rise of 2.5 mb. There was a 0.9 mb draw of the SPR, meaning the actual decline was closer to 4.9 mb.

In the details, refining activity fell 0.3% compared to the 0.9% decline forecast. Estimated U.S. production fell slightly by 0.1 mbpd to 12.2 mbpd. Crude oil imports fell 0.7 mbpd, while exports fell 0.3 mbpd.

This is the seasonal pattern chart for commercial crude oil inventories. We are entering the spring/summer withdrawal season next week; this week’s decline is consistent with the normal seasonal pattern. If this trend continues, we will see weekly draws in stockpiles until the third week of September.

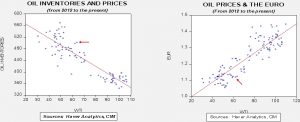

Based on oil inventories alone, fair value for crude oil is $52.34. Based on the EUR, fair value is $51.28. Using both independent variables, a more complete way of looking at the data, fair value is $50.67. This is one of those circumstances when the combined model fair value does not lie between the two single variable models. Current prices are running well above fair value. With this week’s focus on Iran, geopolitical risks are adding around $10 to $13 dollars per barrel to crude oil prices. Assuming we see usual seasonal declines and a stable dollar, fair value for the two-variable estimate rises to $54.05. Simply put, current prices have discounted a significant level of geopolitical risk and prices could see a sizable setback in the coming weeks if tensions don’t rise further. Another factor for oil—it has been acting as a “risk-on” asset and oil will likely fall too if equity values tumble due to trade tensions.

[1] https://finance.yahoo.com/news/china-says-retaliate-trump-does-raise-tariffs-012123878–finance.html

[2] https://finance.yahoo.com/news/trump-says-china-broke-deal-004945552.html

[3] https://www.nytimes.com/2019/05/08/us/politics/china-trade-trump.html?wpisrc=nl_todayworld&wpmm=1

[4] https://www.wsj.com/articles/why-china-decided-to-play-hardball-in-trade-talks-11557358715?mod=hp_lead_pos1

[5] https://www.nytimes.com/2019/05/08/upshot/trade-war-stock-market-china-us-tariff.html

[6] https://www.politico.com/story/2019/05/08/trump-china-trade-2020-election-1311737

[7] https://www.theatlantic.com/politics/archive/2019/05/trump-biden-trade-china/588991/

[8] https://www.scmp.com/news/china/diplomacy/article/3009454/us-upping-ante-china-still-has-trade-war-cards-it-can-play

[9] https://www.axios.com/newsletters/axios-markets-b6a4df56-c655-4fc8-bacf-00dc10eed3b4.html?chunk=4&utm_term=emshare#story4

[10] https://www.axios.com/winners-losers-us-china-trade-war-227dd9e3-f7f1-4744-b091-a3ce4b7ba5aa.html

[11] https://www.ft.com/content/7a613b06-7118-11e9-bbfb-5c68069fbd15?emailId=5cd399f181c6410004afaf77&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[12] https://www.confluenceinvestment.com/wp-content/uploads/weekly_geopolitical_report_04_4_2016.pdf

[13] https://www.politico.eu/article/iran-europe-nuclear-united-states/?utm_source=POLITICO.EU&utm_campaign=3ae8b85be7-EMAIL_CAMPAIGN_2019_05_09_04_35&utm_medium=email&utm_term=0_10959edeb5-3ae8b85be7-190334489

[14] https://www.nytimes.com/2019/05/08/world/europe/eu-iran-nuclear-sanctions.html?emc=edit_MBE_p_20190509&nl=morning-briefing&nlid=5677267tion%3DtopNews§ion=topNews&te=1

[15] https://www.wsj.com/articles/iran-to-stop-complying-with-some-nuclear-deal-commitments-11557297791?mod=hp_lead_pos4

[16] https://www.nytimes.com/2019/05/08/us/politics/iran-nuclear-deal.html?emc=edit_MBE_p_20190509&nl=morning-briefing&nlid=5677267tion%3DtopNews§ion=topNews&te=1 and https://www.ft.com/content/6b47d1dc-7179-11e9-bf5c-6eeb837566c5?emailId=5cd399f181c6410004afaf77&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[17] http://isicrc.org/irgc-basij-and-hezbollah/exclusive-irgc-commander-believed-to-have-defected-to-the-west

[18] https://www.ft.com/content/0e5900da-718e-11e9-bf5c-6eeb837566c5?emailId=5cd399f181c6410004afaf77&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[19] https://www.theguardian.com/world/2019/may/09/south-africa-election-early-results-point-reduced-anc-majority

[20] https://www.reuters.com/article/us-northkorea-missiles/north-korea-fired-unidentified-projectile-souths-military-idUSKCN1SF0ON

[21] https://ftalphaville.ft.com/2019/05/09/1557374439000/Venezuela-is-paying-its-bondholders-/