Daily Comment (May 30, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The White House is once again using Friday to remind markets about its trade concerns. Today’s Comment will discuss how a provision in the tax bill could discourage foreign investment in the US, explain why the administration is crafting a backup plan for tariffs, and report on other latest market-moving developments. As always, we’ll also include a roundup of key domestic and international economic data.

Taxing Foreigners: A little-known provision within the tax bill has caused a stir on Wall Street due to its potential to hurt the US’s safe-haven status.

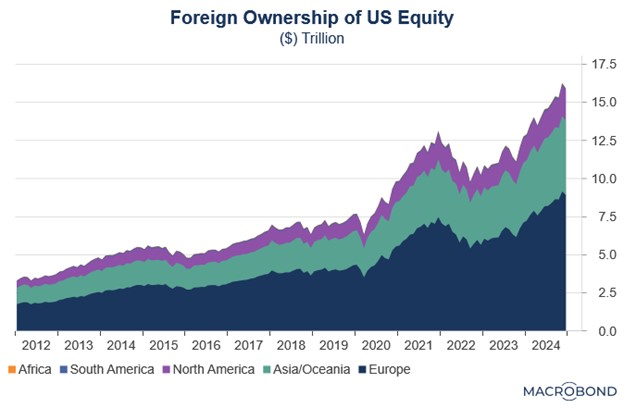

- Section 899 of the recently passed House legislation authorizes the US government to implement reciprocal tax measures against investors and corporations from countries found to maintain discriminatory tax practices targeting American entities. The provision’s broad scope could significantly affect both: (1) US-domiciled firms with substantial foreign ownership, and (2) multinational corporations maintaining operations or investment ties in the US.

- The measure appears primarily targeted at the European Union, which US officials have accused of maintaining discriminatory policies against American companies. The White House has repeatedly urged the EU to reform its Value-Added Tax (VAT) system, arguing it creates unfair trade advantages for member states. This tension has escalated as several EU countries (most recently Germany) have moved forward with proposed digital taxes that would disproportionately affect US tech giants like Meta and Google.

- However, the provision contains significant ambiguity regarding its application to US Treasury securities. While the legislation clearly subjects foreign holders of equities and corporate bonds to potential levies, it fails to clarify whether purchases of government debt — traditionally exempt from such taxation — would also become taxable. The lack of clarity could create an incentive for foreign investors to purchase even more US government bonds.

- This law essentially functions as a form of capital control. Its underlying rationale likely stems from a desire to pressure foreign elites into advocating for US interests, particularly regarding regulatory restrictions. By targeting influential individuals who comply with laws that disadvantage American companies, the US is effectively leveraging financial coercion. The potential impact is twofold: It could drive increased investment into US Treasurys, or it trigger capital outflows from equities.

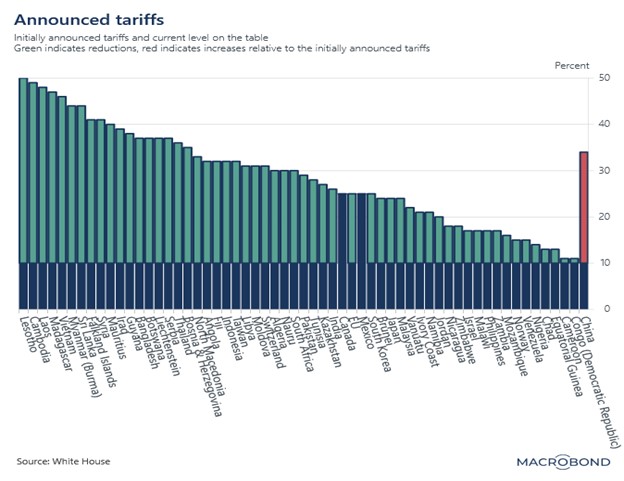

Trade Developments: The Trump administration has received a reprieve from the courts on its tariffs but is already searching for a backup as it looks to regain leverage in trade talks.

- A US federal appeals court has lifted the hold on global tariffs, clearing the way for the White House to escalate the issue to the Supreme Court. This decision is expected to reinstate the president’s import tariffs, reinforcing his push to reshape US trade policy. However, the long-term viability of these levies remains uncertain. The reprieve came after two separate rulings deemed the administration’s approach as unlawful.

- As noted in yesterday’s comment, the president has options should the tariffs be deemed unconstitutional. The administration is exploring the use of the Trade Act of 1974, which permits temporary tariffs of up to 15% for 150 days to rectify trade imbalances. Additionally, the White House is preparing to leverage Section 301, which grants the US authority to investigate and retaliate against unfair trade practices. There have also been discussions about invoking the Smoot-Hawley Tariff Act of 1930 as a potential fallback.

- That said, the ruling has significantly impacted perceptions of the US’s capacity to negotiate effectively with its trading partners. While the US and the European Union have committed to ongoing dialogue in an effort to resolve their trade differences, discussions between the US and China have, by contrast, reportedly reached an impasse. Following the court’s decision, President Trump sharply criticized China for failing to meet its trade agreement commitments.

- The ongoing tariff dispute is likely to fuel further market uncertainty regarding future trade policy. Investors now face a dual challenge where they must not only assess whether new tariffs will be implemented, but also whether existing ones will remain in place. This persistent ambiguity will disproportionately pressure firms with significant trade exposure. Given these conditions, we maintain that the most compelling opportunities lie in companies with resilient earnings power and fortified supply chains.

Monetary Policy Dilemma: President Trump and Fed Chair Powell met this week for the first time since November 2019 to discuss the economy.

- During the meeting, President Trump pressed Chair Powell to cut interest rates at the upcoming FOMC meeting, arguing that the US should align with other central banks’ policies. However, the Fed chair avoided signaling any commitment to the president’s demands, instead emphasizing that the Fed’s decisions would remain data-dependent and based on economic developments.

- The challenge confronting the president and Federal Reserve officials is the impact of US tariffs on both the domestic and global economies. Tariffs, or import taxes, serve two main purposes: revenue generation and import restriction. The latter is arguably the more complex aspect. While US tariffs have the potential to inflate domestic prices by increasing the cost of imported goods or limiting supply, they can simultaneously lead to excess foreign capacity, thereby driving down prices abroad.

- This dynamic is likely to place the Federal Reserve at a disadvantage relative to its international peers. Assuming all other factors are constant, foreign central banks possess greater latitude to implement rate cuts because the decline in exports due to US tariffs has created a surplus of domestic supply, prompting them to stimulate demand. Conversely, the reduction in foreign imports means the Fed may need to maintain higher rates to prevent increased demand from exacerbating domestic supply chain constraints.

- The key uncertainty lies in how US businesses will adapt to tariffs. Some firms may attempt to pass through higher costs, which would reinforce the Fed’s current policy stance. Others may resort to workforce reductions to mitigate the financial impact. This divergence in responses makes unemployment the potential swing factor in the tariff policy calculus.

- We acknowledge the possibility of both higher inflation and higher unemployment, but we’re not convinced they’ll trend upward simultaneously. This phenomenon, known as stagflation, typically occurs during sharp increases in energy prices, which are currently trending downward. Given the hiring trends and the limited purchasing power of households since the pandemic, we believe a cooling labor market is the most likely scenario. Consequently, we think the Fed could still cut rates this year.

Demand Optimism: Despite recession concerns, there are still signs that households may not be changing their spending habits by much.

- Recent driving data indicates that Americans hit the road in greater numbers this holiday weekend. According to GasBuddy, gasoline consumption has increased by 2% compared to the previous year. This uptick suggests households may be shifting spending away from goods and toward services — a potential strategy to mitigate the impact of rising tariffs.

- The shift toward service-oriented spending is expected to bolster the economy amid ongoing uncertainty. This trend will likely persist, provided that businesses keep prices in check. As a result, an immediate recession seems unlikely.