Daily Comment (May 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today starts with a new report confirming that China’s industrial strategy has not only leaned heavily on unfair trade practices, but it has also helped close China’s technology gap with the US and reduced its dependence on imports. We next review several other international and US developments with the potential to affect the financial markets today, including the German parliament’s unexpected failure to confirm Friedrich Merz as chancellor and a new strike at a major US aerospace firm.

China: The US Chamber of Commerce yesterday released a new study confirming that Beijing’s “Made in China 2025” industrial policy is helping close China’s technology gap with the US and has reduced the country’s reliance on imports. The study provides the latest evidence that Beijing has used a range of restricted trade policies — such as massive tax subsidies, low-cost public funding, protectionist trade barriers, and forced technology transfers — to undermine US industry. The report is therefore likely to further exacerbate US-China economic tensions.

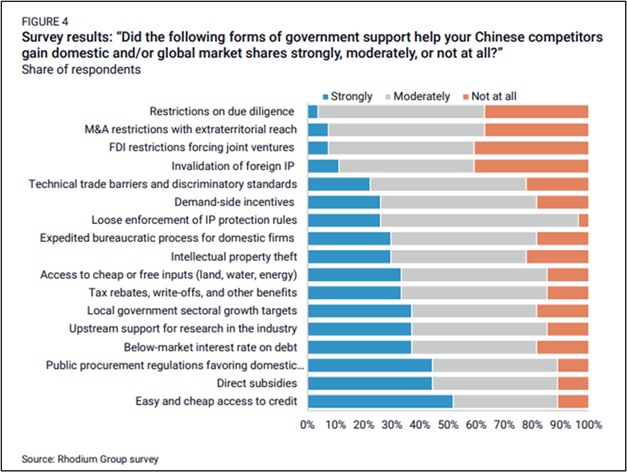

- In one especially interesting section, the report shows the results of a survey conducted among US Chamber member firms facing Chinese competitors. The survey asked the Chamber members what forms of government support were most instrumental to helping their Chinese competitors gain domestic or global market share.

- The three most effective types of support listed were easy and cheap access to credit, direct subsidies, and public procurement regulations favoring domestic producers.

Malaysia: Prime Minister Anwar yesterday announced a fiscal relief package equal to about $356 million to help shield Malaysia’s small and medium-sized enterprises from the effects of President Trump’s “reciprocal” import tariffs. Even though Trump has paused the 24% tariff against Malaysia until early July, Anwar told parliament the money will be made available to SMEs in the form of increased loan guarantees and low-interest loans.

European Union-United Kingdom: In a new sign of post-Brexit reintegration between the EU and UK economies, the European Commission today will reportedly propose new legislation that would ease the recognition of British professional certifications. If approved by the European Parliament, the proposed law would be especially helpful for British lawyers, bankers, engineers, and other skilled workers hoping to work in the EU. In turn, that could allow firms to rebuild some cross-Channel business relationships that were disrupted by Brexit.

European Union-Russia: The European Commission today will announce a 2027 deadline for EU companies to end their contracts for Russian energy. While Brussels has already clamped down heavily on Russian oil and coal deliveries via sanctions, it has struggled to end all natural gas imports because some member countries oppose further sanctions. The outright restriction on import contracts aims to get around that opposition. Of course, the new rules may worsen the EU’s shortage of cheap energy, which has weighed on economic growth.

- The new rules would reportedly require companies to end all spot market gas contracts with Russian suppliers by the end of this year and to end all long-term contracts by 2027.

- Once announced, the measure would still need to be approved by a majority of EU member states and the European parliament.

Germany: Friedrich Merz, leader of the center-right CDU party, today unexpectedly lost a parliamentary vote to confirm him as chancellor. Merz last week had sealed a deal with the center-left Social Democratic Party that gave the coalition 328 of the 630 seats in the Bundestag, but in secret balloting today he only got 310 votes. Merz will still likely prevail in a follow-on vote, but the unprecedented first-round loss will leave him politically wounded as he tries to renew German leadership in Europe and reform the domestic economy to boost growth.

- The embarrassing vote will also likely boost support for Germany’s surging radical populist parties, especially the far-right Alternative for Germany.

- In financial markets, the unseemly show of chaos and instability drove down the value of German assets today, with the DAX stock index closing down 1.3%.

US Monetary Policy: The Federal Reserve today begins its latest policymaking meeting, with its decision due tomorrow at 2:00 pm ET. Based on interest rate futures trading, investors widely expect officials to hold their benchmark fed funds rate steady at the current target range of 4.25% to 4.50%. The next rate cut is expected in late July. However, investors will be paying close attention to any hints Chair Powell may give on the trajectory of rates and any change in the Fed’s bond-buying program.

US Immigration Policy: The Department of Homeland Security yesterday said it will cover the transportation costs and pay $1,000 to any illegal alien who leaves the country voluntarily. Officials said the government would still come out ahead financially in spite of the cost, but they did not indicate where the funding for the program would come from. In any case, we suspect that $1,000 is not enough to spur massive numbers of illegals to “self deport,” but if it is, one result would likely be more labor shortages and costlier workers for some industries.

US Labor Market: Some 3,000 workers in the International Association of Machinists and Aerospace Workers yesterday launched a strike against jet engine maker Pratt & Whitney, a subsidiary of defense giant RTX. The unionized workers at the company’s Connecticut facilities are demanding better wages, retirement benefits, and job security as the company reportedly mulls moving some production to its plants in Georgia. The strike also suggests that the union believes it has increased leverage as the US defense budget increases.

US Energy Market: Diamondback Energy and Coterra Energy, which are active in the prolific Permian Basin oil fields, yesterday both said they are significantly cutting their capital spending this year as they face increased foreign production and lower global oil prices. The statements have sparked concern that US oil output may have peaked already, despite President Trump’s goal to rapidly boost output. Any significant drop in oil drilling could also feed into concerns about future weakness in the US labor market.