Daily Comment (May 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is digesting the latest trade updates. In sports news, Inter Milan has knocked FC Barcelona out of the Champions League semifinals. Today’s Comment will focus on positive trade developments, ongoing conflicts in the Indo-Pacific and the Middle East, and other key market-moving stories. As always, we’ll also provide a roundup of today’s international and domestic data releases to keep you informed.

Positive Trade News: The White House has announced progress in ongoing trade negotiations, a move intended to mitigate concerns regarding potential supply chain disruptions.

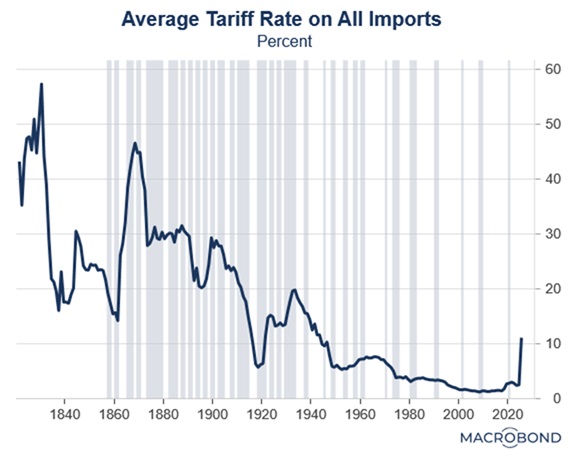

- The US and China are set to hold their first face-to-face talks next week, marking the first high-level discussion between the two powers since tariffs were imposed in April. Treasury Secretary Bessent acknowledged the talks as a positive step but cautioned that the meeting would likely focus on preventing further escalation rather than resolving existing disputes. Meanwhile, Chinese officials have mentioned that they are engaging in talks due to the possibility of tariff relief.

- The ongoing dispute between the two nations comes amid growing evidence that tariffs are weighing heavily on both economies. China has attempted to circumvent the measures by rerouting exports through third countries or undervaluing shipments to reduce duties. Meanwhile, concerns are mounting over potential shortages as reduced Chinese imports mean fewer goods being shipped to the US, leading to speculation that some firms may be hurt due to their hidden exposure to Chinese suppliers.

- The decision by China and the US to hold talks suggests that other nations may soon follow suit. Treasury Secretary Bessent noted that, aside from China, all 18 of America’s other major trading partners have already engaged in discussions in hopes of securing tariff relief before the July deadline. While several countries have submitted proposals, President Trump has made clear that he does not intend to lift all tariffs.

- The UK is poised to become the first country to secure a trade deal with the US under the Trump administration. On Tuesday, officials announced a plan that will exempt certain UK exports from full tariffs under a quota system. In return, Britain has committed to scaling back its digital services tax, which has disproportionately affected major US tech firms.

- So far, trade negotiations appear to be progressing, with the US leveraging tariffs not only to reduce trade barriers but also to secure regulatory concessions that currently disadvantage American firms. While hopes of a trade deal may provide some relief to equities hit hard by tariffs, we believe a sustained market boost would require clear evidence that tariffs have had minimal demand-side impact or, better yet, moderated significantly from their current level.

India’s Response: India and Pakistan appear to be on the brink of war as tensions escalate following an April terrorist attack.

- India executed targeted military strikes against nine locations inside Pakistan, identified as “terrorist infrastructure.” The action was perceived as measured due to its avoidance of Pakistani military facilities. Prior to the attack, Pakistan’s defense minister had warned that the country was prepared to retaliate against any Indian aggression. While the Pakistani government has confirmed plans for a response, it has not disclosed the timing or nature of its countermeasures.

- So far, it remains unclear how far either side is willing to escalate the conflict. The last full-scale war between India and Pakistan erupted in 2019 after a suicide bomber targeted Indian security forces. Both nations now claim to be acting in self-defense, yet their increasingly aggressive posturing risks triggering a dangerous cycle of retaliation that could push the confrontation to a perilous new level.

- The US and China are expected to monitor the conflict closely, given their strategic interests in the region. Washington has sought to maintain strong ties with both India and Pakistan as key partners in its geopolitical orbit. Meanwhile, Beijing has a vested interest in preventing a destabilizing war near its borders, particularly given its close alliance with Pakistan and complex rivalry with India.

- The critical issue to watch now is how both nations handle the Indus River Basin dispute. Following recent hostilities, India suspended a key water-sharing treaty that regulates the flow of river water into Pakistan. This decision has already begun threatening Pakistan’s agricultural output, particularly its vital cotton and rice crops, potentially exacerbating regional tensions.

- While US financial markets have yet to meaningfully price in geopolitical risks, escalating tensions may soon prompt investors to reassess their risk appetite. This uncertainty emerges during an already fragile period for markets, with lingering trade tariff concerns continuing to pressure sentiment. In this environment, we believe quality defensive plays, particularly established companies with consistent earnings track records, may offer investors prudent hedges against potential volatility.

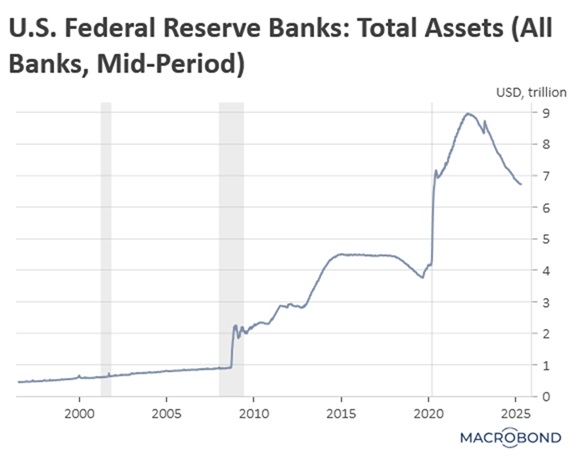

Powell Is on the Clock: While interest rates dominate market focus ahead of the central bank’s decision, its balance sheet is another key element to watch.

- The Federal Reserve is widely expected to leave its benchmark interest rates unchanged at today’s meeting. This decision follows weeks of policymakers voicing concerns about the uncertain inflationary impact of tariffs, even amidst indications of easing price pressures. While some market participants had anticipated that softening economic data might compel Fed action, unexpectedly strong employment figures and resilient consumer spending have tempered dovish expectations.

- If the Fed doesn’t cut rates, it might instead change how it handles its bond holdings. At the last meeting, Fed officials decided to slow down how quickly they were shrinking the bond portfolio because of the debt ceiling fight in Congress. There was even some talk of stopping the reduction indefinitely, and with the economy now sending mixed signals, that idea may be revived.

- The potential conclusion of quantitative tightening should help relieve pressure in the Treasury market. Ending this policy would mean the Fed reinvests proceeds from maturing securities rather than continuing to reduce its balance sheet. This move would boost market liquidity and support bond prices. The policy’s significance was underscored Wednesday when the Fed made its largest participation in a 10-year Treasury auction in over three years, contributing to the auction’s strong performance.

- If the Fed agrees to hold rates steady this month, its policy statement and economic projections will offer critical clues about a potential June cut. Policymakers have adopted a cautious stance, seeking clearer evidence of how tariffs will impact the economy — especially inflation and employment — in the coming months. While resurgent price pressures would likely delay any easing, a sharp deterioration in labor market conditions could force the Fed’s hand toward more substantial rate cuts this summer.

Weak Dollar Problem? There are growing concerns that the strength of the US currency is starting to have an impact abroad.

- Across Asia, there have been signs that central banks are intervening in markets to support their currencies. The Hong Kong Monetary Authority was forced to offload dollar holdings to defend its peg. Meanwhile, Taiwan’s typically stable exchange rate has experienced sharp fluctuations amid rumors of potential intervention to secure a trade deal with the US. Lastly, China has cut its key interest rate and reduced reserve requirements in an effort to prevent further appreciation of the yuan against the dollar.

- While a weaker dollar generally reduces the price of imported goods for foreign consumers, its impact on the wider economy presents a trade-off. It may diminish profits for foreign companies exporting goods to the US, and a declining greenback could incentivize foreign investors to rebalance their portfolios away from US assets. This trend, while not currently critical, deserves careful monitoring.