Daily Comment (May 31, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some unexpectedly soft economic figures out of China, which are weighing on global stock markets so far today. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new sources of tension between China, the U.S., and India and the latest on the deal to raise the U.S. government’s debt limit.

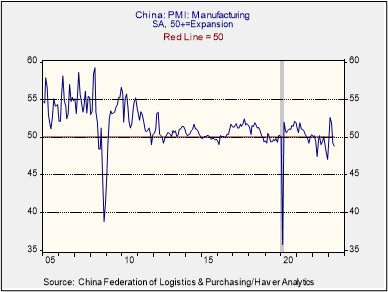

China: The National Bureau of Statistics said the country’s May purchasing managers’ index for manufacturing fell to 48.8, well short of the expected reading of 49.5 and even lower than the April figure of 49.2. In contrast, the official PMI for nonmanufacturing industries only fell to 54.5 in May, compared with 56.4 in the previous month. China’s official PMIs, like most such indexes, are designed so that readings over 50 indicate expansion.

- At their current levels, the PMIs provide more evidence that the economic rebound after the government lifted its draconian Zero-COVID policy is already petering out. Factory activity is shrinking further, and now even the services sector is suffering from slower growth.

- Stagnating demand in China has the potential to drag on economic activity around the world, pushing down commodity prices and weighing on stock markets. Chinese stocks are now in a bear market.

China-United States: The Department of Defense revealed that on Friday, a Chinese fighter jet flew dangerously close to a U.S. reconnaissance plane flying in international airspace over the South China Sea. In what the U.S. called an “unnecessarily aggressive maneuver,” the fighter jet crossed the path of the recon plane just 400 feet in front of its nose, forcing the U.S. plane to fly through its turbulence. The incident shows that U.S.-China tensions continue to spiral, creating greater risks of outright conflict and potentially causing collateral damage to investors.

China-India: New reports say Beijing has recently ejected the last remaining Indian journalists from its country, while New Delhi has evicted the last Chinese journalists from India. The evictions reflect a further worsening of bilateral tensions over border disputes in the Himalayan mountains and other issues. While our analysis puts India in the China-leaning bloc of countries, the ongoing tensions suggest New Delhi is actually “in play” and will likely continue to increase its security cooperation with the U.S.

Japan: If you’re a seasonal allergy sufferer and have always wondered what would give you real relief, the Japanese might have an answer for you. The government yesterday proposed a program that would cut down 20% of the country’s cedar forests over the next decade, with the goal of cutting average pollen counts by half over the next 30 years. The plan will expand the acreage of artificially planted cedars subject to logging, promote the use of domestic wood, and allow more foreign lumberjacks to immigrate.

Eurozone: Similar to yesterday’s report of moderating price growth in Spain, a report today showed France’s May consumer price index was up just 6.0% from the same month one year earlier, marking a significant cooling from the rise of 6.9% in the year to April and coming in lower than the expected increase of 6.4%.

- Moderating inflation in the eurozone has prompted speculation that the European Central Bank could stop its interest-rate hikes as early as July.

- In turn, that prospect is weighing on the EUR today. As of this writing, the single currency is trading at $1.0686, down 0.5% for the day.

United Kingdom: The country’s summer of strikes continues, with the U.K.’s main train drivers’ union walking off the job today. The action has paralyzed most of England’s mainline railroads, heaping more headaches on Prime Minister Sunak and illustrating how inflation and wage demands remain potent issues in the U.K.

Russia-Ukraine War: According to the Wall Street Journal, Ukraine and its Western European allies are planning a July summit of global leaders (excluding Russia’s) to promote Kyiv’s peace proposal. European leaders such as French President Macron have reportedly been lobbying for participation by countries that have sided with Russia or have declined to take a position on the war, such as Saudi Arabia and Brazil. News of the planned summit suggests that Kyiv is operating under a broad, comprehensive plan to win the war by quickly following its expected battlefield counteroffensive with a powerful political operation supporting its own peace plan over China’s rival plan, all the while leaving Russia isolated.

U.S. Fiscal Policy: New analysis of the preliminary deal to lift the federal debt limit indicates it will ensure that student loan payments and interest accruals will restart no later than August 30, with no further extensions to the pandemic-era pause. The need for former students to start making loan payments again could noticeably undermine consumer spending and help give the economy a final push into recession.

- The House Rules Committee approved the debt-limit legislation yesterday and sent it for a final vote of the full House which could occur as early as today.

- The vote in the Rules Committee relied on votes from both moderate Republicans and Democrats, illustrating how passage of the bill in the full House will likely require the cooperation of centrists on both sides of the aisle.

U.S. Monetary Policy: In an interview with the Financial Times, Cleveland FRB President Mester said she sees no compelling reason to pause the Federal Reserve’s interest-rate hikes as long as inflation pressures remain high. Essentially, Mester argued that the risk involved with hiking rates too little was higher than the risk involved with hiking too much. Her hawkish statement feeds into growing expectations that the policymakers will lift their benchmark fed funds rate further at their upcoming meeting in June.

U.S. Labor Market: Goldman Sachs (GS, $330.83) is reportedly planning another round of layoffs, which would be its third since last September. This round will evidently be focused on employees in its investment banking group. Financial dealmaking has been crimped over the last year as the Fed hiked interest rates and, more recently, as regional banks ran into trouble.

- The layoffs underscore how the Fed’s rate-hiking campaign has had the biggest negative impacts, so far, on sectors such as housing, commercial real estate, mortgage finance, and investment banking.

- This Wall Street Journal article provides a useful overview of how the Fed’s rate hikes have tightened conditions in various credit sectors.

U.S. Oil Market: Starting tomorrow, the crude oil transactions used to calculate the Brent benchmark price will include purchases and sales of U.S. oil. As output from the North Sea’s Brent field has fallen, the basket of prices that go into the Brent average has been gradually broadened in recent years. The inclusion of U.S. prices reflects the growing heft of U.S. producers in the global oil market. However, note that the U.S. oil to be included in Brent is not West Texas Intermediate, which is widely referred to as “U.S. crude.”